A look at key E&P metrics

HOW UP-CYCLES AND DOWN-CYCLES INFLUENCE THE VALUE OF PERFORMANCE METRICS

ENERCOM INC., DENVER, COLORADO

EDITOR'S NOTE: EnerCom Inc. is a Denver-based management consulting firm serving oil and gas exploration and oil service companies on corporate strategy, investor relations, analysis and valuation, media, and visual communications design. The firm also produces two annual oil and gas investment conferences in Denver and San Francisco. EnerCom researched and wrote this article exclusively for OGFJ.

An unprecedented four-year streak of high oil pricing above $80 from 1Q10 to late 4Q14 provided the base cash flow and reserves valuations needed to unlock capital and promote technological advancement to develop today's completion and drilling techniques. These techniques were used to spawn the shale production boom in the US, returning US oil production to number one on the global stage.

With great success came over-supply and dwindling market share for the world's second largest oil producer, Saudi Arabia, as US production surpassed Saudi Arabia during the first quarter of 2014 according to the International Energy Agency. From 2000 to 2014, US daily imports of Saudi crude oil fell 26%. So, in 4Q14, the Saudis decided to stop the bleeding of market share to the US shale producers and announced that they again were not going to play the role of "swing producer," resulting in the end to an historic pricing era.

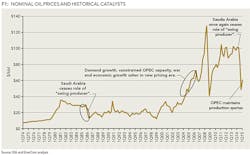

Figure 1 shows, in nominal terms, the domestic refinery delivery price per barrel from 1974 to 1983 and the first month WTI contracts from 1984 to present, as reported by the US Energy Information Administration.

To quote the great Mark Twain, "History does not repeat itself, but it rhymes." Of note is the timing of Saudi Arabia's role in supplying global oil demand and oil price collapses. In only a year, during the period from 4Q85 to 3Q86, the price of oil fell to $13.36 per barrel from $29.48 per barrel, a decline of 55%. Similarly, since 3Q14, on oversupply and Saudi Arabia's decision to increase production in discordance with other OPEC nations, oil prices have fallen 40% as of May 29, 2015.

On May 29, 2015, WTI was trading at $60.30, with the 12-month, 36-month and 60-month strips trading at $61.56, $63.26 and $64.64, respectively. At this point last year, the same longer-term forward strips were 60%, 45%, and 37% higher, respectively.

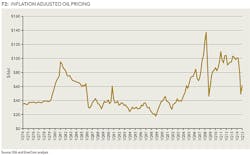

The recent collapse in oil price also marks the end of an era unmatched in the last 40 years. Figure 2 illustrates the US domestic oil price using 1974 prices adjusted for inflation to 1Q15 terms using the quarterly Consumer Price Index as reported by the Bureau of Labor Statistics. For the remainder of this analysis, any discussion involving oil prices refers to the inflation adjusted pricing.

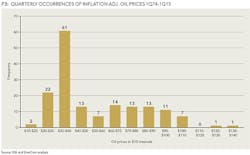

Since 1Q74 prices have been sub-$60 per barrel 64% of the time, with all quarters above $60 falling into two distinct periods from 1980-1985 and 2004-2014. More specifically, of the 60 quarters with $60-plus pricing, 38 quarters or 63% of the occurrences have been in the last decade, marking an extended pricing period that the global market has not seen in four decades. The frequency in $10 intervals of quarterly oil prices since 1974 is represented in Figure 3.

Is the current pricing environment a return to historic normalcy or just a short-term price depression while the market searches for a new equilibrium as supplies continue to build? The data above suggests that the historic market equilibrium, adjusted for inflation, is between $30 and $40 a barrel. In addition, when speaking to reporters on April 27, 2015, Saudi Arabian Prince Abdulaziz Bin Salman Bin Abdulaziz was quoted as referring to the global oil market as "excellent," signaling that Saudi Arabia is content with the current global market. Combining the two aforementioned factors with the likelihood of a strengthening US dollar (note there is a 72% negative correlation of US dollar to oil prices over the past five years), positive indicators remain scarce for a significant recovery in oil prices. Is it time to break out the stone-washed jeans and the flannel, as the 1970s and 1990s seem poised to return? Only time will tell.

In the meantime, what can investors expect to see from US oil and gas producers if prices remain at current levels for the rest of 2015? The next sections will show the trends of key operational and financial metrics during the last down cycle of 2008 and the subsequent recovery.

UP-CYCLE AND DOWN-CYCLE ANALYSIS

EnerCom used its proprietary database to analyze important metrics controlled by management during up-cycles and down-cycles. The metrics are derived from EnerCom's proprietary database that houses operational and financial data on more than 290 public E&P, oil service, and midstream MLP companies. The following sections contain quarterly and yearly analysis of how each of these metrics trended through the time periods of 3Q07 to 4Q09 and 2Q12 to 4Q14, grouped by market cap.

Our analysis in this report is focused on the C-Corporation US-based E&P names in our database that were public during the measured periods. Figure 4 shows the number of companies by market cap for each quarter examined in the subsequent analysis.

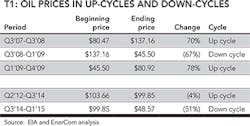

The period of 3Q07 to 4Q09 was chosen as a basis for comparison because it spanned the last down-cycle, the lead into collapse and the subsequent recovery. The lead up to and beginning of the current down-cycle is measured from 2Q12 to 3Q14. Comparison of these time periods is an attempt to identify trends in metrics that may help establish operational and financial expectations through 2016. For reference, oil price declines for both comparable cycles were significant with decreases of more than 50%. The oil pricing in 1Q15 dollars during these periods is summarized in Table 1.

Obviously, the difference between the two price collapses is the period leading into the down-cycle. The period leading into the current price environment experienced stable and uncharacteristically high pricing, where the periods before and after the collapse of 2008 are characterized by oil price increases of more than 70%. Perhaps the trends of metrics during these two periods can give a glimpse of what to expect if oil recovers through the beginning of 2016.

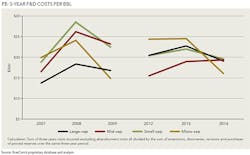

THREE-YEAR F&D COSTS

Low finding and development (F&D) costs can be an indicator of superior asset quality, a company's ability to execute and realize efficiencies in its drilling plans and supply chain management, e.g., purchase power of mission critical services (drilling rigs and frac spreads) and inventory (pipe, power, and proppant). A relevant factor to the current production environment is how the commodity pricing will affect the metric.

If a portion of a company's proved reserves becomes uneconomic to drill at a given year's SEC price deck, the company may have negative revisions in its reserves reconciliations, shrinking the denominator in the calculation and driving the F&D costs per barrel higher. It is interesting to note that costs incurred, the numerator in the F&D calculation, increased, on average, 59% from 2007 to 2008 as companies ramped up during the up-cycle and then declined an average of 41% from 2008 to 2009 as companies reacted to the decline in commodity prices.

As shown in Figure 5, F&D costs across all market caps climbed at year-end reporting for 2008, primarily due to negative revisions throughout the industry resulting from the 67% decrease in oil pricing shown earlier. While the F&D costs trended down for 2014, indicating gained efficiencies across all market cap groupings, it is likely that at current commodity prices, negative reserve revisions that could come in 2015 could outweigh some efficiencies companies may achieve.

If prices remain low through 2015, the market should expect F&D metrics to rise despite continued advancement in drill bit efficiencies. Because F&D metrics are calculated annually, the first bellwether for the effects of pricing on all-in F&D costs will come as companies with non-calendar year-ends will report in June and September 2015. As evidenced in 2009, companies were able to quickly drive down service costs which helped F&D metrics return to historical levels despite a lower annual average price deck.

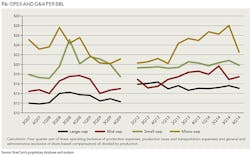

TRAILING 12-MONTH OPERATIONAL AND G&A EXPENSE PER BARREL

As the primary focus of companies shifts from cost control to growth during periods of rising or high, stable commodity price environments, the expenses per barrel tend to rise characterized by the periods of 4Q07 to 3Q08 and 2Q12 to 3Q14. Large market cap companies appear to be the exception to this, as this metric is on a per-boe basis, and larger companies enjoy cost advantages from economies of scale and a stable production base.

Conversely, the changes are much more magnified in the micro-cap group where growth is the primary objective and there are front-end costs associated with ramping up production. With companies achieving efficiencies in shale production and the risk of a new long-term price environment where the equilibrium could fall to $60 per barrel or less, it seems likely that companies across all market caps will remain focused on minimizing costs through 2016 (see Figure 6).

CAPITAL EFFICIENCY

Capital efficiency is a metric that approximates cash flow generated from each investment dollar. Low price environments not only apply upward pressure on F&D costs (the denominator in the capital efficiency calculation), but also downward pressure on EBITDA as margins tighten. As a result, low price environments are compounded in both the numerator and denominator resulting in swings that are more pronounced than with F&D costs alone.

There was a large negative impact during 2009, driven by the spike in F&D costs paired with low prices at the beginning of 2009 (see Figure 7). Despite an oil price recovery from 1Q09 to 4Q09 of 78%, the use of F&D costs from the 2008 year-end reports kept this metric depressed through 2009.

While the downward trend in capital efficiency was compounded by low prices in the beginning of 2009, this may not be the case for 2015, as the SEC price decks used at the end of 2014 were not indicative of the current commodity price environment. As a result, capital efficiency metrics in 2015 should reflect only price related changes to EBITDA and a company's capability to control margins through operating cost efficiencies.

It is interesting to note that as companies have progressed along the unconventional learning curve and have entered the development stage, there is a tighter band across market caps in the outputs in the 2012 to 2014 time period as compared to the 2007 to 2009 period.

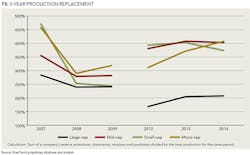

THREE-YEAR PRODUCTION REPLACEMENT

Three-Year Production Replacement is the rate at which a company is replacing its production with new reserves and growing future opportunity (see Figure 8).

It is evident that the price collapse of 2008 had a material effect on production replacement as the replacement rates of all market cap groupings fell sharply. It is also interesting that the replacement rates did not immediately rebound in 2009 despite the 78% increase in oil prices from 1Q09 to 4Q09. This is likely attributable to three factors: capital expenditure budgets were impaired by the lack of cash flow during the back half of 2008 and the beginning of 2009, reserve reconciliations had negative revisions as many new shale plays became temporarily uneconomic, and for much of 2009, many companies had borrowing base re-determinations on their reserves at much lower price valuations.

According to the Macquarie Tristone surveys of lender banks, the base case reserve lending prices fell from $67.15 per barrel (WTI) and $6.88 per MMbtu (Henry Hub) in 2Q08 to $46.61 per barrel (WTI) and $5.39 per MMbtu (Henry Hub) in 1Q09. It is probable that the decreases in production replacement, similar in magnitude to those observed in 2008, will appear again in 2015 for the same reasons. This is evidenced again by falling price decks for borrowing bases.

According to the Macquarie Tristone surveys of lender banks, the base case reserve lending prices fell from $78.53 per barrel (WTI) and $3.62 per MMbtu (Henry Hub) in 4Q14 to $50.50 per barrel (WTI) and $3.02 per MMbtu (Henry Hub) in 1Q15.

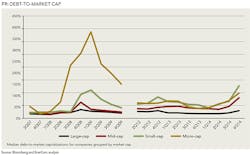

DEBT-TO-MARKET CAPITALIZATION

The small- and micro-cap companies were leveraging up leading into the collapse in 4Q08 to fund growth and development of unconventional plays. As prices fell, small- and micro-cap companies, which are generally perceived by the market as more risky as they do not have a large production base to source cash flow, were hit especially hard. In contrast, all market cap groups remained under 100% debt to market cap through the high price environment of 2Q12 to 3Q14. Only in 4Q14 did companies' debt begin to surpass their market capitalizations as stock prices fell with the 51% decline in oil prices from 3Q14 through 1Q15 (see Figure 9).

Another measure of leverage, independent of share price, is measured by Debt-to-EBITDA. During the 3Q07-2Q08 period leading up to the 67% decline in oil price, the median Debt-to-EBITDA levels for the quartiles were 0.4x, 0.9x, 1.5x, and 2.8x, respectively. During the 2Q12-3Q14 period leading up to the oil price decline of 51% in 4Q14 to 1Q15, the median Debt-to-EBITDA levels had risen to 0.8x, 1.4x, 2.2x, and 3.9x, representing increases of 79%, 68%, 49%, and 40%, respectively. The increase in leverage across the board is likely the reason for the increased levels of volatility in stock prices versus oil prices since the recovery in 2009. From 1Q10 to present, the increased level of volatility for all debt quartiles is apparent in Figure 10.

LOOKING AHEAD TO THE ONSET OF RECOVERY

At this point, the divergent forecasts of oil markets by the oracles, prognosticators, prophets, soothsayers, and fortune-tellers are enough to make one dizzy. But if history rhymes, a recovery in oil prices could be a protracted one, with the market reaching a new long-term equilibrium in the $50-$70 range, opposed to the $100 era of the past decade.

OPEC's decision on June 5, 2015, to maintain its 30 million barrel per day production quota reemphasizes this point and hammers home the idea that asset bases, drilling efficiencies, and debt levels will become increasingly paramount. Operators that have accumulated the highest quality asset bases and are the most successful in reducing costs should experience fewer negative reserve revisions and higher returns and cash flow, resulting in lower F&D costs, higher capital efficiency and production replacement and increased agility versus competitors to exploit new opportunities as they arise.

In fact, at the time of publication, when WTI prices were approximately $60 per barrel, rigs in select US shale basins were going back to work. On Friday, June 5, Baker Hughes reported 233 rigs were running in the Permian Basin, one more rig than the previous week. The same week, rigs running in the Eagle Ford declined for the first time in four weeks. Total US rig count continues to fall, but as operators with the highest quality asset bases and best financial positions adapt to the current environment, select US shale basins could continue to see rig count increases.

In terms of stock performance, asset quality and efficiencies are important, but also relative to debt levels as shown by stock performance of the Debt-to EBITDA quartiles. Unless there is a significant recovery in oil prices, markets should also expect E&P equities with lower levels of leverage to perform better in 2015, with the companies that have the highest quality assets and achieved efficiencies to be the best-in-class.