Sub-$40 oil drives wedge between buyers & sellers, leaving Permian & private equity as main deal drivers

DAVID MICHAEL COHEN, PLS INC., HOUSTON

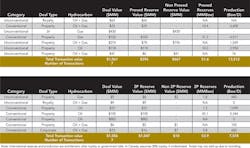

THE RAPID "DOUBLE DIP" SLIDE of WTI oil futures since late June (trading below $40/bbl as of Aug. 24) is shaking up whatever common ground buyers and sellers found this spring when prices broke above the $60/bbl mark. In the current pricing environment, PLS research indicates that the most prolific region for dealmaking continues to be the Permian Basin. Unconventional development in the Wolfcamp, Spraberry and Bone Spring plays remains some of the best in the industry, particularly on acreage where these formations exist as stacked objectives. Outside the Permian, public E&P firms continue to find fresh capital for drilling programs-even in this low-price environment-by striking creatively structured JV deals with private equity partners.

Only two acquisitions YTD with announced values cracked the $1 billion mark, and both included Permian assets-Noble/Rosetta for $3.85 billion and WPX/RKI for $2.75 billion. ExxonMobil may have just made the third with the addition of 48,000 acres to its Midland Basin position. Applying a $23,845/acre metric reported by Diamondback Energy in a Midland Basin deal in May would put Exxon's price tag at $1.14 billion, while an implied $16,450/acre metric from a Parsley Energy bolt-on deal last December would yield a value of $790 million.

Indeed, Exxon could have paid considerably more. RSP Permian announced a $274 million Midland Basin bolt-on acquisition three days earlier, to which most analysts are assigning metrics of $34,000-$35,000/acre after applying a $50,000 per boe/d value to existing production.

In terms of announced deal values, the biggest US upstream deal from July 17 to Aug. 16 was not in the Permian, but rather in the dry gas Utica. Magnum Hunter struck a farm-out deal under which a private equity firm will commit $430 million to drill on 9,500 net acres in exchange for 100% WI in the acreage and resulting wells. When the wells reach a 12% IRR and a 1.20x multiple on invested capital, 90% WI will revert to Magnum, increasing to 95% at 16% IRR.

The deal structure is similar to those employed by upstream MLPs Linn Energy and Legacy Reserves earlier this year to fund unconventional drilling and convert the resulting high-decline production into stable cash flow more appropriate to the MLP model. Its use now by a C-Corp with strong a track record in multiple unconventional plays shows that even established shale drillers need to reduce their risk profile to drill new territory in the current low-price environment.

In Canada, upstream deal activity has come to a near-standstill as the market contends with persistent price volatility and uncertainty on future royalty rates. The latter is particularly on producers' minds as Alberta's recently elected New Democratic Party settles into office after securing a sweeping victory on a campaign in which it pledged to review the province's low oil and gas royalty regime. In the meantime, the deals getting done are relatively small with high 2P reserve content and low capital requirements, such as Eagle Energy Trust's $23 million acquisition of a conventional Pekisko oil producer and Striker Exploration's $6 million Wilson Creek bolt-on deal.

Deal activity outside North America has also been slow, with the notable exception of the North Sea, where supermajors have begun executing on a long-awaited round of sell-downs and divestments.

Total agreed to sell a 20% stake in its Laggan-Tormore project to British utility SSE plc for $876 million. Development of the Laggan and Tormore gas fields in the West of Shetland area began in 2010, and first production is expected in the coming months, ramping up swiftly to a peak rate of 500 MMcf/d plus 100,000 bbl/d of condensate that should stay steady from 2016 to 2020. The nearby Edradour and Glenlivet discoveries will be tied into the project with startup in 2017 and 2018, respectively. Total will retain an operated 60% WI in the four gas fields with Dong Energy holding the remaining 20%. SSE began acquiring upstream assets in 2010, and with this purchase it more than doubles its reserves and is set to ramp up production even as its existing assets begin to decline.

Meanwhile, Shell and ExxonMobil agreed to sell their Anasuria FPSO and associated oil and gas fields offshore Aberdeen to a Malaysian joint venture of Ping Petroleum and Hibiscus Petroleum for $105 million. The sale includes 100% WI in Teal, Teal South and Guillemot A fields and 38.65% WI in Ithaca Energy-operated Cook field, with 45 MMboe of 2P reserves and 2014 production of 5,344 boe/d. Additional North Sea assets are likely high on the list of assets to be included in a targeted $30 billion divestment program by Shell to raise funds and refine its portfolio following the pending $82 billion acquisition of BG Group.