Time to tack towards gas

LONG-TERM DEMAND FOR GAS IS FORECAST TO GROW 6% THROUGH 2030

JOHN CORRIGAN, STRATEGY&, DALLAS; DANNY WILDEROTTER, STRATEGY&, DALLAS; VIREN DOSHI, STRATEGY&, LONDON; AND GEORGES CHEHADE, STRATEGY&, MIDDLE EAST

GONE ARE THE DAYS of $100 per barrel oil. The new normal is now closer to $60.

The winds in today's energy markets have changed and companies must set a new course based on changing supply and demand dynamics. The precipitous drop in oil prices from the fall of 2014 has companies reconsidering capital plans and deferring completions of oil wells. However, the same headwinds facing oil are propelling the future of natural gas in North America. Growing demand, decreasing production costs, and significant investment in infrastructure has allowed gas to maintain its price and will lead to higher prices in the future.

The companies that will thrive in this environment are those that have the flexibility and foresight to shift production and acquire capabilities to capitalize on this transition before their competition. As we have seen in prior price dips, industry consolidation is inevitable as smaller producers struggle to survive and larger players face pressure to meet growth targets. Identifying the right opportunity is critical for success, and first movers in the market place are often rewarded long term.

WHERE THE MARKET WILL BE

In the last few years, we have seen a dramatic shift in global energy markets. On the heels of the unconventional gas revolution came unconventional oil, and with it, a surge in domestic production. The United States is producing record amounts of oil, and storage is almost 90% full, causing crude prices to reach their lowest levels since 2009. WTI prices are down 60% since their high last summer, and relief is nowhere on the horizon.

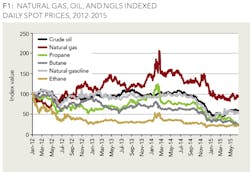

Natural gas, however, has fared much better. Prices have stabilized since their collapse in 2008, and, unlike oil, remained relatively constant over the past few years (See Figure 1). Near-term demand forecasts suggest this trend will continue. Short-term demand (through 2016) for natural gas is expected to grow by 3% YOY while demand for crude is expected to remain flat. Furthermore, long-term demand for gas is estimated to grow 6% between 2014 and 2030, providing additional relief for prices. Much of this growth will be driven by two key segments in the US: power generation and industrial manufacturing.

Power generators invested heavily in new gas-fired generation, responding to the competitive economics of natural gas compared to coal and continued regulatory pressure to reduce greenhouse gas emissions. In the past 10 years, gas consumption for power generation has increased 33%, whereas coal consumption has decreased 18%. With coal continuing to lose favor with regulators and consumers, power generators will continue to favor gas as the fuel of choice for new power plant construction.

The recovering US industrial sector provides a similar growth story for gas consumption. Since 2005, gas consumed for industrial purposes has risen 15%. As industrial output continues to grow in the future, the US Energy Information Administration forecasts that gas consumption will grow an additional 10% by 2030, reaching 8.4 trillion cubic feet per year.

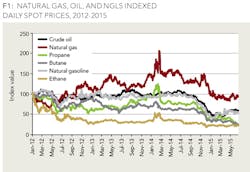

On the supply side, the story is equally compelling. Exploration and production companies continue to invest in technology to improve drilling efficiency. Rig productivity in the Marcellus Shale has improved 38% YOY since January 2012, and new wells produce at a rate of 8 MMcf per day (See Figure 2).

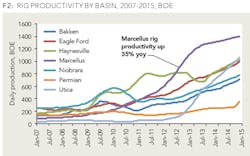

With advances in drilling practices, top-quartile performers like Cabot Oil & Gas are now able to earn a 10% return at Henry Hub prices as low as $1.75. Thus, despite the sustained period of low prices, gas production continues to grow and there are adequate low cost domestic supplies for this growth to continue in the future (See Figure 3).

The radical growth in the production of natural gas coupled with the shift in producing regions is fueling rapid expansion in infrastructure investment. Additional pipeline capacity is needed to de-bottleneck key producing regions as well as service new centers of demand. In response, midstream companies are investing in construction of new pipelines and expansion of existing pipelines to bring the gas to market.

By 2019, an additional 24 bcf/day of pipeline capacity is expected be brought online, providing producers with new egress opportunities. Over half of this capacity is targeted in the Marcellus and Utica Shale regions and will enable producers to not only sell gas in the large Northeast market but will also provide egress opportunities to the Midwest, Canadian, and Gulf Coast demand centers.

LNG will also be a game changer for gas producers. With 6 bcf/day of LNG liquefaction plants currently under construction and another 10 bcf/day under development, gas producers will have the opportunity to market their gas to international markets in addition to domestic consumers. While low oil prices have dampened LNG prices somewhat, the sharp increase in export capacity will have a significant impact on natural gas prices domestically. In total, we project basis at key Gulf Coast and West Coast market hubs to increase $0.10-$0.25 from the construction of LNG export facilities and new pipeline capacity.

OPTIONS FOR CAPTURING FIRST MOVER ADVANTAGE

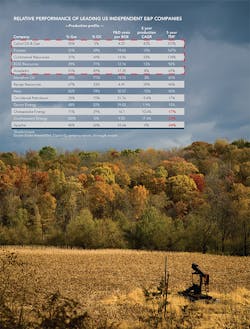

The companies that will thrive in this environment are those that have the flexibility and foresight to shift capital and production to acquire capabilities and capitalize on this transition before their competition does. While being a first mover is risky, the market rewards those who correctly enter new markets before their competitors. Among independent producers, the companies with the highest five-year shareholder return are not necessarily those with the greatest growth in production or those with the lowest F&D costs. The companies that have earned the greatest returns are those that entered new basins before the competition and successfully developed their resources.

Cabot Oil & Gas was one of the first companies to enter the Marcellus, and remains one of the largest landholders today. Similarly, Continental Resources and EOG were among of the first companies to produce in the Bakken, while Pioneer Natural Resources captured a sizeable stake in the Eagle Ford. All four of these companies have significantly outperformed their peers due in large part for their ability to take a chance and execute in new resource basins before the competition (See table).

Companies looking to change their tack before the competition have several options, each requiring tradeoffs between cost, execution risk, and future optionality, depending on the basin. Purchasing land is likely the least complex option and carries the lowest level of execution risk. However, in most basins the majority of available land has already been purchased.

While prices have decreased significantly from their peak, acquiring land remains one of the most expensive options. For example, recent transactions in the Eagle Ford closed at a purchase price of $10.65 per BOE of proved reserves acquired. Furthermore, acquiring land in a particular basin limits a company's options should they want to shift their focus and locks them into a particular resource group.

Forming a strategic partnership is another option for companies to increase their exposure to natural gas. In light of high land costs, partnering with another producer provides an opportunity to enter a basin and share the costs, effectively limiting the financial risk. However, establishing a successful joint venture is highly complex, and many partnerships fail to live up to expectations. Partnerships in certain plays are limited by the number of participants (e.g. Haynesville Shale), while low prices have made other basins unattractive for partnership opportunities (e.g. Eagle Ford).

A third option is to make a strategic acquisition. In prior price periods of declining oil prices, industry consolidation prevailed as the preferred method to grow capabilities and assets. As seen in Figure 4, independent E&P companies can be categorized into four main buckets based on their balance sheet strength. Identifying the right partner can open the door to multiple resource basins at relatively low cost.

SUMMARY

Now is the time or North American E&P companies to change tack and shift their strategic focus away from oil and towards natural gas. Growing demand, declining supply costs, and investment in infrastructure to support production growth provide a compelling future for companies willing to take the risk and capture first mover advantage. Depressed oil prices have weighed on the balance sheets of many small E&P companies, creating ample opportunities for producers to acquire the assets and capabilities required to successfully position themselves to lead the market forward. The companies that will succeed and deliver the best return to shareholders are those that recognize the shifting winds and act before their competitors.

ABOUT THE AUTHORS

John Corrigan is a partner at Strategy& (a member of the PwC network of firms) in Dallas; Danny Wilderotter is an associate at Strategy& in Dallas; Viren Doshi is a senior partner at Strategy& in London; and Georges Chehade is a partner with Strategy& and the leader of the Energy, Chemicals, and Utilities practice in the Middle East.