EDITOR'S NOTE: OGFJ recently spoke with Barry E. Davis, president and CEO of Dallas-based EnLink Midstream, and his executive team - Michael J. Garberding, executive vice president and CFO; Steve J. Hoppe, executive vice president and president of gas gathering, processing, and transportation; and Mac Hummel, executive vice president and president of natural gas liquids and the crude oil business.

OIL & GAS FINANCIAL JOURNAL: EnLink Midstream was formed in early 2014 when Crosstex Energy and Devon Energy combined their US midstream assets. Can you provide our readers some background as to how this came to pass and what the advantages are to the new entity - for the company and its customers?

BARRY DAVIS: Crosstex existed for over two decades building a company based on relationships. We had a very broad set of relationships across the entire producer and the end-user community. One of our longest standing relationships was with Devon Energy who was also one of our largest customers. Our partnership was built on trust and operational excellence. After many years of working together successfully, management of the two companies decided to merge their respective midstream assets to create the type of company that we think is needed in today's market: a company that offers diversity of services to our customers, the scale that is needed to compete in a competitive environment, an investment-grade balance sheet that gives us the financial capability we need to grow and prosper, and most importantly, the capability to serve all commodities and provide the services our customers need.

We wanted to execute a step-change transaction that would transform our business, so when Devon announced it was considering an IPO for its midstream business, we quickly approached them about creating a combined company. Because of our history and shared values, we were able to get some early momentum for the transaction.

OGFJ: Can you expand on the relationship between Devon and EnLink today? Are there Devon people on your board of directors, for instance?

DAVIS: Yes. Our relationship with Devon is really a key attribute of our company. The majority of our board members are Devon representatives and we have a number of key operational and leadership employees who came over to EnLink from Devon, including Steve Hoppe, who now heads the gas side of our business. Steve is a part of EnLink's executive team and brings a great history and connection to Devon.

OGFJ: There are two EnLink Midstream companies, both of which are listed on the New York Stock Exchange. But one - EnLink Midstream Partners LP - is an MLP. EnLink Midstream LLC is not and has a separate listing. Why did you create two business entities and what were the advantages of doing so?

MIKE GARBERDING: Our MLP, or ENLK, is treated as a partnership, and the general partner, or ENLC, is the parent. There is a different investor base with each of these entities and strategic advantages. When we formed EnLink, it combined a $2 billion company, which was Crosstex, with Devon's midstream assets, which were valued at around $4 billion. Ultimately, the combination created a company that was worth more than $10 billion after the transaction was completed. Going forward, we like having those two entities because it gives us continued optionality as to which entity we grow with - and not all MLPs today have that.

OGFJ: Is Devon your biggest customer? Who are some of your other customers?

DAVIS: Yes, Devon is currently our largest customer. More than 50% of our revenue, or gross margin, is generated from our relationship with Devon. That is important because it helps provide stability in the organization. The contract we have with Devon, backed by a five-year minimum volume guarantee, is totally fee based. In fact, 95% of our margins are based on fixed fees and, importantly, not sensitive to commodity price fluctuations. Secondly, the minimum volume commitments do not expose us to volume fluctuations, so that's a very important part of the Devon relationship going forward.

GARBERDING: We're different from a lot of our peers. About half of our revenue comes from our relationship with Devon, which provides stable and predictable cash flows. We also have a thriving third-party business, which accounts for the other half of our business, and it continues to grow. About 80% to 90% of our customers are investment grade, so we have a very strong customer portfolio.

DAVIS: I agree that EnLink has highly attractive customers. If you think of the typical gathering and processing company, of course their customer base is going to be E&P companies. However, our business has a breadth of operations, including the NGL side, which some of our peers don't have. Our capabilities are now stronger for all our customers, and we've seen greater opportunities as a result of the financial capability and the service capabilities we have after the transaction.

EnLink

OGFJ: As one of the larger midstream businesses, EnLink has gathering systems, processing facilities, and fractionation plants, as well as transportation and logistics assets. In building up these assets, was your intention to maintain sustainable growth? How do you continue to steer the company in that direction?

DAVIS: EnLink was created with a focus on stability and growth. Stability comes from our financial strength and flexibility, including our investment-grade balance sheet, diversity of assets, and scale of our organization. Growth comes from what we describe as our four avenues of growth. These include drop-downs, or the transfer of assets from Devon or our general partner, ENLC, into our partnership, or ENLK; growth with Devon by providing infrastructure and services in the areas where they are focused; organic growth, which we have done for more than two decades; and mergers and acquisitions. In all, we have executed on $4.3 billion of growth opportunities through these four avenues since becoming EnLink last year. Stability and growth are really the foundation that EnLink is built on.

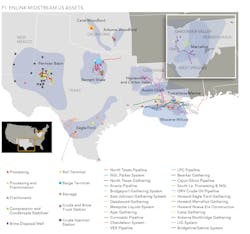

OGFJ: EnLink has operations in nine oil and gas producing regions - North Texas, the Gulf Coast, Haynesville, the Permian Basin, the Utica, the Marcellus, the Eagle Ford, Cana, and Arkoma-Woodford. Are you satisfied with the geographic scope of your business at this time, or will we see the company expanding into other plays?

GARBERDING: We've always focused on our core areas. All of the acquisitions we've done in the past year have supported expansion in those key regions. We continue to focus on building our strategic footprint, including strengthening our diversified services.

DAVIS: Our focus areas look like a historical road map to the evolution of the shale business. We started in the Barnett Shale play and were one of the first movers there. Then we became one of the first movers in the Haynesville. And so on. We are now in nine of the top 12 resource basins in the United States. If the right opportunity were to present itself in a new, prolific basin, we certainly would have interest. But the emphasis, as Mike said, is on our core areas with focused growth in the Permian, the Eagle Ford, Louisiana, and the Mid-Continent regions.

OGFJ: Let me ask you about Mexico. The country has recently instituted some reforms in its energy sector in an attempt to attract foreign investment in its aging energy infrastructure. Would you consider expanding your operations into Mexico?

DAVIS: EnLink has an ownership interest in Howard Energy Partners. Howard recently won a contract to develop the Nueva Era Pipeline, a 200-mile, 30-inch natural gas pipeline that will transport gas from Webb County in South Texas to the area around Monterrey, Mexico. The pipeline is expected to be in service in July 2017. Any participation by EnLink in opportunities in Mexico would come through our ownership in Howard.

OGFJ: How has the current low-price environment impacted your business? Obviously it's affected many of your customers.

DAVIS: We were built for this. We didn't predict this downturn - the timing of it - but we were certainly prepared for it. We knew that we are in a cyclical industry and would see a down cycle at some point, so we specifically designed the company to be able to sustain itself during a down cycle. In the first 18 months of existence as EnLink, we've executed on our growth objectives. We have completed $4.3 billion worth of transactions across all four avenues of growth in a wide variety of basins. Our financial results to date continue to be very strong and consistent with our projections early on. We believe we are one of the best-positioned midstream companies, and we're going to come out of this cycle even better because of our capabilities and financial strength.

OGFJ: Let me ask you a broad question about the industry. Some industry analysts are predicting a lengthy down cycle this time with recovery not until 2017 or even later. If this gloomy assessment turns out to be correct, what will be the impact on the industry and on your business?

DAVIS: Our crystal ball is not any better than anyone else's. However, we do spend time listening to well-informed people and trying to reach a consensus.

STEVE HOPPE: Looking at the type of environment we're in today, it gives producers a reason to take an in-depth look at the gas side of their portfolios and reevaluate their focus. Previously, a number of producers looked at the high prices for oil and began making the switch from gas to oil. Now you're seeing oil come down in price and gas has been relatively stable, with the current outlook being more optimistic for gas. We are beginning to see new opportunities because of this, which help with the diversification we have in our business. I think that's going to be a positive for us in the current market environment.

EnLink

MAC HUMMEL: In addition to the hydrocarbon supply growth we've seen in the US, we've also seen a resurgence of the petrochemical industry. The rise in the petrochemical industry is driven by the abundance of natural gas liquids the producing industry has developed. We've seen large petrochemical investments being made in the Gulf Coast to use NGLs as feedstock for manufacturing plastics and derivative products. The petrochemical market for us is a demand-driven market versus a supply-driven market, and we're well positioned to serve that demand - not only with NGLs, but also with gas. In fact, on the gas side, we see significant demand growth for LNG and industrial customers. As for crude, we tend to think that the supply-demand situation is sorting itself out right now. Long term, we see crude demand continuing to increase on a global basis, so while we're currently in this low crude-price environment, we believe that supply and demand conditions will normalize over time. Importantly, EnLink is well positioned to take advantage of the opportunities when they do.

OGFJ: How about LNG? The US is on the verge of becoming a significant exporter of liquefied natural gas in the next few years. How will this affect the domestic natural gas industry, and what will it mean for EnLink's business?

HUMMEL: It will be very significant for domestic producers and for EnLink. The estimates I've seen are that upwards of 12 bcf per day of LNG could be developed along the Gulf Coast. That's a significant step up in the amount of demand for US gas. Export facilities are being proposed and constructed in Louisiana along the coastal areas, and EnLink is very well positioned with our infrastructure to participate in serving that LNG demand growth. We are actively talking to LNG producers where we think we can provide a solution with the "last mile" of pipe from some of the large interstate expansions that are looking to move volumes from the Northeast to the Gulf Coast.

OGFJ: That will require some additional investment in infrastructure for EnLink.

HOPPE: Yes. When you look at gas demand, you're looking at industrial growth and the ability of gas to replace coal for power generation. LNG is really the third leg to that stool. Gas will continue to see some price growth, and there will be a significant increase in gas volumes as the US begins exporting LNG.

HUMMEL: Also, the large footprint EnLink has in Louisiana, it allows us to take full advantage of the capacity we already have. That means we can begin serving the LNG market without having to make much of an initial investment.

OGFJ: Let's talk about acquisitions. EnLink has acquired a number of assets from other companies, most recently the Delaware Basin System in West Texas from a subsidiary of Matador Resources. Can you tell our readers a little about your strategy with regard to acquisitions?

GARBERDING: Our strategy is actually a Permian-based strategy. Four years ago we established a position in the Midland Basin, and from that we grew our gathering and processing systems in the area. We wanted to expand our footprint, and the acquisition of the Coronado assets was a perfect fit with our existing footprint. We have a great position in the core of the Midland Basin where some of the best areas are going to be developed. In fact, we've seen some of the best drilling results right there in the five or six counties where we have assets and infrastructure.

We wanted to apply the same strategy in the Delaware Basin. We started with the LPC acquisition, which expanded our oil gathering and trucking capability and liquid capability in the basins. More recently, we acquired Matador's midstream assets in the area which include a small processing plant and gathering pipeline. We now have a platform to build from, and we think it's in the right location in the Delaware Basin to pursue additional opportunities.

Also, the commercial and operating teams that came from the Coronado and LPC acquisitions are best in class. They have great connections in the community as well as the industry and we'll be able to utilize their relationships in the area to support future growth. We are extremely happy with the excellent personnel that have become a part of our EnLink family.

OGFJ: Is this a good time to acquire assets?

DAVIS: We want to be able to use our financial strength in a down cycle to take advantage of opportunities, and we are doing exactly that. If you look at the last three or four transactions that we've done, we believe our financial capability differentiated us. These were transactions we probably wouldn't have done a year ago just because of the more competitive environment. But I want to emphasize that we are focused on areas where we already have a presence. Our goal in acquiring assets is to get better from a capabilities standpoint. If you look at everything we've done, that's always been our aim.

OGFJ: Does that mean you wouldn't consider an opportunity in a basin where you don't already have a presence - the Niobrara or Bakken, for instance?

DAVIS: Well, we've passed on far more opportunities in this market than we've pursued because many have not been a good fit with what we're trying to do.

OGFJ: Can you sum up EnLink's short-term and long-term goals and how you plan to achieve them?

DAVIS: We are one of the largest midstream companies in the marketplace, and from day one our intent was not only to be one of the Top 10 midstream companies in terms of size, but to remain one of the best. Looking forward, we expect to capitalize on a variety of opportunities, with a focus on acquisitions, efficiencies and synergies, diversification and expansion. That means we have to continue providing great customer service. We have to remain great at operational excellence and execution. We have to maintain our position of financial strength and flexibility. We are excited about the future and will continue to focus on the same things we have always focused on.

OGFJ: Thank you all very much for your time today.