The smart approach to transfer pricing

Multinational oil and gas companies must think globally and act locally in order to comply with complex tax laws.

To meet the growing global demand for oil and natural gas, international oil companies and oilfield services firms, among others, are expanding their operations to an ever-wider range of “new frontier” nations. New national affiliates and corporate subsidiaries are developing the infrastructure needed for oil and gas production in countries that, not long ago, were little known in the United States.

New frontier expansion, however, means more than just opportunity for these multinational oil and gas companies. It also requires an increased focus on the issue of transfer pricing, which is defined as the price charged for tangible and intangible assets, services and financial instruments sold or transferred across borders by multinational companies to their affiliates. In a recent Ernst & Young survey of oil and gas financial executives, a majority said transfer pricing was likely to be critical or very important in the coming years.

The advent of transfer pricing rules and regulations around the world represent a significant financial risk that has broad implications for today’s global oil and gas companies – requiring them to think globally so that transfer pricing is managed properly across the enterprise, and act locally to be in compliance with a myriad of different tax laws.

As a tax and financial reporting issue, transfer pricing is a relatively new challenge. As late as 1995, only the United States had specific transfer pricing regulations, designed to prevent multinational companies from creating issues around taxable profits by selling or transferring assets and services at non-market prices to foreign subsidiaries.

Today, however, more than 50 countries have some form of transfer pricing regulations, requiring multinational companies to:

- Develop market-based, intra-company pricing protocols and agreements

- Educate employees around the globe and ensure that all applicable team members stay abreast of regulations

- Manage documentation of all cross-border transfers and sales

- Ensure tax compliance with a broad range of rules and regulations

As many multinational companies – especially those in the oil and gas sector – are finding, these efforts require significant resources, and the process grows more complex each year.

Globalization drives regulation

The growth in the number of countries implementing transfer pricing rules – and the impact of these rules on multinational companies – is the result of the increased globalization of business.

In the 1960s and ‘70s, many US-based companies began to seek new markets outside the United States. At the same time, foreign-based companies began increasing their presence in the United States, eager to sell products and services to American businesses and consumers. The global scale of business increased rapidly throughout the 1980s and ‘90s, and the volume of transactions among related affiliates grew significantly.

Those affiliate business deals began to draw the attention of governments, which saw the regulation of transfer pricing as a way of capturing tax revenue that was escaping their jurisdiction due to corporate policies designed to minimize liabilities.

Oil and gas industry impact

The oil and gas industry has been affected in two unique ways. First, many of the developing countries where companies have operations today are still defining their transfer pricing and tax policies, making it difficult to keep pace with changes. These new frontier nations often have no tax treaties with the United States, which can result in double taxation in the event of an audit and subsequent adjustment.

In addition, it is not unusual for every step in the hydrocarbon value chain – from extraction or production to refining, marketing and distribution – to take place in a different country, requiring multiple transfer pricing transactions and necessitating a detailed “paper trail” to ensure tax compliance in each jurisdiction. Indeed, many oil and gas companies employ sophisticated cross-border and interaffiliate services in their upstream strategies, making more complex the determination of true market pricing for services and intangibles.

Further, governments increasingly are working together under multilateral initiatives focused on cross-border enforcement, with particular attention paid to under-reported income. And many countries that used to focus on attracting foreign investment through favorable tax policies are now aggressively pursuing tax revenues from the very companies they attracted. Tax authorities are increasingly wary of foreign-based companies that claim losses or marginal profits.

Companies recognize the risk

It is clear that transfer pricing regulations – and their importance to tax revenues – create financial risk for global oil and gas companies. A recent Ernst & Young LLP survey of multinational firms found that 67% of oil and gas sector respondents believe transfer pricing will be “absolutely critical” or “very important” to their organizations over the next two years.

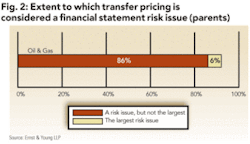

That same study showed that 20% of the oil and gas companies surveyed had undergone a tax audit that resulted in an adjustment at least once since 2003.

These findings demonstrate that the oil and gas sector recognizes the potential issues associated with transfer pricing regulations and, increasingly, is focused on mitigating that risk. But one of the biggest potential pitfalls for companies is assuming that maintaining accurate transfer pricing of their production commodities – the oil or natural gas they produce and transport across borders – is enough.

While it is true that commodity transactions can easily be priced using well-known index pricing guides, it is the intangibles – such as intellectual property, trademark use, financial instruments (i.e., loan guarantees) and intercompany service transactions – that create the most difficulty and are often most susceptible to audit by tax authorities.

Keys to managing risk

The increasing amount of resources needed to maintain compliance is another factor impacting oil and gas companies in their efforts to successfully manage transfer pricing risk. It is not uncommon for companies today to supplement internal transfer pricing teams of accounting, tax and operations personnel with counsel and support from external experts who have on-the-ground knowledge of local laws and requirements.

In general, transfer pricing risk mitigation involves a multifunctional, enterprise-wide compliance effort that ensures pricing agreements are completed and followed and that all transfers and sales are recorded using those protocols. The process includes:

- Determining which countries have material operations.

- Gaining a thorough understanding of the rules and regulations in each of those countries.

Though this is an enterprise-wide activity, it is critical that local expertise be consulted, since every country has its own transfer pricing regulations and they can vary widely between jurisdictions. The mantra should be “global exercise, local implementation.”

- Developing the appropriate transfer pricing protocols and policies, and training the applicable accounting, tax and operations personnel.

Every relevant employee should understand that any intracompany transfer must be priced at “arm’s length,” or as a third-party transaction. Intracompany pricing agreements must be clearly defined and followed.

- Documenting all relevant transactions and tagging them with the appropriate company policy or pricing protocol. This must be done before taxes are filed to determine if there is exposure.

- Developing pricing agreements between affiliates that mimic third-party behavior in countries without transfer pricing regulations.

To the extent that outside assistance is needed to supplement staff efforts, senior management must allocate the proper resources and ensure that each affiliate within the corporation has structured its transfer pricing regulations according to corporate policy and local tax laws.

The development of pricing agreements and documentation of all transfer pricing transactions is critical. For example, the Internal Revenue Service typically will not charge a penalty to companies that are forced to adjust earnings following an audit as long as there is good documentation in place before the tax return is filed that supports the pricing rationale used.

However, with no documentation, the penalty can reach 20% or 40% of the adjusted amount, depending on the adjustment. And since the IRS will look at a two- to three-year cycle of transfer pricing transactions, even an adjustment of a quarter percent can quickly add up to a very costly penalty.

Transfer pricing risk management also must be viewed by senior management as an ongoing effort, primarily because regulations change frequently. In 2008, more than 40 countries have released new, supplemental or proposed transfer pricing rules. Maintaining compliance requires diligence in understanding and responding to these types of changes.

Structure and resources

In the years to come, the quest for oil and gas will continue to take multinational oil and gas companies to new frontiers, and companies will likely become more global, rather than less. At the same time, both developed and developing nations will turn to stronger enforcement of transfer pricing regulations so that tax revenues are not being lost.

These trends increasingly require oil and gas companies to devote additional resources to the development of transfer pricing policies and intracompany agreements, as well as to the proper, ongoing documentation of the transfer of goods, services and intangibles. Without a structured, properly managed transfer pricing program, companies may find themselves at risk of earnings restatements and penalties, which are costly – to both the bottom line and their reputations. OGFJ

About the author

Purvez Captain [[email protected]] is Ernst & Young LLP’s US transfer pricing and energy economics leader. The views expressed herein are those of the author and do not necessarily reflect the views of Ernst & Young LLP.