Aligning IT to accelerate post-M&A integration

Every 20 minutes, somewhere in the world, a merger or acquisition happens. Given this speed of change, affected businesses must be able to transform themselves in the most nimble and flexible way.

Whether a company is pushing to become the market leader in an industry, leveraging synergies, to cross-sell to an installed base or looking to gain economies of scale, global mergers and acquisitions can be an exciting and essential part of its growth strategy – a strategy that offers tremendous rewards as well as potential risks.

With the frenetic pace of M&As showing no signs of abating, CIOs today must at some point struggle with the enormous challenges of integrating acquired companies. Too often, however, success eludes the merged companies with IT getting part of the blame for the failure. In fact, research conducted by the Wharton School of the University of Pennsylvania places the range of failure between 50% and 80%.

The case for early involvement

In enterprises with successful M&As, CEOs and other high-level executives recognize the strategic importance of early and ongoing involvement of their finance, human resources, and IT teams in the M&A process. Leading organizations have these teams weigh-in during the pre-merger assessment and evaluation phase and remain after the ink is dry to spearhead detailed post- merger integration efforts.

In the case of IT, the CIO must recognize potential pitfalls that await the IT team and learn the steps businesses can use to avoid these in order to achieve rapid, highly effective post-merger integration. Although most organizations intuitively understand these issues, even the best companies can underestimate the intricacies involved as they try to address M&A challenges quickly and thoroughly. These include:

- Overestimating synergies: Without the right data or tools to evaluate and calculate synergies, acquiring companies frequently overestimate the value and timing of the deal, especially potential synergies and costs created by the deal. As a result, mergers frequently fail to achieve expected revenue synergies.

- Customer loss: Determining which customers are profitable and creating a plan to retain them should be one of the top priorities in a merger, but companies often fail to transition customers to the merged entity for several reasons. They may lack consistent customer relationship management (CRM) processes or they have a changed product portfolio or product duplicates. A loss of a trusted sales team or inconsistent pricing, maintenance, and support may also contribute to difficulties in transitioning customers.

- Employee attrition: When employees leave as the result of a merger, it’s usually the top performers who defect. According to a Hewitt Associates study, top HR issues in M&As include retention of key employees, compliance with applicable laws, alignment of culture, compensation and benefits as well as duplicate or undefined roles, lack of consolidated employee data and incompatible HR systems.

- Supplier consolidation: The ability to consolidate and synergize supplies from various vendors can reduce costs and add value to the supply chain. Companies that cannot integrate or establish a supplier relationship management (SRM) system quickly are prevented from enjoying the advantages of joint development, marketing and sales efforts with partners.

- Inability to track key performance indicators (KPIs): Disparate systems and data prevent management from having visibility into the performance of the combined companies, which is essential to assessing the success of a merger or acquisition. By tracking performance, executives can identify problems earlier to keep earnings on track.

- Slow and incomplete integration: The quality and speed of post-merger integration is crucial to M&A success. According to research by Booz Allen Hamilton, more mergers fail because of inadequacies in the integration process than because of a fundamental flaw in the concepts. The lack of a flexible, adaptable IT environment hinders a company’s ability to merge processes assets and systems.

With an IT group aligned with the business needs of the merged company and therefore a strategic partner in the business initiatives, and participating throughout the pre- and post-merger processes, companies gain value insights into potential synergies and challenges and have a greater chance of achieving significant value from the merger or acquisition.

Peer-to-peer assessment

When involved early, IT experts can help assess the value of the merger or acquisition as well as address any limitations to rapid post-merger integration. For example, they might rectify data quality issues, integrate processes or replace rigid systems that inhibit change.

Aligning IT to support these business needs requires two core areas of action. First, assessing potential synergies or lack of them between the companies to determine how these synergies may impact the two companys’ infrastructure and applications. Next, swiftly capitalizing on acquired IT assets after the merger is signed and moving expediently and successfully toward realizing the planned synergies in their entirety.

As they assess and evaluate the merger, IT experts can conduct a peer-to-peer analysis comparing the acquiring and target companies. Depending upon the overlap of various functions, such as a single help desk and combined employee portal, the IT team can also analyze the value of master data for all enterprise resource planning (ERP), CRM, SRM, and HR applications as well as assess governance procedures and investigate synergies between IT systems.

Through these assessments, valuable insight is gained about shared customers, especially when it concerns retaining top-line customers; prospects or target markets for gauging potential growth; shared vendors to identify redundancies and streamline costs; products to determine overlap and pricing inconsistencies and develop a combined portfolio; and employees to help HR pinpoint overlap and identify and retain top talent and continue benefits and compensation without interruption so employees know quickly that they can rely on the merged entity for day-to-day operation requirements.

The IT team can also assess the use of current governance compliance and risk-management tools to ascertain potential security vulnerabilities as well as evaluate the overall synergy of IT systems, including the enterprise architecture, hardware, networks, data stores, technology platforms, business software and user interfaces so that companies can plan a comprehensive migration path and more accurately estimate overall savings.

A flexible, unified IT environment

Visionary CIOs use the prospect of M&As to drive needed IT changes that accelerate rapid, effective post-merger integration that leads to a flexible IT environment that maximizes interoperability, shortens development time, and enables seamless integration internally and across merged companies. In such an environment, the IT organization can improve IT effectiveness in numerous ways:

- reducing the risk and effort of integration;

- unifying the IT infrastructure of the merged companies by setting an order of priority and consistently communicating changes to employees, customers and partners impacted by the merger;

- driving cost savings by identifying and eliminating redundant data, processes or systems;

- enabling end-to-end business processes across merged organizations by seamlessly integrating existing applications and creating new shared-user interfaces from which users can implement the end-to-end processes;

- supporting expanded product or market breadth by integrating new products into key systems and centralizing master data management (MDM) while minimizing costs; and

- enabling increased business scale by supporting expanded locations, offerings and customers with new, quickly composed services and applications.

To help IT organizations achieve the agility they need to support M&As, a more flexible business process platform is needed, one based on enterprise service-oriented architecture (SOA) that facilitates greater interoperability between software systems, seamless integration of applications, and rapid innovation of new business processes.

To deploy such a business platform, IT organizations can start with preconfigured software to help manage current business processes more efficiently and cost-effectively. IT teams can build upon these solutions and extend their business process platforms by adding functionality to meet specific needs by using ready-to-execute software for business processes, reusable enterprise service, and a unified technology foundation that delivers enterprise services, which can be combined, extended or created via easy-to-use composition tools.

A common path to integration

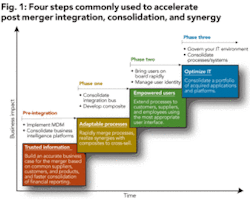

An SAP study of 175 companies found that IT organizations successful in supporting M&A integration took a common path using the following steps:

- Step 1: Develop a single version of truth for corporate information by consolidating master data and leveraging consolidated data for reporting.

- Step 2: Enable flexible business processes across merged organizations by using enterprise services, industry-specific business packages or flexible adapters.

- Step 3: Empower users to take advantage of shared assets by enabling user productivity through an enterprise portal to facilitate communication and encourage collaboration among merged organizations while delivering a common framework for security across the merged entity without the need for two separate infrastructures.

- Step 4: Optimize the IT landscape by consolidating the infrastructure of acquired and existing legacy landscapes around a business process platform and build an adaptive landscape to support business change.

Overcoming common M&A hurdles by following these steps in developing the right adaptable, flexible and nimble IT environment can help merged companies achieve finance goals quickly, reduce operating costs and free up working capital by eliminating redundancies and reducing inventory levels.

Valero’s success story

A prime example of a company that aligned IT to reach the ultimate success in post-M&A integration is Valero Energy Corp., the largest oil refining company in North America. CIOs across industries and geographies can learn from its example.

Growing rapidly, primarily through its aggressive growth-through-acquisitions strategy, Valero went from one refinery in 1997 to 17 today, from 0.2 million barrels a day in refining capacity to 3.1 million, and from $5 billion in revenue to more than $95 billion.

One of its most challenging aspects of tackling these acquisitions was the integration of many disparate IT systems that the new acquisitions brought with them. The new entities all had applications that were ill-equipped on their own to communicate with one another or with the application suite that runs Valero’s core business. Moreover, they had to be integrated quickly because most of the acquired companies were distressed assets that were acquired at low costs. IT integrations that take most companies 12 to 24 months had to be completed by Valero in three.

To reach its objective, Valero employed an enterprise SOA upon which it developed more than 50 integrated, reusable web services that replaced 200 stand-alone ones – all on a single dashboard with room to expand for hundreds more. This new breed of enterprise applications is far less time consuming to develop – two weeks compared to six months in some cases – and could more easily be reused.

Valero’s enterprise SOA and integrated IT infrastructure have allowed the company to improve business efficiency, on-time reliability and performance tracking accuracy while cutting time to bill, time to close and maintenance and support costs. Overall, Valero was able to cut IT cost versus revenue from a comparable 3% for many other companies to a mere 0.15% for Valero.

The key lesson learned from Valero’s experience bears repeating: IT organizations that prepare early and effectively for M&As and are best aligned with business objectives can speed post-merger integration, provide a stable environment for core business during the transition and enable the company to meet its merger goals. Those that don’t will be textbook examples of failure in this dynamic world market.

About the authors

Henning Kagermann is CEO of SAP AG, since April 2008 jointly with Léo Apotheker. Besides the shared overall responsibility for SAP’s strategy and business development, he also oversees product development for large enterprises, global communications, internal audit, and top talent management. Kagermann joined SAP in 1982. He has been a member of the SAP executive board since 1991.

Hal Zesch serves as senior vice president and CIO of Valery Energy Corp. He has nearly 22 years of experience with Valero and has held numerous positions within the company’s accounting and information systems divisions. Most recently, he served as vice president of SAP Systems Integration, with responsibility for the configuration, integration, and production support for all of the company’s SAP-related systems.