The risk intelligent energy company: weathering the storm of climate change

Risks associated with global climate change require a fresh and highly integrated approach that helps mitigate the unparalleled challenges of so much uncertainty.

Risk is no stranger to energy companies. Physical operations risk, regulatory risk, and price risk, among others, have darkened the doors of all oil and gas enterprises at some point in time.

In fact, the likelihood of risks in these areas has driven development of many successful risk management approaches, which, in turn, provide helpful preparation for unwelcome circumstances. But those traditional types of risks are usually specific to a geographic location, a business unit, or to certain processes and market conditions.

Today, there is a new set of risk factors associated with the dramatic–even ominous–developments brought about by global climate change. Due to the sheer scope and unpredictability of the root threat, these new and emerging risks feature a complex set of circumstances never before seen in this industry–a high degree of interdependency of a variety of types of risks (e.g., physical, regulatory, and price), the potential for global implications, and the broad swath cut across an entity’s various business units (e.g., operations, legal, PR, strategic planning, human resources).

Risks associated with global climate change, then, require a fresh and highly integrated approach that helps mitigate the unparalleled challenges of so much uncertainty. At the same time, as with any number of other paradigm–shifting developments throughout business history, climate change will also present some level of opportunity: a risk factor for one company can be an opportunity in disguise for another company that has a different asset mix, strategic approach, and set of locations.

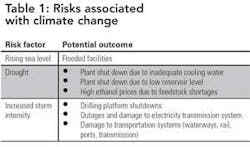

So the right approach will help identify prospective opportunities for better managing eventualities. While each company will face a unique set of risks, the following table provides an illustrative list of risks and potential outcomes:

In order to deal effectively with this new set of challenges and possible opportunities, energy industry decision makers will need to develop and support a new level of “Risk Intelligence.”

Risk Intelligent energy executives are characterized by their “un–siloed” view of the organization. That is, they create connections between functions and business units, find common ground, promote information and idea exchange, and get risk managers speaking the same language and using common measurements, all to support smart risk taking as a way to increase shareholder value and enable more effective and efficient approaches to addressing pressing business issues.

Properly implemented, Enterprise Risk Management (ERM) provides the full–spectrum approach needed to address the major climate change risk factors across all business units and functions. These factors include compliance, financial, hazard, operational, and strategic components. ERM assures alignment of risk activities with a company’s business strategy and appropriate correlation with a predefined “risk appetite.”

Oil and gas companies that have a fully–realized ERM program understand that risk and opportunity are two sides of the same coin. These companies embed climate change considerations in their strategic and ERM planning. We believe enterprises without an established ERM process should begin now to think about how to apply an appropriate framework to climate change issues.

There are at least eight major risk types that have a strong relationship with climate change:

- Regulatory

- Technological

- Price/Market

- Strategic

- Physical Operations

- Volume

- Modeling/Valuation

- Human Capital

Climate change is a “global” issue in every sense of the word: it affects business units across a broad range of risk types as well as across a broad range of geographical locations. By successfully applying the foundational principles of Risk Intelligence to an ERM framework, an energy enterprise can counter climate change risks and realize four key benefits:

- Improve risk management across a number of business units and functions.

- Impact risk factors that affect a number of types of risks, described above.

- Take important correlations into consideration.

- Inspire issue “champions” and involvement by senior executives.

Failure to adopt a framework with an enterprise–wide perspective can cause decisions to be made out of context, that is, without considering the impact on other business units and the business strategy and objectives as a whole.

Applying a Risk Intelligent Framework to climate change issues

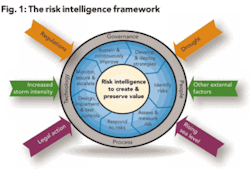

A Risk Intelligent Framework (as depicted in Fig.1) is a conceptual tool for organizing an ERM program. The outer arrows represent the specific external factors impacting the organization relevant to climate change. The shaded circles embody the key elements of the enterprise: the goal of creating and preserving value is stated at the core; the intermediate blue circle features the processes that must be at work at all times; and the outer grey circle shows the four capabilities that are developed and enhanced when Risk Intelligence forms the basis of the ERM program.

Responsibility for climate change risks have to be elevated beyond the health, safety, environment, or compliance department, given the broad–reaching impacts to the enterprise. Awareness of risks needs to reside at levels that can objectively evaluate both the challenges and opportunities they represent so that resources can be assigned accordingly. Therefore, senior executives must be held accountable for intelligent risk–taking, and the board must assume its rightful governance responsibility for risk oversight.

Further, risks are so pervasive in an organization that essentially every employee participates at some point in managing – or mismanaging – them. Success of the ERM program is dependent on all employees understanding their risk–related responsibilities as they relate to their overall job activities.

Technology is a great facilitator of efforts to integrate and access data from disparate systems and applications across the company, but it can also pose a significant obstacle to effectively implementing a Risk Intelligence–infused ERM program. Data availability, quality, and accessibility are key technology issues that often make or break a Risk Intelligent program implementation.

Those responsible for risk oversight should be aware that while there are some very effective component programs for performing specific tasks available in the ERM software market, few, if any, end–to–end programs exist. However, solutions are evolving and emerging rapidly.

Key processes briefly defined

Processes describe how work gets done in an enterprise. Enterprises subject to climate change risks will benefit from the seven processes defined in the blue intermediate circle of the Risk Intelligence Framework chart:

Develop and deploy strategies – Strategic opportunities come with risks and companies cannot make money for their shareholders without assuming risk. In order to thrive, an enterprise must have a clear set of objectives against which performance is measured. The Risk Intelligent Enterprise carefully weighs the risk–adjusted return.

Identify risks – This process prompts a company to evaluate business processes from a value chain perspective across all components of the enterprise. It is extended to risks faced by suppliers and customers and other stakeholders.

Assess and measure risks – An energy company has to get a handle on how much risk it faces and how those risks relate to the enterprise’s overall risk appetite. Only then can senior management confidently make informed decisions about risk responses. Structural simulation models have emerged as the preferred analytical technique.

Respond to risks – This process involves developing and implementing cost–effective risk treatment strategies that increase benefits while reducing costs. Typically, risk mitigation measures are designed to either lower the probability or severity of a risk factor, risk, or consequence. However, many climate change risks are driven by external factors outside the control of the company. This necessitates more innovative planning around relocating facilities, transferring risks to third parties, or finding ways to reduce impacts.

Design, implement, and test controls – Smart energy companies will seek to implement a balance of preventive and detective controls that are automated to the extent economically possible.

Monitor, assure, and escalate – A Risk Intelligent ERM program is not a one–time project. It is ongoing, dynamic, and requiring of continuous attention and review: risk treatment plans must be monitored for progress; internal loss events and near misses must be recorded and investigated; controls need to be tested and effectiveness assessed.

Sustain and continuously improve – Like all processes, ERM processes have to be reviewed periodically for effectiveness.

Conclusion

Energy companies face many significant risks every single day. Issues and concerns around climate change have heightened the need for enterprise–wide risk management efforts.

Treating climate change risks in an isolated or one–off manner can result in flawed decisions that cost a company dearly in both financial and reputational terms. ERM applied in a Risk Intelligent manner is well suited to dealing comprehensively and effectively with climate change risks. It is an effective approach for handling complex, correlated risks and it offers a meaningful structure for identifying, measuring, prioritizing, and responding to these additional risks.

With the appropriate commitment and involvement of the board and senior management, a progressive oil and gas company can organize cross–business unit teams, mandate the sharing of key information, fund integration of technology systems, and ensure that climate change risk management is embedded in strategic planning.

In short, a Risk Intelligent ERM program for climate change issues will give the organization the right information at the right time to support key decisions and ultimately create enhanced shareholder value.

About the authors

Pat Concessi [[email protected]] is a partner in Deloitte’s Global Energy Markets practice, and also serves as the leader of Deloitte’s global Climate Change and Sustainable Resources group. She has consulted for many energy companies with respect to management of commodity risk and this increasingly includes emission allowances, renewable energy, bio fuels, and Clean Development Mechanism investments. Previous to joining Deloitte, Concessi had 19 years experience with a major electric utility.

Patchin Curtis [[email protected]] is director in Deloitte’s Global Energy Markets practice. Patchin consults to energy companies with respect to enterprise risk management and energy market restructuring. Her experience encompasses the design and implementation of enterprise risk management capabilities, especially with respect to quantification of risk types historically considered difficult to quantify such as operational, political, and strategic risks. She is a contributor to Deloitte & Touche’s Risk Intelligence whitepaper series.