Service company earnings drive independent growth in 3Q2007, oil/gas producers show declines

The Energy Information Administration (EIA) reports that earnings for the 43 independent energy companies it surveyed grew 10% in the third quarter of 2007 compared to earnings in the same quarter of 2006 (see Table 1). This was driven by the performance of oilfield service companies, says the EIA report. In contrast, oil and natural gas producers and refiner/marketers had declines in earnings over the year–ago quarter.

Energy price news

The crude oil price for the third quarter increased 12% relative to a year earlier, while the price of natural gas decreased almost 1%. The US refiner average acquisition cost of imported crude oil increased from $63.78 per barrel in 3Q2006 to $71.18 per barrel in 3Q2007 (see Table 2). This increase follows two consecutive quarters of decreases relative to the year–earlier quarter, which followed 18 consecutive quarters in which crude oil prices increased relative to their year–earlier levels.

The average US natural gas wellhead price decreased from $5.96 per thousand cubic feet (mcf) in 3Q2006 to $5.91 per mcf in 3Q2007 (see Table 2). This decline follows last quarter’s increase relative to a year earlier, which followed four consecutive quarters in which domestic natural gas prices fell relative to the year–earlier quarter.

The gross refining margin (the per–barrel composite wholesale product price less the composite refiner acquisition cost of crude oil) was 35% lower in 3Q2007 than in 3Q2006 (see Table 2). A negligible decline in the petroleum product average price (from $85.37 per barrel to $85.19 per barrel) was overshadowed by a $7.40 per barrel increase in the price of crude oil resulting in a substantially lower margin.

Independent energy company earnings

Net income of the independent oil and gas producers included in the EIA report declined 35% between 3Q2006 and 3Q2007, while revenues increased 16% (Table 1). Despite the upward push of the 12% increase in oil prices (Table 2), profits declined due to a variety of other factors, such as decreases in commodity derivative income, foreign currency losses, and increased operating expenses.

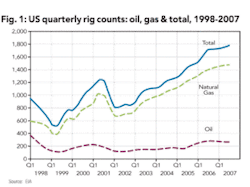

Net income of US oilfield service companies included in the EIA report increased 23%, as revenues rose 18% (Table 1). US oilfield service company earnings were strengthened by an increase in the US rig count of 4% from 1,719 in 3Q2006 to 1,788 in 3Q2007, according to data acquired from Baker–Hughes.

Rig count impact on service companies

Higher rig counts and the resulting higher demand for rig services directly increased the demand for the equipment and services supplied by oilfield service firms. The Petrodata Day Rate Indices for rig rentals reflects that, as rates in 3Q2007 were substantially higher than in 3Q2006.

Breaking down the overall (oil plus natural gas) US rig count into its components, the natural gas rig count grew 5%, while the oil rig count decreased 3% over that period (see Figure 1). This was the nineteenth consecutive quarter in which the natural gas rig count has increased relative to its year–earlier level.

The worldwide rig count increased negligibly over the year–ago quarter. While overall rig counts grew 4% in the United States from 3Q2006 to 3Q2007, they dropped 30% in Canada and grew 8% in the rest of the world.

US refiner earnings decline

Earnings of the independent refiners included in the EIA report decreased 25%, from $418 million in 3Q2006 to $315 million in 3Q2007 (see Table 1). This was attributed to a decrease in refining margins of 35% over the year–ago quarter (Table 2).

NOTE: The gross refining margin is the difference between the composite wholesale refined petroleum product price and the composite refiner acquisition cost of crude oil.