Iraq: The energy wild card

Jason Reimbold

The Theseus Group

In a time of great uncertainty about world oil supplies, there has been no bigger question than what role a rebuilt Iraq will play in the global supply chain.

As the price of crude fell off in early August, consumers breathed a sigh of relief. A sluggish economy influenced a decrease in oil demand in the United States, and the strengthening of the dollar also helped to correct the price of crude, but absent a long-term worldwide recession, the global demand for oil is still projected to outstrip supply in the near future.

Additionally, geopolitical risk continues to be a significant force driving commodity prices and with the US presidential election on the horizon, the world is curious to see how US policy may change regarding Iraq—the energy wildcard.

It is estimated that Iraq possesses the world’s fourth largest oil reserves of 115 billion barrels. However, the country has never produced more than 3.0 million barrels per day which was Iraq’s historical peak in 1990. Since then, multiple wars, a lack of leadership, and insufficient investment in development and infrastructure has not only resulted in diminished production, but Iraq’s immense oil reserves have also gone mostly untapped.

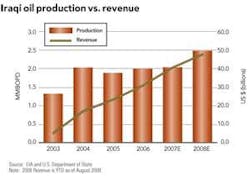

During the last five years, oil production in Iraq has been relatively flat due to insurgent attacks on infrastructure. However, their industry is beginning to show the early signs of recovery.

The Iraqi government is proactively confronting security issues as demonstrated by regaining control of Basra from militants earlier this year. Additionally, the US State Department has reported that attacks on pipelines are also down in 2008, and the improved security is yielding favorable results.

In July of this year, Iraq managed to achieve daily production of 2.55 million barrels of oil per day, and the Minister of Oil, Hussain al-Shahristani, expects the country to reach OPEC quotas of 4.6 million barrels per day within five years, but al-Shahristani will face many challenges on the path to 4.6 MMb/d.

Antiquated infrastructure and skilled manpower shortages are only a couple of the hurdles the Iraqi Oil Ministry will face in the coming months and years, but perhaps the most significant near-term challenge lies within the uncertainty of US spending in Iraq after a new administration occupies the White House.

Since 2003, the United States has played a significant role in rebuilding Iraq’s oil infrastructure and has spent more than $1.6 billion to support these efforts. However, the rate at which US dollars will be allocated to Iraq after a new President is elected is unknown.

Unfortunately, many more billion dollars will be required to complete rebuilding efforts despite increased revenue from oil exports. High oil prices have driven increases in Iraqi oil revenue at a greater rate than production in recent years, but the majority of this revenue is siphoned by the government to fund other programs instead of being used to rebuild their oil infrastructure.

The greatest hope Iraq may have for sustaining its current progress in addition to achieving new production goals could be attracting foreign partners that have both the capital and experience needed to develop its reserves and build a sufficient infrastructure.

Thus far, attracting international partners has been hindered by the Iraqi government’s failure to agree upon a set of laws that outline the terms under which partnerships will operate.

The Iraqi Oil Ministry is at a crossroads, and the outcome of the US presidential election is likely to have a significant influence on the manor in which Iraq realizes their full oil production capacity. While it is unlikely that US support will altogether stop in 2009, it is possible that Iraq could receive significantly less aid—perhaps this will be the much needed push towards self-reliance.

About the author

Jason Reimbold is vice president of The Theseus Group (www.thetheseusgroup.com), an energy M&A consulting firm based in Tulsa, Okla. In 2005, Reimbold founded www.GlobalOilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co-authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.