RETENTION: A growing concern in the executive suite

There is rising competition to fill the executive suites of energy companies, especially in the thin ranks of candidates over age 45. This article takes a look at what smart companies are doing today to ensure the highest quality executive leadership in the future.

Stephen M. Kaufman Clark Consulting Houston

Two forces are converging to reshape the energy sector. First, impressive energy profits (well-earned after decades of losses) are transforming a large number of energy companies into regular US taxpayers, perhaps for the first time. Historically, tax exposure was a non-issue for energy companies due to investments in research and development, drilling, long payback time, and razor-thin margins.

Secondly, a generation gap has emerged in the executive talent pool. The last high tech boom drew a large amount of talent to the technology sector that would otherwise have joined energy companies, forcing energy firms to scramble to recruit and retain executive talent. One way to narrow that talent gap is an effort to help executives accumulate retirement funds.

Situation worsens

Today’s energy recruit faces many threats to even an adequate— let alone comfortable—retirement:

- Longer life spans. US life expectancy has reached 78 years, a record high driven by declines in all but one of the major causes of death, according to government reports.

- Tenuous Social Security. The US Social Security trust fund will be exhausted by 2041 according to consensus actuarial reports. The Medicare Hospital Insurance trust fund will run out of assets by 2019, according to trustees of the program and research by the National Coalition on Health Care.

- Soaring healthcare costs. Healthcare spending continues to rise at the fastest rate in our history at 6.9% in 2007, or two times the rate of inflation, with employer healthcare premiums up by 6.1%, according to the National Coalition on Health Care at www.nchc.org/facts/cost.

- Rising college costs. Average annual cost of a four-year private college jumped to $32,307 in 2007-2008, faster than inflation, according to the College Board.

- Limits on 401(k) contributions. For 2008, the maximum employee contribution to 401(k) plans is $15,500 as set by the IRS, with a catch-up contribution limit of $5,000 (only for those age 50 +), plus limits imposed on company contributions to 401(k) plans.

- Stock price volatility. The 200-point swings on the Dow of late are well documented and wreak havoc with retirement accumulation.

Companies threatened by the potential loss of key people must rethink their approach to executive pay. Most companies instinctively reach to cash and stock solutions, “raising the tide for all boats.” But this may no longer produce an adequate outcome.

SERP solution

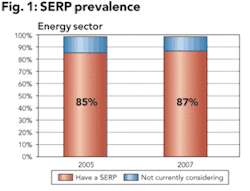

A best practices solution to talent retention is the Supplemental Executive Retirement Plan (SERP). The energy sector has long relied on SERPs. In fact, according to Clark Consulting’s Executive Benefits—A Survey of Current Trends: 2007 Energy Industry Results, 87% of responding energy companies used SERPS as a recruit/retention tool. And, SERP prevalence is on the rise. (See Fig. 1: “SERP prevalence”).

null

Golden handcuffs

SERPs are non-qualified plans that can be tailor-made to fit the specific needs of companies in the energy industry, and can be implemented for either a specific group of executives or a single targeted executive. A well-designed SERP builds retirement income for the executive, and provides “golden handcuffs” for retention.

SERP contributions can add value without adding a new fixed cost to the balance sheet. Because SERP contributions can be made contingent upon company or individual performance, the cost can be variable. Further, the well-designed SERP should create increased incentives for executives to save their own funds pre-tax, by deferring salary, bonus, long-term pay, and/or restricted stock. In this way, total retirement accumulation is increased without any increased company cost, through the executives’ own money.

Reward for performance

There has been an important shift toward defined contribution SERPs—away from defined benefit SERPs, and their requisite fixed cost burden—which has created a hybrid alternative to traditional SERPs. In a performance-measured SERP, the company contribution to the executive’s retirement account is tied to the satisfaction of individual and/or corporate goals, such as revenue, profit or stock price, that are measured over a specific, pre-determined period.

The performance measures can be distinct to the SERP contribution or can be the same as the measures utilized for some other executive remuneration, such as the annual incentive bonus award. Creating effective performance criteria comes from a constructive dialogue and negotiation process between the board compensation committee and management.

Caveat on goals

When effective “stretch” goals are put into play, executive performance can outstrip the competition. For example, let’s say that your executive team is in line for a SERP “performance-based contribution” of 15% of current salary and bonus in any year that 100% of “goals” is reached.

Over a 20-year period that contribution level can produce a retirement outcome that is both reasonable and can be shown to be competitive with what peer companies are providing.

What if the executive achieves 150% of target in a given year? The SERP contribution could be boosted to 22.5%. If the executive hits only 50% of target, then it could be cut to 7.5%.

Thus, the contribution varies with company/executive performance, as does its cost. Over time, a well-performing executive team would achieve a reasonable and competitive retirement accumulation, without the company having to carry a fixed cost.

At a time when executive pay has faced vociferous public scrutiny, a performance-based plan can clearly communicate a new kind of message to shareholders, boards, executives, and employees.

Benefit funding

Let’s assume your company has created a competitive benefits plan with a pay-for-performance SERP. If the executive team is successful in meeting performance goals, the SERP liability will grow over time. To properly manage corporate risk, it should now be funded. (Unfunded liabilities today pose a trillion-dollar obligation to corporate America over the near term.)

SERPs can be funded in a variety of ways, some of which offer attractive financial outcomes for companies and welcomed peace-of-mind for executives that funds will be available to meet the company’s SERP obligations.

Admirably, the energy sector has taken a leadership role in funding: 100% of energy respondents to the 2007 Clark Consulting survey informally fund their non-qualified deferred compensation plans, while 71% fund their SERPs. Both of these measurements are double-digit increases over 2005.

For energy companies that now find themselves regular US taxpayers, tax-advantaged funding approaches are increasingly attractive and sensible methods to minimize corporate P&L cost.

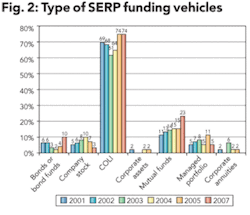

Financing benefits with taxable investments such as mutual funds is one way. Selecting a COLI (corporate-owned life insurance) arrangement for informal funding can often be a better tax choice. A company should explore funding alternatives by building financial models that measure the outcomes of the alternatives.

New look at COLI

COLI products are specially designed to assist corporations in the informal funding of non-qualified deferred compensation plans such as SERPs, while delivering long-term tax advantages. With COLI, a corporation buys life insurance on the participants in the performance-based SERP who have given their written consent.

The corporation pays the insurance premiums, owns the cash value of each policy, and is the sole beneficiary. In the meantime, assuming the requirements of applicable law are satisfied, the company accumulates the cash value asset on a tax-deferred basis and receives tax-free death benefit proceeds, resulting in improved after-tax results.

‘A-ha’ moment

Historically, COLI has only been utilized negligibly by companies in the energy sector to informally fund non-qualified SERPs and deferred compensation plans. Understandably, energy companies have not been long-term taxpayers, and minds have been closed to this tax-advantaged alternative. The recurrence of regular US taxpaying status should change that.

In fact, as energy companies come to resemble general industry—as far as tax-paying status is concerned—the use of COLI as a SERP-funding vehicle should also be similar. In Clark Consulting’s Executive Benefits – A Survey of Current Trends – 2007, 74% of responding companies from all industry sectors that fund their SERP liabilities used COLI. (See Fig. 2: “Type of SERP funding vehicles”).

Of late, there’s been a surge in “a-ha” moments among benefit leaders as they begin to rediscover the advantages of COLI. With COLI, there are no surprises on P&L costs as they are neutralized. You gain tax-free growth with the potential to improve after-tax results. COLI products are offered in a very competitive marketplace by top-rated carriers. As a result, a company’s choice will depend on careful analysis of its specific business objectives.

Energy veterans may know every inch of the oil patch, like their favorite all-weather boots, but today’s tax and talent realities call for a surefooted willingness to change and think differently.

In summary, the important next step energy firms need to take is to fill and stabilize the executive ranks, whether from inside or outside the sector. The most effective solution is to offer a highly competitive retirement accumulation plan such as a performance-driven SERP that is properly funded. In doing so, energy companies will better protect the vitality of an executive’s financial portfolio with time-tested retirement strategies which, in turn, will serve the corporate agenda for a continued, prosperous future.

About the author

Stephen M. Kaufman [[email protected]] is a registered representative of, and securities products and services are offered through, Clark Securities Inc., DBA CCFS Inc. in Texas. Kaufman is an independent consultant of Clark Consulting Inc. A Harvard graduate in economics, Kaufman has held and holds numerous professional and community leadership positions in Houston and Texas. This article is for information purposes only; it is not intended as an offer or solicitation for the purchase or sale of any financial instrument and is not intended to present an opinion on legal, tax, accounting or investment matters.