Purging the risk premium: the fundamentals driving 2009 oil prices

Jason Reimbold

The Theseus Group

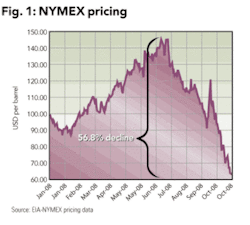

It has been an interesting year in the oil and gas industry to say the least. At the start of the year, the market witnessed oil breaking the $100 threshold, but that was only the beginning. Throughout most of the year, oil tested the ceiling ultimately peaking at $145.29 on the NYMEX. In fact, in my January article “Can this boom be sustained”?, I stated that the combination of global supply and demand issues in addition to geopolitical uncertainty would be the primary driver of high energy prices and that we could expect record prices for oil provided the world did not enter into a global recession. Unfortunately, since late third quarter, the market has indeed been exhibiting the characteristics of such a recession.

The recent decline in the price of crude has been partially motivated by slowing demand in the US and other OECD nations, but it is important to point out that demand destruction was not the primary driver of this decline. The US credit crisis had a much greater impact worldwide than analysts had projected. Dissolving financial institutions, chaotic markets, and a federal bailout were a shock to both the world and the oil and gas industry. As financial chaos propagated through the US and global markets, the price of crude began to drop precipitously. At the time of publishing, the NYMEX futures price for crude had fallen as low as $62.73 which is a 56.8% drop from the July high of $145.29 per barrel.

The financial crisis has had a much greater impact on the price of crude this quarter than geopolitical uncertainty. This was demonstrated when OPEC announced a cut of $1.5 MMbpd in production in late October and the price of crude failed to increase. Nevertheless, the fundamentals should easily support oil prices above $50, and the markets are likely to see $100 oil again in the coming year.

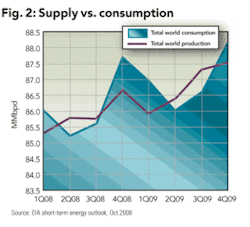

In OECD countries, the demand for oil declined 2.6% in the first three quarters of 2008, and decline is projected to remain on trend. The EIA estimates consumption will decrease throughout 2009 to 48.37 MMbpd down from 49.09 MMbpd in fourth quarter 2008.

In contrast, non-OECD nations are estimated to increase consumption in 2009 by 3%, resulting in an increase of total worldwide consumption to 88.16 MMbpd, thereby outstripping estimated supply for 2009.

Total world oil production is expected to increase to 87.53 MMbpd by the end of 2009, and it’s reasonable to expect crude prices to remain elevated due to tight supply. Contributing to supply problems, the development of US reserves could be hindered by an adverse taxation policy that may be implemented by the new administration in Washington. New corporate taxes and shrinking CAPEX budgets, that have been the result of tightening capital markets, could further impede the development of domestic reserves thus supporting a higher floor for the price of crude.

At the time of publishing, the NYMEX forward curve indicated a crude oil price of $74.33 for December 2009 delivery. In October, Barclays was projecting an average of $75 oil for 2009 while the EIA published the most aggressive projection of $112 per barrel for WTI. Although we may not see $140 oil in 2009, $40 oil appears improbable.

Furthermore, we are unlikely to see a lull in geopolitical uncertainty in the coming months. In fact, worldwide financial strain in addition to diminishing natural resources may lead to greater instability especially if the withdraw of US forces from Iraq is executed in an imprudent manner.

Nevertheless, the US financial crisis appears to have purged much of the risk premium from the price of oil which the market encountered in mid 2008. Unless geopolitically charged events actually interfere with supply, the true risk of supply and demand fundamentals, given a recessionary financial climate, are likely to have more influence on the price of crude in 2009 than perceived geopolitical risk. OGFJ

About the author

Jason Reimbold serves as the Director of Capital Markets for the PLS A&D Group (www.plsx.com). In 2005, Reimbold founded www.GlobalOilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co–authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.