Emerging stronger from the storm

Pradeep Anand, Seeta Resources, Houston

Lives of senior executives and stock analysts would be a lot easier if markets and businesses grew at steady, predictable rates. But, market growth and decline cycles rarely resemble smooth sinusoidal curves. They expand and contract with irregular rhythm.

To compound the complexity in predicting market behaviors, businesses possess inertia that delays their responses to economic growth and decline cycles. Moreover, firms behave differently when they emerge from a declining market and when they sink into a declining market.

Coming out of a decline, firms are slow and cautious to expand when market opportunities present themselves because they are concerned about committing a false positive error. Having been in a decline, most firms develop mindsets and habits attuned to scarcity conditions and no one is quite ready to stand up and proclaim that the market has bottomed out.

The consequence is that most businesses lose great competitive and market opportunities, which are, unfortunately, invisible losses that are lost forever. Similarly, firms that were in growth markets are also slow to respond to declining market conditions. They commit a false negative error before they finally confront the reality of a market decline.

The consequence is that the business suffers great losses, which unlike opportunity costs, are very visible to the world.

Also, behavioral economics tells us that humans have an aversion to loss. We have a tendency to focus on what we may lose rather than what we may gain. We do not tolerate losses, especially very visible ones.

So, businesses approach market declines with aggressive slashes rather than strategic incisions for the inevitable growth cycle of the future.

Today, business leaders recognize that this storm too shall pass and markets will resume their growth trajectory.

Despite an abundance of bad news, savvy executives are working on positioning their businesses for growth in their current markets, while looking out for emerging market opportunities.

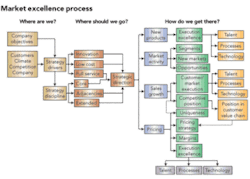

A broad process framework is shown in the figure below. Among many activities, they:

- Reevaluate their market positions by revisiting customers, business climate, and competition to rediscover their markets and reinvent their business;

- Define the strategic direction of the firm and communicate them succinctly to their stakeholders;

- Establish parameters that monitor and enforce strategic discipline. Old habits die hard and many “stay-the-course” and “not-invented-here” habits must be shed;

- Trim and balance the firm’s portfolio of offerings based on anticipated growth markets and own (competitive) positions of strength in these markets. Growth markets create imbalances that become starkly evident when tides decline;

- Prepare and strengthen the needed competitive muscles for the future by participating in and establishing beachheads, if not bastions, in critical, focused markets. Competitive edge is sharpened by engaging with the customer. Isolation blunts it;

- Work on their pricing models and discipline in executing them. They recognize that a slight increase in price contributes substantially to profitability;

- Exploit new opportunities that declining markets expose. Customers are also affected by economic conditions and are often willing to consider new products and services that can improve their profitability and cash flow; and

- Define and develop the A Team of the future.

Expansion and contraction are rhythms of life. Those that recognize these waves, their peaks and troughs, and take advantage of them will emerge substantially stronger out of the economic storm that is blowing around us. OGFJ

About the author

Pradeep Anand [[email protected]] is president of Seeta Resources (www.seeta.com). He has more than 25 years’ experience in marketing and business strategy development and execution in the oil and gas, technology, and engineering industries. Before founding the firm in 1993, he was vice-president, marketing at Landmark Graphics. Before that he worked for Baker Hughes and Sperry Sun. Anand has an MBA from the University of Houston and a bachelor’s degree from the Indian Institute of Technology, Bombay, India.