The Iranian energy threat

Jason Reimbold

The Theseus Group

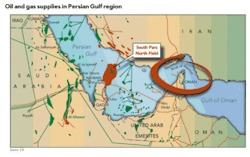

Iran’s government is perhaps the world’s greatest threat to energy security. The country’s insistent pursuit of becoming a nuclear power despite UN and US sanctions demonstrates the theocratic state’s unwillingness to act in good faith with the global community. Regrettably, this regime governs the world’s third largest oil and second largest natural gas reserves affording them significant leverage in the world’s energy economy.

In recent years, the price of oil has moved in tandem with marked increases in demand introduced by emerging economies around the world, and high prices have well supplied the Iranian treasury making them bolder in their opposition to the West. However, proven reserves and a positive trade balance are not the only resources providing leverage to Iran. The country also dominates one of the world’s most critical oil transport points.

It is reported that up to 40% of the world’s crude oil supply passes through the Strait of Hormuz which is the only channel for exporting Middle Eastern oil by sea. In recent years, Iran has made threats suggesting it would halt oil transport through the strait if provoked. Although this threat has not been carried out, the possibility that Iran could stop the flow of oil from the Gulf States is an alarming notion. Even a short-lived blockade would certainly incite an already turbulent global financial system.

Thus far, UN and US sanctions have been somewhat successful, but Iran continues to form strategic partnerships around the globe. However, these alliances are more than political posturing—they are an act of necessity for the country.

Despite immense oil and gas reserves, Iran is not without its own energy dependence issues. Ironically, Iran’s demand for gasoline, combined with their insufficient refining capacity, has made the country considerably vulnerable to fuel shortages.

Iran imports approximately 40% of its gasoline, but this is not their only pressure point. Their demand for natural gas can also be in rough equivalence with domestic production in the event of spiking consumption. In fact, Iran experienced natural gas shortages during a period of unusually cold weather in January 2008.

As is the case with many petrostates, insufficient capital is reinvested in the country to advance the continuing development of resources and to sustain and improve new infrastructure, and Iran is looking for foreign investment dollars to rectify these inadequacies. However, UN and US sanctions and global financial uncertainty has slowed progress on a number of joint venture projects in Iran.

Given these conditions, it appears that Iran would have much to loose by exerting its leverage in either cutting off oil/gas supplies or halting oil transport through Strait of Hormuz.

Next year, elections in Iran are not likely to have a positive impact on current geopolitical conditions in the region. Whether Ahmadinejad is re-elected or not, Iran’s true political power lies with the country’s Supreme Leader Ali Khamenei who has never given a signal that he would be interested reestablishing relations with the United States. In fact, Khamenei has been quite effective in disrupting attempts to normalize relations with West, and he is credited with undermining the efforts of past Iranian presidents Rafansjani and Khatami who both were gradually taking steps towards opening dialogue with the United States.

Stronger sanctions could severely limit foreign investment in Iran, but it is unlikely that anything but regime change will nullify Iran’s threat to global energy security.

About the Author

Jason Reimbold serves as the Director of Capital Markets for the PLS A&D Group (www.plsx.com). In 2005, Reimbold founded www.GlobalOilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co–authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.