Gas shale development is now faced with challenging issues What can we expect through 2009?

Don Warlick, Warlick International, Houston

The ongoing economic downdraft that has impacted global economies is affecting plans for gas shale development in North America for the balance of 2008 and all of 2009. It is at the end of the pipeline where natural gas production finds its markets, and it is there that gas demand and natural gas prices have softened.

There are positives, and certainly a number of negatives in the changing natural gas environment. This brief article addresses a number of obvious and not-so-obvious issues that will affect drilling, production, inventory, supply and gas price through 2009. This based on a growing history of research and business assessment in unconventional gas markets by Warlick International.

Positive issues

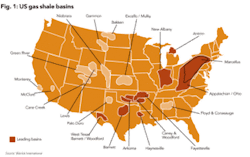

Gas shale opportunities are widespread – the development of gas shale potential has taken place on a fast-track basis in the United States, although early-stage activity is now occurring in Canada. In Figure 1 we see broadly-located gas shale plays, with the most significant (in terms of drilling and production as well as huge potential) arrayed in widespread fashion.

Unconventional gas is critically important to supply – gas shale, coalbed methane, and tight gas together accounted for slightly more than 42% of US gas supply in 2007; by 2010 they could be as much as 48% of US gas supply. Conventional gas production onshore and offshore will decline approximately 12% over that same period. Canadian imports are likewise declining. LNG imports fell in 2008 but have potential, albeit limited to grow in 2009. Overall, gas shale and unconventional gas resources will be a big factor in North America’s future gas supply.

Technology applied in gas shale drilling is hugely positive – that goes also for coalbed methane and tight gas. The three major technical breakthroughs supporting growth of unconventional development are hydraulic fracturing, horizontal drilling & completion, and seismic/microseismic techniques. The combination of these major technologies has been basic to developmental success in the major gas shale basins. They are providing an essential platform for increased efficiencies in drilling and completion and…they are allowing drillers to tap into marginal prospects in economic fashion.

Timing is a big factor – what do we mean? The impending slowdown in drilling and development is perfectly timed with the beginning of the 2008-2009 winter heating season, the period in which almost half of annual US natural gas consumption takes place. No one likes a slowdown but if able to pick our time, November is not all that bad.

Negative issues

The severe downturn is dampening the overall economy – besides the havoc across financial markets this negative event will stay alive for months through 2009 and possibly longer. It will have a continued dampening effect in all sectors of the economy, with the ultimate result of reducing hydrocarbon demand, natural gas included.

There are two significant negative impacts on energy – first, the ongoing economic crisis is straining the E&P sector’s ability to secure credit and financing for drilling and production. Secondly there is downward pressure on natural gas prices (as a result of flattening demand). The result? Less attractive economics upon which to base financing for development. In recent years drillers could outspend their cash flows, anticipating steady to increasing hydrocarbon pricing for the future. But now the E&P sector is reducing capital expenditures to bring them into line with market conditions.

A natural gas oversupply has been building for months – thanks largely to added output from unconventional gas fields, US gas production in 2008 was up more than 8% by midyear, with more coming. Natural gas will be backing up before long with potential for a huge oversupply by spring. The logical production response by E&P is to cut capital expenditures, consider shut-ins and reduce drilling programs to slow the flow. After contract commitments are satisfied, some of the gas drilling fleet will be idled or less utilized, pumping services will logically follow.

Lastly, in January the US will have a new President – changes of Administration in any case, always bring uncertainty – and especially today with strategic focus on energy around the world. The new American President will predictably make regulatory and tax changes to energy. How the oil and gas sector handles these changes will be very important to its future.

Gas shales offer opportunity

For those who are involved with gas shale development – tight gas and CBM as well – the long-term price of gas is recognized as the real driver for drilling and development. This is not to take away from the importance of short-term hydrocarbon pricing but gas shale, tight gas and CBM development campaigns typically position for the long term. Those efforts anticipate a 30-year buildout for drilling and development, ideally in basins with high potential.

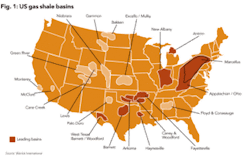

Representing the best of US gas shale opportunities, Figure 2 provides the metrics for what is becoming and will become premier gas shale systems that will produce and pay off for many years to come.

In summary, given the challenging economic, supply, demand and political issues ahead for natural gas development, the energy industry will be called upon throughout 2009 and perhaps into 2010 to manage its operations and future wisely. The new business environment demands the best that gas shale developers and the oil and gas industry can do to power through the problems, and then anticipate improved conditions that lie ahead – hopefully in a more stabilized business environment that could possibly begin to reveal itself by late 2009.

About the author

Don Warlick [[email protected]] is president of Warlick International, a market and business consultancy established in 1977 that specializes in the global energy business. Previously, Warlick served in marketing and corporate development roles with Getty Oil Co., PepsiCo Inc., and The Williams Companies. He has BS and MS degrees in engineering from the University of Tulsa.