Board compensation: What is responsible?

Companies are advised to address the renewed growth of board member compensation in a recovering oil and gas industry.

Lance Froelich, BDO USA, Houston

The US economic recovery has spurred a new wave of growth in the compensation packages for board members of oil and gas companies. Sensitive to the losses incurred by the industry and shareholders during the economic downturn, board members for the past few years had accepted the fact that there was little to no growth in compensation. According to our data, though, that's beginning to change.

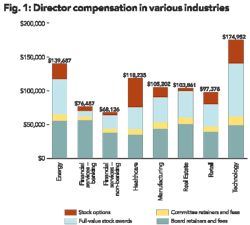

The annual BDO 600: Survey of Board Compensation Practices of 600 Mid-Market Companies found that increasing demands on board members' time and expertise have led to some of the first double-digit pay increases the industry has seen since the boom that began in the early 2000s. According to the study, mid-market energy industry directors received an average total compensation of $139,687 in 2010, representing an 18% increase over the prior year.

Greater responsibilities and liabilities

As the result of the Sarbanes-Oxley Act and, more recently, the Dodd-Frank Wall Street Reform and Consumer Protection Act, directors have had to take on expanded responsibility and increasingly time-consuming duties. Today's board members are required to have a very particular set of skills and expertise to handle the challenges presented by their expanded accountabilities while being faced with a shifting regulatory environment and an uncertain economic recovery.

Following the BP oil blowout and spill in the Gulf of Mexico last year, the public's eye is even more focused on how effectively directors represent investors' interests. Compensation has risen to reflect these new accountabilities, as oil and gas companies are pressed to recruit and retain the best and brightest candidates and to attract those individuals with the right management, financial and industry experiences needed to provide sound judgment and guidance.

A major impetus behind these compensation changes is the fact that guiding companies through challenging times is simply harder work. In the course of a "normal" year, board members usually meet about six times, perhaps more often if they are also members of a particularly busy committee. But in the past year, the average number of meetings has jumped significantly. For example, members of the BP board met 25 times in 2010 to manage the fallout from the Deepwater Horizon explosion and subsequent oil spill.

Even in the absence of such disasters, directors have found it necessary to meet more often to address issues such as financial restructuring, mergers, and acquisitions. These types of deals and organizational shifts take months of careful and time-consuming analysis on the part of directors – something that cannot be done in only six meetings a year.

Recent regulatory changes have also had an impact on the shifting role of board directors. The Dodd-Frank Act passed last summer substantially changed the roles and responsibilities of directors in its corporate governance provisions, especially for those directors who serve on executive compensation committees. In order to address the American public's concerns about unfair or outsized executive compensation packages, the Act now requires directors to give shareholders a "say on pay."

Disclosures are provided to shareholders on the composition of executive compensation and golden parachute packages – allowing them to judge the impact such programs may have on a company's financials and to cast an advisory vote as often as annually. While the votes are advisory in nature, directors must take the feedback seriously and be responsive when a significant percent of shareholders express their disapproval of all or any part of the executive pay program.

Along with ensuring that their companies are properly governed, directors are also concerned about their own personal liability. The oil and gas industry in particular exposes directors to significant personal risk in relation to not only governance and business risk issues but also environmental issues and operational hazards. A recent BDO analysis of risk factors as reported in 10K filings of the 100 largest E&P companies found that some of the top risks include operational hazards including vessels sinking or colliding, blowouts, spills, personal injury, and loss of life.

While companies have some insurance to cover these risks, there are certain instances in which directors can be held personally liable. Facing the possibility of such lawsuits, it's not surprising that the best board director candidates expect that their compensation will reflect the risk associated with their good-faith efforts to be of service to shareholders.

Compensation: determining the right value and structure

The question that oil and gas companies now face is this: how to appropriately compensate board directors for their commitment of time to their organizations? While our data has shown that many companies are already offering double digit pay increases for their directors, many other companies remain uncertain about how to structure the amount and method of payment of their compensation programs. Though the US economy is in recovery, compensation for directors and executives remains a touchy subject for many companies who understand that pay packages deemed to be excessive can be detrimental to their relationships with their investors.

Independent analyses offer the best solution for companies concerned about putting together attractive compensation programs without going overboard. A benchmark comparison against other companies with similar size and business lines, conducted by an independent expert, can offer organizations great insight on setting appropriate compensation values. Such studies also help to ensure that companies are making compensation decisions based on industry standards and competitive trends, rather than on pre-conceived – and possibly mistaken – notions.

One of the standard practices that is being re-examined right now is the practice of paying meeting fees to directors for attendance at board or committee meetings in addition to the annual cash retainer. In recent years, there has been a trend toward setting a fixed annual retainer for service on the board and paying no fees for meeting attendance. Given the increased workload by some committees and the chairs of those committees, there is some evidence that this trend is beginning to stall. We expect to see a reversion to the practice of paying meeting fees in order to reflect the reality that some directors are required to commit more time than others to their roles based on their committee assignments.

By properly analyzing such a trend and its application in light of a board's experience, companies can make better decisions about a fair and appropriate director compensation program for their organization.

Stock awards

In addition to cash meeting fees and retainers, stock awards are the other component of most public companies' outside director compensation packages. Historically, stock options have been the dominant choice for oil and gas companies, but over time there has been a major shift toward the use of restricted stock and restricted stock units. Stock options can often be problematic for directors, as they offer only limited exercise opportunities and often raise concerns about how shareholders may interpret the timing of their exercise.

Another issue with stock compensation is the method of determining how many shares to grant. In the past, many companies simply decided on a number of shares to grant without regard to their value, resulting in widely varying year-to-year compensation values depending on the market price of the company's stock when it is granted.

Today, we see many energy companies adopt a target grant value for the equity component of their compensation programs and then award shares or options with a grant date value equal to the target. Using this method is a reasonable approach that assures the intended amount of compensation is being delivered and then reported to shareholders.

Whether a company decides to use fixed-share or target-value grants, it is increasingly common that they have in place some form of ownership guidelines or holding requirements for directors. Most oil and gas companies have recognized that this is an important issue for shareholders and are now adopting requirements that directors own a specific amount of stock while they are active board members.

Typically, if ownership guidelines are adopted, it is expected that directors will own shares valued at three times their annual cash retainer within five years of the adoption of the guidelines or the director's appointment to the board. If holding requirements are adopted, directors are most typically required not to sell shares that are received as part of their compensation until they leave the board.

Board leadership

There is a trend toward separating the positions of chairperson and CEO of public companies. While there are a number of companies in which one individual successfully fills both roles, there is a concern that the combined role may impede the ability of the full board to govern. Our data indicates that between 25% and 30% of mid-market companies separate the roles.

As non-executive chairs are appointed, a fair and appropriate amount of compensation for serving in that position must be defined. The decision on the amount of additional compensation received is typically based on an assessment of the amount of time that will be required to fulfill the duties of the position. Because the definition of the role varies so widely, the amount of additional compensation the non-executive director receives also varies greatly, but the answer we find most often is that actively engaged non-executive chairs are paid additional compensation equal to approximately 80% of the standard board compensation package.

Alternately, when companies decide to combine the CEO and chairperson roles, it is increasingly common to see the appointment of a "lead" or "presiding" director who serves as a liaison between the chair and the rest of the board. The additional compensation offered to lead directors is most often the same retainer that is paid to the director who chairs the audit committee of the board.

While the components that make an attractive compensation package can vary from company to company, and sector to sector, companies across the board are recognizing the need to rethink the compensation they pay for service on their board of directors. Compensation programs that have not been recently updated may not reflect the commitment required by directors in today's environment and economy. Compensation programs for outside directors should be seen as a worthwhile investment in expert contribution that includes providing advice on the strategic direction of a company, assuring it is governed appropriately, and at all times representing the interests of its shareholders. OGFJ

About the author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com