Revenue rises 28% in 2Q, net income surges by 48%

Don Stowers,Editor, OGFJ

Laura Bell,Statistics Editor, Oil & Gas Journal

Revenues in the second quarter of 2011 rose 28% over the second quarter of last year and were up 8% over the prior quarter for the group of companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal. Net income for this same group of companies surged 48% compared to the second quarter of 2010 and increased by 38% over the previous quarter.

For the 131 companies reporting second-quarter revenues, total revenue was $327 billion, up $70 billion over the $257 billion reported in the 2Q2010. Revenues grew by $22.5 billion over the previous quarter.

Net income for the group increased by $11.7 billion from the 2Q2010 to 2Q2011. It was up $9.8 billion compared to the prior quarter.

Year-to-date capital spending stands at $81.6 billion, an increase of nearly $44 billion from the first quarter. Compared to the same quarter last year, spending was up by $22 billion, a 37% increase.

Total asset value for the combined OGJ150 group of companies grew to $1.276 trillion from $1.119 trillion – about a 14% increase – from 2Q2010 to 2Q2011. Assets were up by $33.5 billion over the previous quarter, a more modest 3% increase.

Stockholder equity for the entire group rose 9% to $589.2 billion, a $45.6 billion increase over the same quarter in 2010. However, equity dropped by nearly $9.5 billion, a 2% decline, from the first quarter this year. This figure is roughly in line with decreases in stock value in the market as a whole for the quarter. As this is written, the stock market, led by energy stocks, has showed a slight resurgence over the past couple of weeks. It remains to be seen if this is a trend or a slight correction from what many analysts believe are undervalued oil stock prices.

Largest in net income

The 20 largest companies ranked according to net income had $33.3 billion in collective net income for the quarter. This compares with $23.4 billion for the 2Q10 and $27 billion for the 1Q11. This represents about 92% of the net income for the entire OGJ150 group. So, after the top 20, the remaining 111 companies on the list shared about $2.8 billion in net income.

Of the 131 companies in the group, 30 showed a net loss in the income column. This ranged from a $79 million reported loss by Black Hills Corp. (oil and gas operations only) to a $100,000 loss by Savoy Energy Corp. Individually, some of the smaller companies had significant increases in net income, but in general the larger companies performed better.

The top three companies in this category – ExxonMobil, Chevron, and ConocoPhillips – had slightly more than $22 billion in net income, up from $19.9 billion the previous quarter. This represents around 62% of the net profits of all 131 reporting companies in the group.

The top five companies by net income for the quarter are ExxonMobil ($10.9 billion), Chevron ($7.8 billion), ConocoPhillips ($3.4 billion), Devon Energy ($2.7 billion), and Occidental Petroleum ($1.8 billion). They are followed by Apache Corp. ($1.3 billion), Marathon Oil ($996 million), Hess Corp. ($569 million), Anadarko Petroleum ($562 million), and Chesapeake Energy ($510 million). ConocoPhillips and Marathon have spun off their upstream business units from their other operations, and it remains to be seen how this will impact their future rankings in the OGJ150 quarterly reports.

Leaders in stockholder equity

Combined stockholders' equity for the top 20 companies continued to climb during the last quarter. It was up $63.3 billion (13%) over the second quarter of 2010 and up $11.8 billion (3%) over the first quarter of 2011. The 10 largest companies in this category are ExxonMobil, Chevron, ConocoPhillips, Occidental, Apache, Anadarko, Devon, Hess, Marathon, and Chesapeake. The top 20 companies in this category have 95% of the total stockholders' equity for the OGJ150 group of companies.

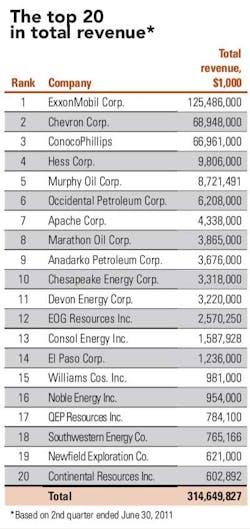

Largest in total revenue

There are two new entrants among the largest companies in total revenue. Consol Energy debuts in the No. 13 position, and Continental Resources in the No. 20 position. Pioneer Natural Resources (formerly No. 19) and Denbury Resources (No. 20) drop out for the quarter. Otherwise, the companies and relative positions are about the same as for the previous quarter.

Total revenue for the top 20 companies increased 27% from the same quarter in 2010 and grew 7% from the prior quarter.

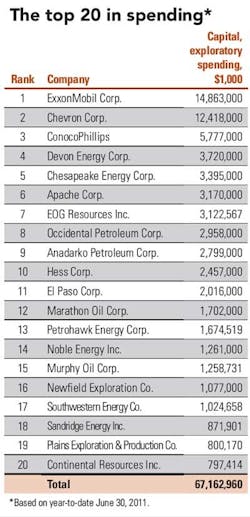

Top spenders

Spending by the top 20 companies in the second quarter was up $17.2 billion (35%) over 2Q10 and by $35.8 billion (114%) over the prior quarter. The top 10 spenders were, in order: ExxonMobil, Chevron, ConocoPhillips, Devon, Chesapeake, Apache, EOG Resources, Occidental, Anadarko, and Hess.

Fastest-growing companies

For the second consecutive quarter, Callon Petroleum Co. is the fastest-growing company based on growth of stockholders' equity compared to the previous quarter. Callon, based in Natchez, Miss., showed a 27.7% growth in this category. Although this led the pack, it was down from the 484.6% increase Callon had in the first quarter of this year.

Stone Energy Corp., based in Lafayette, La., was the second fastest-growing company. The Lafayette, La., company grew by 21.9% compared to the prior quarter.

W&T Offshore Inc. and Brigham Exploration Co. each recorded a 12.3% growth in stockholders' equity. Norway's Statoil recently made a $4.4 billion offer for Brigham, which is expected to close in late 2011 or early 2012.