LAURA BELL, STATISTICS EDITOR - OIL & GAS JOURNAL

OIL AND GAS companies continued their long climb back to prosperity in the first quarter of 2017. Although the industry has been gradually pulling itself out of a deep hole for several quarters, we may look back at the 1Q17 as a turning point when the downturn began to change direction.

We say this because there are some significant thresholds that were crossed in the first quarter.

• Total revenues for the OGJ150 group of companies reached their highest level in six quarters - since 3Q15.

• Revenues were up 42% year over year;

• Net income was the highest in 10 quarters - since 3Q14; and

• 1Q17 marked the first positive net income figures for the group of companies since 4Q14.

Of course not all companies in the group showed the same level of improvement - quite a few continued to show negative growth in terms of net income and revenue. Generally speaking, larger companies tended to be more profitable. However, there were notable exceptions: No. 4-ranked Anadarko Petroleum reported a net loss of $275 million for the quarter; No. 7 Hess Corp. lost $324 million; and No. 9 Marathon Oil Corp. suffered a $5 billion net loss.

Of the top 20 companies ranked by total assets, 16 reported a positive net income. ExxonMobil had the largest profit - slightly less than $4.1 billion for the quarter. Chevron came in second at approximately $2.7 million.

Four companies in the top 20 reported negative net income, the three companies mentioned above plus Denver-based Whiting Petroleum, which lost $87 million for the quarter.

In all, 74 of the 124 companies in the OGJ150 group reported a positive net income, while 29 reported a negative net income. As a group, there was substantial improvement over the previous quarter, which may portend a brighter financial future for US producers, at least for the near term. As of this writing, WTI prices stand at nearly $50 again, and Brent crude is a couple of dollars more.

TOTAL REVENUES

Total revenues for the OGJ150 group of companies in 1Q17 grew by $43 billion (42%) compared to the same quarter in 2016, from $100.2 billion in 1Q16 to $143.1 billion a year later. It grew by $14.8 billion (11%) from the 4Q16. That's a rise from $128.3 billion to $143.1 billion. Those are the first double-digit revenue percentage increases since the onset of the downturn in late 2014.

Here is a quick look at total revenue for the group for the past 10 quarters:

• 1Q17 -- $143.1B

• 4Q16 -- $128.3B

• 3Q16 -- $127.7B

• 2Q16 -- $117.3B

• 1Q16 -- $100.2B

• 4Q15 -- $123.9B

• 3Q15 - $145.5B

• 2Q15 - $159.3B

• 1Q15 - $145.2B

• 4Q14 - $198.1B

As you can see, total revenue for the group bottomed out in the first quarter of 2016 and has improved incrementally in subsequent quarters. However, current revenues are still approximately $55 billion less than in the fourth quarter of 2014, just nine quarters earlier.

NET INCOME

In contrast to the losses in the first quarter of 2016, net income for the group grew by $28.8 billion in 1Q17 - from a net loss of $18.9 billion to a net income of $9.9 billion. The latter represents the highest net income for the group since the third quarter of 2014. Similarly, net income grew by $27.4 billion from the fourth quarter of 2016 - from a net loss of $17.5 billion to a net income of $9.9 billion.

These figures bolster the argument that the upstream oil and gas industry is rapidly recovering from the severe downturn. In the fourth quarter of 2015, US oil and gas producers collectively suffered a loss of $58.5 billion, which was the low point for profits for the group, as oil prices plummeted.

Here is a glimpse at net income figures for the group for the past 10 quarters (brackets indicate a net loss):

• 1Q17 -- $9.9B

• 4Q16 - [$17.5B]

• 3Q16 - [$1.0B]

• 2Q16 - [$17.1B]

• 1Q16 - [$18.9B]

• 4Q15 - [$58.5B]

• 3Q15 - [$47.3B]

• 2Q15 - [$28.5B]

• 1Q15 - [$15.2B]

• 4Q14 -- $2.5B

As mentioned above, the first quarter of 2017 marks the first time the OGJ150 group of companies has collectively recorded a positive net income since the fourth quarter of 2014 - nine quarters ago. Some forecasters had predicted a return to profitability for the upstream sector by the second quarter, so it appears that the group may be a little ahead of schedule.

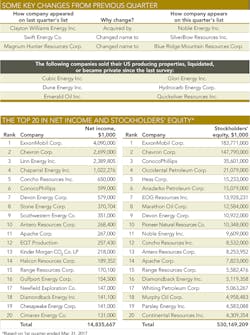

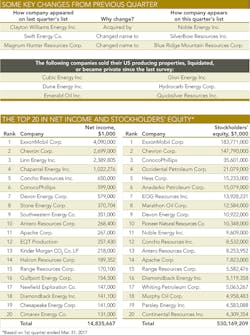

EXXON STILL ON TOP

Among the top companies in net income, ExxonMobil reigns supreme. The supermajor realized $4.1 billion in net income for the 1Q17 compared to $1.7 billion for the 4Q16 and $1.8 billion year over year. No. 2-ranked Chevron earned $2.7 billion in net income for the quarter compared to a $438 million loss for the 4Q16 and a $707 million deficit in 1Q16.

The rest of the top 10 in net income includes:

• Linn Energy Inc. - $2.4B

• Chaparral Energy - $1.0B

• Concho Resources - $650M

• ConocoPhillips - $599M

• Devon Energy - $579M

• Stone Energy - $371M

• Southwestern Energy - $351M

• Antero Resources - $268M

TOP 10 IN TOTAL REVENUE

ExxonMobil again leads the pack with $63.3 billion in total revenue. Chevron is No. 2 with $33.4 billion.

The remainder of the top 10 in total revenue includes:

• ConocoPhillips - $7.8B

• Anadarko - $3.8B

• Devon Energy - $3.5B

• Occidental - $3.0B

• Chesapeake Energy - $2.8B

• EOG Resources - $2.6B

• Apache Corp. - $1.9B

• Pioneer - $1.5B

TOP 10 IN SPENDING

Chevron Corp. was the top spender in the first quarter of 2017 with $3.3 billion in capital and exploratory spending. ExxonMobil was No. 2 with $3.2 billion in spending.

The rest of the top 10 in spending includes:

• Anadarko - $1.2B

• ConocoPhillips - $966M

• EQT Production - $945M

• EOG Resources - $912M

• Devon Energy - $747M

• Occidental - $722M

• Noble Energy - $587M

• Concho Resources - $457M

LIST CONTINUES TO SHRINK

By press time for this issue, only 104 of the 124 companies included in the shrinking OGJ150 Quarterly Report (down from 130 companies in the previous quarter) had reported their financial results to the US Securities Exchange Commission.

YTD CAPITAL SPENDING

Year-to-date capital spending in the first quarter of this year stood at about $20.9 billion, down approximately $3.2 billion (13%) from year-ago levels. As a further indication that companies continue to spend less even as oil prices and profitability climb, this represents a dramatic 56% drop from 1Q15 capital spending, which was about $47.7 billion.

The severity of these cuts continues to hammer the oilfield services and equipment sectors and other industry vendors as well as workers. The OFS sector continues to consolidate, and workers are still being laid off as companies combine to improve scalability and efficiencies.

Total asset value for the OGJ150 group has stabilized. Asset value for the group rose by about 1% from 4Q16 to 1Q17 - from $1.194 trillion to $1.207 trillion. Compared to the same quarter in 2016, however, asset value fell about $11.9 billion (less than 1%).

STOCKHOLDERS' EQUITY

In another measure of relative stability in the upstream sector, stockholders' equity has begun to rise modestly. Stockholders' equity increased by $22 billion (about 3%) to $572.5 billion for the group in the 1Q17 compared to the previously quarter. It rose by nearly $30 billion (5%) compared to the same quarter in 2016.

The top 10 companies ranked by stockholders' equity are: 1) Exxon Mobil Corp. ($183.8 billion); 2) Chevron Corp. ($147.8 billion); 3) ConocoPhillips ($35.6 billion); 4) Occidental Petroleum Corp. ($21.1 billion); Hess Corp. ($15.2 billion); Anadarko Petroleum Corp. ($15.1 billion); EOG Resources Inc. ($14 billion); Marathon Oil Corp. ($12.6 billion); Devon Energy Corp. ($11 billion); and Pioneer Natural Resources Co. ($10.3 billion).

MARKET CAPITALIZATION

The top 10 companies in market capitalization as of March 31, 2017, are: 1) ExxonMobil ($347.5 billion); 2) Chevron ($203.4 billion); 3) ConocoPhillips ($61.7 billion); 4) EOG Resources Inc. ($56.3 billion); 5) Occidental Petroleum ($48.4 billion); 6) Anadarko Petroleum ($34.2 billion); 7) Pioneer Natural Resources ($31.7 billion); 8) Devon Energy ($22 billion); 9) Apache Corp. ($19.6 billion); and Concho Resources Inc. ($19 billion).

FASTEST-GROWING COMPANIES

For a change, the 1Q17 brought some "fastest-growing companies" back to the OGJ150 report. Ranked according to growth in stockholders' equity, these were the fastest-growing oil and gas producers:

• Halcon Resources Corp. grew by a whopping 520.1% over the preceding quarter;

• Sabine Royalty Trust by 42.3%;

• Diamondback Energy Inc. by 27.4%;

• RSP Permian Inc. by 20.5%; and

• Newfield Exploration Co. by 17.3%.

KEY CHANGES

Some key changes in the OGJ150 for this quarter: Clayton Williams Energy Inc. was acquired by Noble Energy Inc.; Swift Energy changed its name to SilverBow Resources Inc.; and Magnum Hunter Resources Corp. changed its name to Blue Ridge Mountain Resources Corp.

Click here to download the pdf of the OGJ150 Quarterly "1st Quarter ending Mar. 31, 2017"