Price malaise may last a while

PRODUCERS SHOULD POSITION THEMSELVES TO SURVIVE AN EXTENDED PERIOD OF SUB-$70 PRICES

JIM HARDEN, HEIN, HOUSTON

EDITOR'S NOTE: This article ran previously on Hein's website. It has been republished here with permission.

THE PAST COUPLE OF YEARS have not been the best of times for producers of US commodities. This is particularly true for domestic oil patch operators, who continue to struggle with a pricing trend that has by no means been friendly to profitability.

Since peaking at $60 per barrel in June 2015, the price of West Texas Intermediate (WTI) crude oil took a sharp nosedive to under half that price before rallying to the low-$50 range by the end of 2016 and has languished between $45 and $55 since. While people are optimistic to see $60 to $70 oil prices sooner than later, there are signs that this might not be the case.

There are a number of reasons to believe that this cycle may not be a temporary event, and that producers will need to position their operations to survive an extended period of crude oil pricing below $70 per barrel. Here are three key trends fueling this malaise:

THE US DOLLAR VS THE EURO

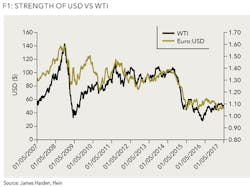

Oil is a global commodity that is transacted in US Dollars (USD). For that reason, the recent strength of the Dollar against most other developed market currencies – particularly the Euro – has dampened oil price growth (see Figure 1).

Interestingly, when crude oil hit its pre-recession all-time high in July 2008, the USD hit its all-time low against the Euro. More recently, the US economy has continued to gain strength at a rate greater than most other advanced markets, resulting in a stronger Dollar that has driven the exchange rate on the Euro down to under $1.10. The coefficient of correlation (r2) between the USD and WTI was greater than 0.73 r2 over the past 10 years and over 0.94 r2 since January 2013.

While a strong Dollar policy was initially favored by the fledgling administration of President Donald Trump, in recent weeks the tide has seemingly turned, with Treasury Secretary Steve Mnuchin saying an "excessively strong Dollar" might hinder short-term economic growth. However, continued US job market strength, rising government debt levels, and upward pressure on interest rates – combined with continued Eurozone debt issues – will make it difficult for policymakers to weaken the Dollar's near-term trajectory.

What's the bottom-line? As long as the US Dollar remains strong, it makes US exports more expensive on world markets. If the current Dollar-to-Euro exchange rate remains near parity, WTI oil prices will linger in the current range, absent an unforeseen supply issue or major geopolitical event. That said, a recent forecast from a major European bank projected the Euro could fall as low as 95 cents on the USD later in 2017, a scenario that would take crude prices much lower, perhaps even below $40 per barrel once again.

GLOBAL DEMAND: LONG, SLOW RISE

While China remains the world's largest energy consumer, overall demand from that nation continues to be sluggish. According to a recent analysis, China's total demand for oil rose just 2.5% in 2016, the third consecutive year in which consumption growth has declined. That's largely attributable to a slowing Chinese economy, which fell from 7% growth in 2015 to 6.7% through the end of last year.

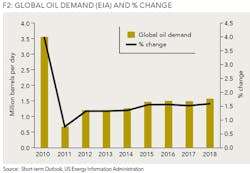

China's decline in energy use is part of a broader global picture. In its most recent monthly report, the International Energy Agency (IEA) noted that global oil product demand rose by 1.6 million barrels per day for 2016 to an overall total of 95.6 million daily barrels of consumption. This year, however, the IEA expects the level of growth to drop back to 1.4 million barrels per day, pointing to softer demand in key markets such as Germany, India, South Korea, and Japan.

For US producers, a glimmer of hope is on the near-term horizon, as the US Energy Information Agency (EIA) forecasts that growth in global oil demand will inch back to 1.6 million barrels per day by 2018 (see Figure 2). Further, the IEA's 2016 medium-term oil report projected that global oil consumption will rise from an estimated 96.9 million barrels per day this year to 100.5 million barrels per day by 2020, with a slight tightening of global crude oil inventories during that time.

GLOBAL PRODUCTION: IN SEARCH OF A BALANCE POINT

A generation ago, news reports were full of headlines about "energy shortages" and "peak oil," with doomsday scenarios pointing to how global economies would need new kinds of energy to power themselves in a post-petroleum world. While today's energy sources are indeed more diverse, so are the ways in which petroleum producers have been able to tap oil and gas reserves previously thought to be inaccessible.

The result? The world is awash in oil and gas supplies, which makes inventory management a critical factor in market pricing.

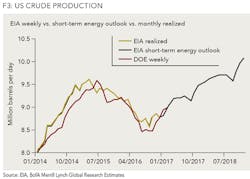

To help address the supply issue, US oil producers last year hauled back production from 9.2 million barrels per day in January to 8.6 million barrels per day by September (see Figure 3).

While fourth quarter oil production bounced slightly upward, the overall 2016 production average of 8.9 million barrels per day was well below the daily average of 9.4 million barrels recorded the previous year. On the global stage, producers in the Organization of the Petroleum Exporting Countries (OPEC) agreed at the end of 2016 to a historic cut of 1.8 million barrels per day in an attempt to restrict supply and boost crude oil pricing. While some industry analysts question if all OPEC nations will abide by the production cuts, scheduled to last through June 2017, the cartel said it would consider an extension through year-end 2017 if oil supplies and demand had not reached more favorable balance. [NOTE: Since this was written, the OPEC cuts have indeed been extended through the end of 2017.]

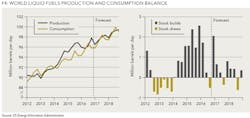

Through 2016, global oil inventories increased an average of 0.9 million barrels per day, including a sharp production uptick in the fourth quarter by both US and OPEC energy firms. However, a short-term outlook by EIA forecasts that overall oil production will rise more slowly in 2017 and 2018, causing existing inventories to gradually decline (see Figure 4). By the second half of 2018, the EIA projects that worldwide crude oil inventories will decline by about 0.1 million barrels per day.

In summary, a case for rising crude oil prices in the next several years is dependent on three main factors: A slow (if steady) rise in global demand, US and OPEC restraints on production, and a weakening US Dollar. If the demand and production forecasts hold up, recent OPEC quotas are adhered to, and the Euro rallies to the $1.20 range against the Dollar, it's very possible WTI crude pricing could rebound to the $75 per barrel range by 2019 to 2020.

ABOUT THE AUTHOR

Jim Harden serves as is a principal at Hein and services as the firm's Business Valuation Services Leader. With more than thirty years of experience in the energy industry, he provides valuation, economic consulting and litigation support services to public and private companies, investment firms and law firms. Prior to joining Hein, Harden was a director at Berkeley Research Group. Prior to Berkeley, he served as the global oil and gas valuation leader for Ernst & Young. He received his BS in geology from Fort Hays State University and has an MBA.