Brazilian E&P industry

Mexican E&P market creates competition for foreign investments

KJETIL SOLBRAEKKE, RYSTAD ENERGY

THE BRAZILIAN E&P INDUSTRY is fighting to maintain its position as one of the most attractive places for E&P investments. Production from Brazilian pre-salt reservoirs is already surpassing one million barrels of oil equivalent per day (boe/d) and is expected to continue to grow and pass two million boe/d by 2020. However, almost all of this production is from licenses that were awarded 15 years ago. As such, the post-salt production lacks focus and new investments. Only the Libra round has been offering licenses in the pre-salt area since.

The desired investment to secure new growth in the Brazilian E&P can only come from abroad. The Brazilian government has been in deep economic crisis for years and is looking for ways to reduce costs and increase revenue in all areas. Local content policies divide the industry and make reasonable economic decisions difficult. Petrobras is trying to reduce debt and limiting the exposure.

Yet, new growth from abroad is becoming more challenging, especially with increased international competition from Mexico. This article looks closer into how the opening of the Mexican E&P market to the international industry influences Brazil.

Brazilian pre-salt production

With the first discoveries of pre-salt reservoirs in 2006 and pilot production starting in 2009, pre-salt production has taken off. Rystad Energy expects 2017 production from pre-salt fields to be 1.36 MMboe/d, increasing to 2.3 MMboe/d by 2020. It is impressive to see that 60% of Brazil's oil and gas production is estimated to come from pre-salt by the end of this decade (See Figure 1).

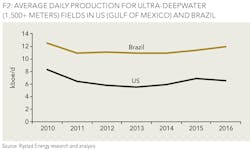

Brazil well productivity offshore

Comparing offshore well productivity between Brazil and the US (Gulf of Mexico), including post-salt wells, we see that deepwater wells from Brazil are close to twice the productivity compared to the US. We also see pre-salt wells to be about four times as productive as the average well in the Gulf of Mexico. This may in fact indicate a preference for exploration and investment in Brazil (See Figure 2).

However, the picture is obviously more complex than this. In the World Bank's rank of "ease of doing business," we find Mexico in first place in Latin America and the Caribbean, and Brazil in 22nd place. Compared to the rest of the world, Mexico holds the 47th place versus Brazil in 123rd place.

The recent rounds in Mexico appear successful and have been well received by the IOCs and investors. In Brazil, there are still uncertainties regarding key issues linked to new license rounds, like the tax regulation known as "Repetro" and local content requirements. As if this was not sufficient, Total recently had to ask for more time to start up drilling in the north of Brazil due to delays in achieving environmental permits from the Brazilian Institute of the Environment and Renewable Natural Resources (IBAMA). These factors can play a decisive role when companies consider where to allocate investments.

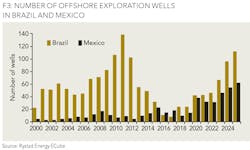

Offshore exploration in Brazil and Mexico

Figure 3 looks at completed and expected wells in Mexico and Brazil. Offshore exploration activities in Brazil have almost collapsed with a reduction from 140 wells in 2011 to less than 20 wells expected in 2017. Currently, Mexico is drilling more wells offshore in 2016 and 2017 than Brazil. Looking ahead, we still estimate there will be more wells drilled in Brazil than in Mexico, however these numbers can be heavily influenced by further delays in new rounds in Brazil or an even more positive anticipation of new rounds in Mexico.

It seems that Brazil will face considerable competition from Mexico in the fight for foreign investments into the E&P sector. Unless Brazil realizes the competition, becomes more long-term focused and implements competitive terms for the oil and gas industry, the situation might become even more challenging.

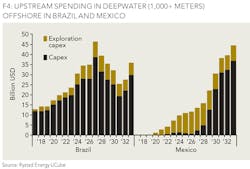

Spending in Brazil and Mexico

Based on currently planned exploration activity in Mexico and Brazil, we are assuming an increased level of capital expenditure in both countries as shown in Figure 4. The numbers indicate that Mexico can reach the same level of investments as Brazil in 15 years, indicating significant yet-to-find oil and gas resources in the deepwater offshore in the Gulf of Mexico. The recent license rounds show that the IOCs and the investor community find it attractive and interesting. There are reasons to believe that the exploration play types are fairly similar in Mexico as they are in the US. There is also reason to believe that the discoveries might be in the same range as in the US and more or less of similar productivity. This is an indication that pre-salt in Brazil is very competitive, if only evaluated from the perspective of economics before government take and other regulations like local content and IBAMA licenses.

Politics matter

The answer whether Brazil will be able to maintain the position as the leading offshore country in Latin America lies to a huge degree in the hands of the politicians in Brazil. If they are able to move the country upwards on the "ease of doing business" World Bank ranking there are good reasons to believe that Brazil will attract more investments and realize a higher growth. If no decisions are being taken, Brazil will be sooner than they desire observing Mexico to become the key Latin American E&P player.

ABOUT THE AUTHOR

Kjetil Solbraekke is the head of Rystad's Rio de Janeiro office. He first arrived in South America after being responsible for the acquisition of Peregrino field in Brazil in November 2005. In Brazil, Solbraekke has held several management positions, including CEO for Panoro Energy and general manager for Norsk Hydro. Before moving to Rio de Janeiro, he worked at Norsk Hydro in Oslo as CFO and SVP for international business development for 10 years. Solbraekke started his career at the Ministry of Petroleum in Norway as an economist from the University of Oslo.