Reserve-based lending

The evolution through the downturn

PAUL F. JANSEN, CONWAY MACKENZIE INC., HOUSTON

THROUGHOUT 2015 AND 2016, more than 90 energy companies filed for Chapter 11 bankruptcy protection and restructured more than $70 billion in debt. As commodity prices began their decline in the second half of 2014, upstream reserve values fell precipitously, resulting in the significant reduction of reserve based loan (RBL) capacities across the industry. The reduction in loan capacities left many borrowers over-advanced on their RBL facilities and their respective lenders exposed to increased credit risk. As the energy industry experienced a collective balance sheet restructuring, the Shared National Credits (SNC) program undertook a review of RBL practices and loan classifications. The results of the SNC review led to a March 2016 pronouncement issued by the Office of the Comptroller of the Currency (OCC) that proposed changes to RBL underwriting analysis and loan risk rating determinations by national banks and federal savings associations (collectively, banks).

The following review quantifies the change in size and availability of RBL facilities between 2014 and Q1 2016, analyzes the changes required by the OCC pronouncement and compares financial terms and covenants for pre-petition and exit loans for select exploration and production (E&P) companies.

Impact of commodity prices on borrowing bases and liquidity

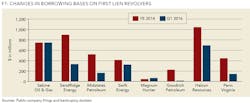

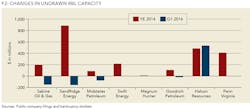

Projected reserve values and related borrowing base availability are both heavily dependent on future commodity prices and forecasted capital expenditures. Beginning in 2014, as commodity price forward curves decreased, borrower liquidity evaporated, leaving many companies unable to maintain ongoing operations, execute their development plan and service their debt. The eight E&P companies in Figure 1 witnessed their borrowing base capacity fall nearly 50% on average from year-end 2014 through Q1 2016. Changes in Sabine Oil & Gas' and Magnum Hunter's borrowing bases reflect post-petition and interim RBL facilities as both companies filed for bankruptcy prior to 2016.

As production and commodity price levels declined, E&P companies were unable to cure borrowing base deficiencies, service junior debt or fund ongoing operations. Furthermore, companies with remaining availability and limited cash hoarding covenants, such as Quicksilver Resources Inc. and Linn Energy LLC, drew down the remaining available liquidity in preparation for inevitable balance sheet restructurings. Many E&P companies also monetized their commodity hedge portfolios to provide additional liquidity or to pay down existing debt obligations.

Throughout 2015, E&P companies continued to report asset value impairments on their oil and natural gas (O&G) properties, forcing lenders to review - and potentially write down - significant portions of their energy portfolios.

These write-downs, paired with the increase in classified energy loans (classified loans are rated substandard, doubtful, or loss and require additional reserves as outlined in the Shared National Credits (SNC) Program - 2015 Review and Shared National Credits Program - 1st Quarter 2016 Review), resulted in the OCC and other regulatory authorities issuing new reporting and rating standards for banks to follow.

Impact of OCC Guidance on loan classifications and ratings

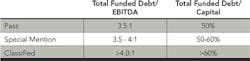

Following the November 2015 review, the SNC determined that "classified O&G borrowers totaled $34.2 billion, or 15% of total classified commitments in 2015 compared to $6.9 billion, or 3.6%, in 2014." Total classified O&G commitments continued to increase in 2016 totaling $77 billion, or 27% of total classified commitments per the SNC's first quarter 2016 review. Just as analysts had failed to anticipate the collapse in home values during the 2008 mortgage crisis, analysts also failed to anticipate a 70% decline in oil prices. Therefore, the resulting portfolio value at risk was not sufficiently mitigated. Upon perceiving this increased risk, the OCC issued new underwriting and review guidance for banks. The new provisions deviated from prior standards by requiring banks to now apply risk ratings to loans based on a borrower's ability to timely repay all secured debt, rather than simply the debt provided by the bank. In addition, the new guidance updated financial covenant requirements imposing stricter debt to EBITDA and debt to total capital provisions.

Subsequent to March 2016, loans are evaluated by banks through the secured debt repayment and covenant tests and rated as "pass", "special mention" or "classified" based on level of risk. Loans rated "special mention" and "classified" require banks to set aside greater reserves which impose higher carrying costs on banks. The banks' higher carrying costs appear to have been passed onto borrowers as further discussed below. This additional cost of capital does not carry over to non-bank RBL lenders, thereby increasing substantial risk to banks.

Impact of OCC Guidance on borrowing bases and interest rates

In response to the new rating guidance, banks continue to adjust the terms and structures of newly issued RBL facilities. As demonstrated, borrowing bases for several E&P companies emerging from bankruptcy were initially set at, or below pre-petition levels. Despite consistent or reduced borrowing bases, interest rates increased from 25 to 50% in most cases commensurate with the increased risk for banks having to pass stricter review and potentially increasing capital reserves. To provide companies exiting bankruptcy more time to strengthen their balance sheets - and to mitigate the risk of a repeat filing - lenders of several recently issued credit facilities have instituted "borrowing base holidays" and non-conforming RBL tranches. Borrowing base holidays are designed to postpone the redetermination process used in calculating a company's borrowing capacity and to provide borrowers with a consistent level of liquidity, improving the chances of covenant compliance and total secured debt repayment. In addition, despite increases in interest rates, default penalties and commitment fees remained at pre-downturn levels. See Table 1.

Comparison of pre-petition vs. exit facility covenants

Lenders appear to have adjusted covenants on newly-issued RBL facilities to reflect the new OCC regulatory and commodity price environments. In an effort to reduce required reserves, lenders have set covenants on newly issued facilities at or below the new standards. The analyzed companies were subject to post-emergence leverage covenants that were set at the new 3.5x total funded debt to EBITDA threshold, more stringent than the 4.0x ratio previously needed to secure a "pass" rating. For companies projected to exceed this requirement at emergence, the RBL facilities often incorporated step-down provisions, allowing companies sufficient time to repay outstanding debt and progressively comply with the OCC's guidelines. Furthermore, in response to the updated total secured debt repayment test, research showed lenders imposed stricter limitations on subsequent debt issuances, placing additional emphasis on the total capital structure. While the debt rating system only requires lenders to evaluate a company's ability to repay secured debt and interest on all funded debt, exit facility covenants frequently require the use of total debt when calculating quarterly ratios.

In response to companies harboring cash, lenders have also implemented tighter controls on liquidity through newly implemented anti-cash hoarding and anti-borrowing provisions. To prevent excess cash buildup, lenders frequently require borrowers to immediately repay outstanding balances when liquidity exceeds specified thresholds. While this reduces lending exposure, this practice may produce unintended negative consequences in some cases as companies potentially lose access to adequate liquidity and may be unable to pursue economic projects in the future.

Conclusions

The aforementioned examples illustrate that increased regulation imposed on E&P RBL facilities has resulted in two primary changes: 1) increased cost of RBL capital for borrowers, 2) more rigorous financial covenant provisions. See Table 2. Both of these changes are the result of greater risk perceived by lenders as commodity price volatility drives uncertainty around future reserve value, ability to service debt and time of repayment. As banks are now required to consider total secured debt repayment when determining covenants, alternative financing may become more attractive to borrowers in some situations and drive deal flow away from banks. In addition, it is possible that the higher cost of capital may slow the recovery of the oil and gas industry if healthy companies are unable to afford extensive drilling programs and subsequently decrease growth forecasts. Similarly, companies recently emerging from restructurings may be overburdened and unable to operate within the restrictive covenants placed on them by RBL lenders. As lenders continue to implement the OCC updated guidance, recovery in the E&P RBL market may lag behind the broader recovery of the energy industry and a return to previous levels may be particularly challenging.

ABOUT THE AUTHOR

Paul F. Jansen is a managing director in Conway MacKenzie's turnaround, crisis management and restructuring practice. Jansen has a master's degree in economics from Maastricht University with concentrations in corporate finance and business and he is a Certified Insolvency and Restructuring Advisor (CIRA), Certified Public Accountant (CPA) in the state of Texas and a Registeraccountant (CPA equivalent) in the Netherlands. Jansen is a member of the Association of Insolvency & Restructuring Advisors, the Turnaround Management Association and the American Institute of CPAs.