Tillerson seals Exxon legacy with Bass deal en route to Washington

ANDREW DITTMAR, PLS INC., HOUSTON

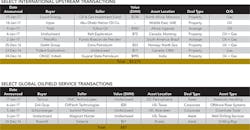

DC ISN'T THE ONLY AREA in the United States with January fireworks as upstream deal activity kicked off with a bang in the Permian and Eagle Ford. Early 2017 deal markets are being driven by multi-billion-dollar moves by Sanchez Energy, Noble Energy and even the granddaddy of them all, ExxonMobil. Just through the first three weeks of 2017, US upstream markets have already racked up $14 billion in deals, or 20% of the 2016 total.

After patiently biding its time, Exxon finally jumped into the market and scooped up companies owned by the Bass family including operating firm BOPCO for $5.6 billion in equity plus a $1.0 billion cash sweetener that kicks in starting in 2020. The deal was reportedly negotiated personally by Rex Tillerson with members of the Bass family. The Bass family companies are principally focused on the New Mexico portion of the Delaware Basin, where they have leased up 250,000 net acres in large, contiguous blocks that are largely held by production. Exxon estimates the resource potential for these assets to be 3.4 Bboe, which more than doubles Permian resources owned through shale subsidiary XTO.

This deal is notable on the seller side as well. The Bass family of Fort Worth is one of the most distinguished in the Texas oil industry with roots stretching back to the early days of wildcatting. Perry Richardson Bass joined his uncle and legendary wildcatter Sid Richardson in discovering the giant Keystone field in West Texas along with other finds around the world. The family has subsequently diversified outside of oil and gas with investments as widespread as Disney and, in recent years, Blue Bell ice cream. Notably, the Bass family followed another famous oil family, the Yates, who also sold their New Mexico Permian position for $2.5 billion in EOG Resources equity. It is remarkable that in just a few months, two of the longest running Permian family oil-built fortunes decided to sell/partner with two of the best run companies to ensure their futures.

Just one day before the Exxon deal with Bass, another storied Permian independent rode off into the sunset when Clayton Williams agreed to sell itself to Noble Energy for $3.2 billion. Clayton has assets across the Permian, but the core of its portfolio and the reason for interest from Noble is 71,000 net acres located in the Southern Delaware Basin primarily in Reeves County. The acreage is well positioned in an oily portion of the county and near active drilling activity. The quality of the acreage is reflected in Noble's adjusted acquisition price of just over $32,000/acre, right in line with other core southern Delaware deals.

While Clayton Williams' (Claytie to industry veterans) roots in the Permian don't date back quite as far as the Bass family, the company still has a notable 35-year-plus legacy riding the booms and busts of the oil business. After dropping below $7/share in March, Claytie found a top and sold off at a remarkable $138.97/share.

These sales don't mean all family-run independents are cashing out in this boom though and some are even doubling down. Sanchez Energy partnered with Blackstone (50/50) to buy out Anadarko's interest in a massive Eagle Ford asset located mostly in Dimmit and Webb counties. Named Comanche by Sanchez, the asset covers 155,000 net acres (318,000 gross) and has net production of 67,000 boe/d. Sanchez knows this area of the Eagle Ford perhaps better than anyone from its experience drilling the nearby Catarina project, which it acquired from Shell in 2014. Sanchez also leased 110,000 net acres north of Comanche and has now leap-frogged to the third largest Eagle Ford acreage holder, behind EOG and Lewis Energy.

Teaming up with Blackstone plus getting funding from the firm's credit arm GSO Capital Partners allowed Sanchez to take down an asset substantially larger than its market cap. In turn, Blackstone was able to pick up an interest in a world-class asset in conjunction with an experienced operator. The two companies will be joined in the Eagle Ford by new non-op partner and KKR portfolio company Venado Oil & Gas, which bought out SM Energy's stake for $800 million one week earlier.

Both Anadarko and SM Energy have been very active in deal markets as they focus their portfolios on core projects with the highest returns. For SM, this means selling Bakken assets in addition to Eagle Ford to raise capital for drilling up the Midland Basin properties it acquired in the second half of 2016. Anadarko, meanwhile, also reached an agreement in late December to sell its Marcellus position to Alta Resources for $1.2 billion. Moving forward, Anadarko is focused on its core Delaware Basin, DJ Basin and Deepwater Gulf of Mexico assets.

Deal activity in the midstream and oilfield service sectors has been more subdued after they went through a major period of consolidation recently. FMC Technologies was able to complete its 50-50 merger with Technip to form a combined subsea powerhouse firm.