LAURA BELL, STATISTICS EDITOR – OIL & GAS JOURNAL

THREE MONTHS AGO, we said that total revenue and net income for the OGJ150 group of US-based companies had finally come out of a two-year tailspin and had begun to show improvement. As we look at the results for this group in the third quarter of 2016, this is still the trend. Revenues and income continue to improve, although the companies as a group continue to bleed red ink.

With crude prices moving into the $50 to $60 range and remaining steady, operators have been able to adjust their operations to this new reality. As a result, well-managed companies are leading the way to profitability again. Shale producers operating in the Permian and Delaware basins of West Texas and southeastern New Mexico for the most part have been the top performers recently, although several other plays are starting to show signs of life as well. There has even been M&A activity in plays such as the Cotton Valley in East Texas, the Haynesville in northwest Louisiana, and the Eagle Ford in South Texas, some of this triggered by private capital, which is finally making some long-awaited moves into upstream and midstream deals.

Total revenue for the group inched up by nearly $10.4 billion (8%) from the previous quarter and stood at $127.7 billion by quarter's end. However, that figure was down approximately $17.8 billion (12%) compared to the same period in 2015. The 8% growth in revenue from the prior quarter is about half the 18% revenue growth seen in the second quarter of 2016, so it would be a mistake to assume this is a linear recovery.

Here is a quick look at total revenue for the OGJ150 group of companies for the past eight quarters:

3Q16 – $127.7 B

2Q16 – $117.3 B

1Q16 – $100.2 B

4Q15 – $123.9 B

3Q15 – $145.5 B

2Q15 – $159.3 B

1Q15 – $145.2 B

4Q14 – $198.1 B

As you can see, total revenue for the group bottomed out in the first quarter of 2016 and has improved in the two subsequent quarters.

Similarly, here is a glimpse at net income figures for the group for the past eight quarters (brackets indicate a net loss):

3Q16 – [$1.03 B]

2Q16 – [$17.11 B]

1Q16 – [$18.94 B]

4Q15 – [$58.45 B]

3Q15 – [$47.27 B]

2Q15 – [$28.51 B]

1Q15 – [$15.17 B]

4Q14 – $2.52 B

The last quarter that showed a positive net income was the fourth quarter of 2014, and that was a fairly modest amount – $2.5 billion. We've had seven consecutive quarters of net losses. Losses for the group peaked in the third and fourth quarters of 2015. It's been a long, slow road to recovery – and we're not quite there yet. At least not as of Sept. 30, 2016. In the coming weeks, we'll see what the final numbers were in the fourth quarter and for the year. Reports are starting to come in as of this writing (late January).

Net income remains in negative numbers, although the improvement seen during the third quarter of 2016 was significant. The group showed a net loss of slightly more than $1.0 billion for the quarter compared with a net loss of $17.1 billion in 2Q16. Year over year, the $1.0 billion loss looks even better than the $47.3 billion loss in the 3Q15. So the movement is in the right direction, but we're still not back to zero.

By press time for this issue, only 108 of the 135 publicly traded companies included in the OGJ150 Quarterly Report had reported their financial results to the US Securities Exchange Commission. Of these companies, only 34 reported a positive net income for the third quarter. However, this is up from the 20 companies that reported a positive net income in the previous quarter.

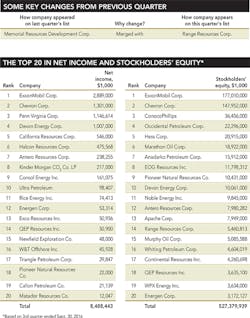

ExxonMobil once again led the way as the top company in net income with $2.9 billion in reported income. For the previous quarter, the Irving, Texas-based company had $1.7 billion in net income. XOM was followed by Chevron Corp. at $1.3 billion; Penn Virginia Corp. at $1.1 billion; Devon Energy at $1.0 billion; California Resources Corp. at $546 million; Halcon Resources Corp. at $476 million; Antero Resources Corp. at $238 million; Kinder Morgan CO2 Co. LP at $217 million; Consol Energy at $161 million; and Ultra Petroleum at $98 million.

The producers showing the biggest losses for the quarter were (in order): Chesapeake Energy – $1.2 billion; ConocoPhillips – $1.0 billion; Anadarko Petroleum – $747 million; Southwestern Energy – $708 million; Whiting Petroleum – $693 million; Apache Corp. – $559 million; Seneca Resources Corp. – $453 million; Sandridge Energy – $404 million; Breitburn Energy Partners LP – $365 million; and Hess Corp. – $317 million.

In all, 68% of the 108 reporting companies had a net loss for the quarter. That is down from 81% that reported a net loss for the previous quarter. Also, in the last quarter five companies reported losses in excess of $1 billion. For the 3Q16, only two companies (Chesapeake and ConocoPhillips) reported losses greater than $1 billion.

YTD CAPITAL SPENDING

Year-to-date capital spending in the third quarter of 2016 stood at approximately $63.3 billion, down about 48% from the $121.9 billion in the third quarter of 2015. This represents a spending cut of nearly half of expenditures, year over year, in the same quarter. So oilfield services companies, drilling contractors, and equipment manufacturers are obviously still not happy with volumes at this point.

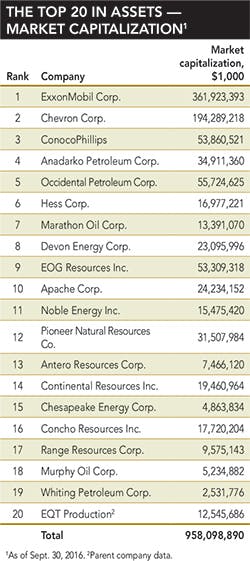

TOTAL ASSET VALUE

Total asset value for the OGJ150 group of companies has fallen by $116 billion (8%) since the third quarter of 2015. It currently stands at a little more than $1.2 trillion. The decline from the previous quarter was less than 1%.

STOCKHOLDERS' EQUITY

In another sign that the economic recovery in the oil patch may be approaching, stockholders' equity rose slightly in the third quarter to $547 billion, an increase of about $1.2 billion from the second quarter. Although this represents less than 1% growth, at least it is not negative. However, producers still have a long way to go. At this point in 2015, stockholders' equity stood at about $614.5 billion. Therefore, we have experienced about a 10% decline in stockholders' equity since then.

Memorial Resources Development Corp., which appeared on last quarter's list, merged with Range Resources Corp. and is no longer listed separately.

There were no "fastest-growing companies" to report for this quarter.

Click here to download the PDF of the OGJ150 Quarterly "Quarter ending Sept. 30, 2016"