Recent events help shape oil prices

HAS A NEW WORLD ECONOMIC ORDER BEEN LAUNCHED BY THE US ELECTION?

MIKE ISSA, GLASSRATNER ADVISORY & CAPITAL GROUP, IRVINE, CALIF.

IN THIS INCREASINGLY complicated world, it is useful to fall back on an examination of the three things that matter for our industry: supply, demand, and currency exchange rates. There are several meaningful headwinds and perhaps several crosswinds that have occurred since we wrote about Brexit for the August issue of Oil & Gas Financial Journal. The US election, OPEC's intentions versus their reality, and the seeming direction of Brexit are the key influences for this reflection and comment. The markets clearly believe that Trump can deliver on much of his campaign platform with Republican control of both houses in Congress and have traded up based on that perception. People want to believe that OPEC can actually deliver on and honor a production curtailment program. And, Brexit continues to evolve in potentially adverse ways.

What are the markets telling us about the shocking Trump victory and how will it really play out?

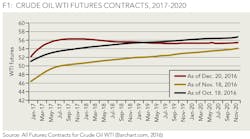

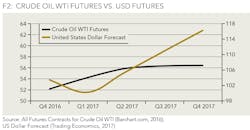

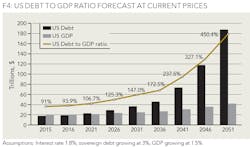

The markets clearly interpret the Trump win as a victory for capitalism, with an attendant reduction in taxes, and fiscal stimulation that will accelerate US GDP growth. In the wake of the election, US interest rates have trended up (from 1.8% to 2.3% (CNBC, 2016)); equity markets have risen to new highs (CNBC, 2016; Bloomberg, 2016), and the US dollar has been on a tear against the euro and against a basket of world currencies (CNBC, 2016).

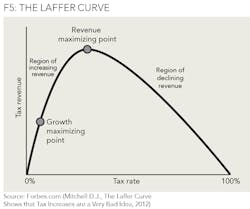

Laffer Curve Research

OPEC's intention vs. reality

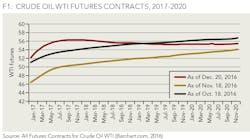

- The markets reacted positively to OPEC's "agreement in concept" for the collective curtailment of production at their 170th Meeting on September 28th. Crude immediately traded up from $44.65 to $47.07 (US Energy Information Administration, 2016), but the increase was only temporary.

- After the 171st Meeting, which took place on November 30th, 2016, OPEC actually agreed to a specific allocation of the curtailment. A production curtailment was exactly the right thing for OPEC to attempt and is clearly in the economic best interest of OPEC's members. Since the meeting, crude oil has climbed to nearly $53. An OPEC production cut of about 4% has resulted in a lift in crude pricing of roughly 10%, clearly a positive economic outcome for OPEC members if it holds.

- However, OPEC members have historically "tended to cheat" when given quotas for production. According to the Financial Times, parties to any such agreement will inevitably cheat on their production allocation (Financial Times, 2016). Former Saudi-oil minister Ali Al-Naimi confirmed this at an event in Washington at the beginning of December (Forbes, 2016).

- The simple facts are that at these prices, a number of OPEC members are in desperate straits for cash and literally can't pay their bills. Note that Saudi just floated a $17.5B bond offering, because they need the money (Wall Street Journal, 2016). Venezuela is dead flat broke (CCC credit rating-second lowest rating among all rated countries) to the point of insurrection (Bloomberg, 2016).

World Oil Supply & Demand Effects Based on November OPEC Meeting

Brexit update

- Our Brexit update is also mixed in terms of its implications for our industry. We originally said that Brexit stood to adversely impact the GDP of the UK, the world's fifth-largest economy, and to strengthen the US dollar, which is inversely related to movements in crude pricing. Clearly the strength of the dollar has played out as expected, with considerable additional lift resulting from the US election. This is a strong headwind for crude pricing that looks as though it has legs, perhaps for some number of years. Brexit's impact on the UK GDP is a more nuanced topic.

- Various pundits have observed that the other shoe for GDP has not yet dropped; implying that perhaps it won't drop at all. This is easily explained. British exports have been robust exactly because the GBP hit a 31-year low in October of 2016 of $1.18 (CNN, 2016), making UK goods substantially cheaper on world markets (Wall Street Journal, 2016). Exports have surged and this growth has stabilized UK GDP for now (The Telegraph, 2016). When Leave is actually negotiated between the UK and the EU, clearly the exit will have penalty clauses which will include trade tariffs. A virtual certainty is that the UK will no longer participate in the EU as part of the member free market system. Any tariffs set by the EU will erode the current UK export price advantage. A simple way to contemplate this is to reflect on which UK exports a user might be willing to pay a 20%+ premium to continue to buy post-Leave. Jaguar or Range Rover? No thanks. If and when the UK export volume tanks, so will their GDP. The UK's exports of goods and services has hovered around 30% of GDP for the past five years (UK Office for National Statistics, 2016).

- Prime Minister May actually said on several occasions that she intended to concentrate on immigration issues more than the trade issues in the exit negotiations. If one wanted to concoct the scenario that is likely to do the maximum damage to the overall UK economy, this is probably it. Fortunately for the UK, Parliament has asserted their privilege to be involved in the exit negotiations, which was upheld by the High Court on November 3rd, 2016 (The Independent, 2016). A Supreme Court judge, Lady Brenda Hale, has suggested that even a "simple Act of Parliament" would not be sufficient to trigger Brexit, potentially delaying the move for two years (Merrick, Theresa May dealt fresh blow as Supreme Court judge signals major delay on starting Brexit, 2016). The Supreme Court threw a further hurdle in the way when it ruled that Scottish and Welsh governments can intervene in the triggering of Article 50 on November 18th, 2016 (Merrick, Brexit: Fresh blow for Theresa May as Supreme Court rules Scotland and Wales can intervene in Article 50 triggering, 2016).

- Also fortunately, someone has apparently warned May of the potential economic storm that is brewing and the Prime Minister has expressed support for cuts in the corporate tax rate and attendant economic stimulation as a partial mitigation against the likely Brexit-driven economic decline.

Tax cuts in the US and the UK

- Theresa May "officially endorsed a move by Britain's previous Conservative government to lower the main corporate tax rate to 17% by 2020, from today's 20%" (Wall Street Journal, 2016).

- She "stopped short of endorsing her predecessor's further recommendation—made after the Brexit vote—to go down to 15%" (Wall Street Journal, 2016).

- Assuming that the UK goes forward with Leave, it is very likely to have a meaningful adverse impact, conceivably disastrous, on the economy of the UK with collateral damage to the EU. The ripple effect of this could be more severe than anyone presently anticipates. We note in passing that the UK Central Bank owns 13% of the ECB (Europa, 2016), which may be the last safety net for Greece and perhaps for several other EU "have-not" members.

Ripple effects and OECD forecasts

- The procedures and goals outlined by May would put the country on a timetable to exit "not just from the EU, but from the preferential terms of access to EU markets on which investors, both foreign and domestic, rely" (Financial Times, 2016). While the EU currently takes almost half of the UK's exports, the UK will "not be deemed a credible negotiating partner until its EU deal is finalized. By March 2019, then, the UK is likely to find itself without preferential access to any EU markets" (Financial Times, 2016).

- The United States is the largest single investor in Britain, and many firms consider it the gateway to free trade with the EU-28. Brexit would be "bad for the UK, it would be bad for Europe, it would be bad for the world, including the United States," Angel Gurría, secretary general of the OECD, said in a recent interview (Washington Post, 2016).

- In September, the OECD downgraded the UK economy's 2017 GDP forecast by 1% (from 3% to 2%) (Sky News, 2016), and held it at 2% in their November 28th update (OECD, 2016). Other pundits have forecast an actual drop in UK GDP rather than merely a decline in the GDP growth rate.

- As a result, OECD's forecast for the combined GDP of its 36 members – most of which are developed economies – has decreased to 1.7% for year-end 2016 (down from 2.2% for CY 2015) (OECD, 2016).

Possible "Frexit"

- France is the next big western democracy with a presidential election pending. The country's presidential election is upcoming in May.

- Marine Le Pen is running on a platform appealing to voter concerns over immigration and globalization. She advocates radical measures including "an exit from the EU, a tightening of asylum criteria, and a ban on the wearing of the Islamic veil in all public places." (Financial Times, 2016).

- Le Pen's election now begins to seem more plausible after Trump's win in the US. In a statement on November 9th, she is quoted as saying: "This election should be interpreted as the victory of freedom. Let's bet that it will give another reason for the French, who cherish freedom so much, to break with a system that hampers them." (Financial Times, 2016).

Conclusion

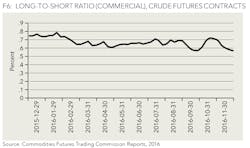

For the reasons outlined, it is hard to see a meaningful improvement in crude pricing or in the health of the industry in the next few years. In fact, it is hard to rationalize any degree of upward slope of the crude futures curve with the currently known facts. Note that the crude futures curve flattened considerably since early November as the market came to this realization. (See Figure 6.) Having said that, absent a global economic cataclysm, all gluts burn off. Prices eventually revert to the mean and life goes on. The crude futures chart tends to reflect this, even if the reasons are not always well understood at the time. We are hopeful for the economies of the US and the world post-election. It is incontestable, although not universally acknowledged, that capitalism works and that socialism does not. The US political landscape now appears to favor the side of capitalism again. Having said that, there does not seem to be a compelling reason to play the crude trade on the long side at present.

In fact, the risk-reward ratio may favor the hedge-sell side of the trade based on the supply overhang, Brexit complexities and their potential for disaster, and the new world economic order that was just launched by the US election, with a currently raging US dollar as an unintended consequence.

ABOUT THE AUTHOR

J. Michael Issa is the managing principal of the Irvine, Calif. office of GlassRatner Advisory & Capital Group LLC. He is a former banker, a CPA (inactive), a FINRA licensee, and a court-appointed fiduciary for corporate bankruptcies in the Central District of California. Issa is an authority on oil and gas matters, having worked on dozens of transactions, including both capital formation and workouts, in his multi-decade career. His clients have included E&P companies, service companies, and refineries. Issa is currently functioning as chief restructuring officer for several oil and gas service companies. GlassRatner's headquarters are in Atlanta, Ga., with offices in a number of major US cities.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, opinions or positions of GlassRatner Advisory & Capital Group LLC or Oil & Gas Financial Journal.