Majors are on the move and boosting global deal making

ANDREW DITTMAR, PLS INC., HOUSTON

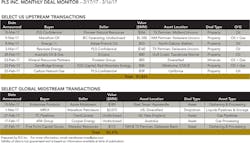

PLS Inc. reports that upstream deal activity spread beyond US shale plays as some of the industry's largest players cautiously look to return to growth mode after two years of deep cost cutting. On one Thursday morning, March 9, a remarkable $15 billion in upstream deals were announced across the US, Canada, and Africa. Global expansion of the deal markets reflects active portfolio repositioning in light of the new oil and gas price paradigm.

Canadian Natural Resources alone accounted for nearly $10 billion in acquisitions on March 9, mostly by acquiring Shell's interest in the Athabasca Oil Sands Project and assorted other oil sands assets for $8.5 billion. CNRL additionally teamed up with Shell to acquire Marathon Oil's stake in Athabasca on a 50/50 basis for $1.25 billion each. Once the dust settles from both deals, CNRL will hold a 70% operated stake in Athabasca while Shell will have sold down to 10% and walk away with $7.25 billion toward its $30 billion global divestment goal.

Oil sands deal making has mostly been driven by large Canadian companies buying out non-Canadian partners. During 2016, Athabasca Oil bought Statoil's interest in Alberta thermal oil assets for $444 million, and Suncor acquired Murphy's stake in the Syncrude project for $742 million. While lacking the flexible growth profile delivered by today's hot shale plays, oil sands projects do look likely to provide substantial free cash flow in coming years. CNRL and Suncor, the two largest oil sands producers, are expected to generate $7.9 billion of free cash flow in 2018, according to The Wall Street Journal citing analysts polled by FactSet. With a combined market cap of $90 billion, this represents a free cash flow yield of 8.8%. Both CNRL and Marathon saw a nice bump on their share price from the deal.

Marathon's stock jump could also be attributed to its acquisition in the hottest shale play of all. Concurrent with the oil sands sale, the company announced the $1.1 billion acquisition of assets in the Delaware Basin from BC Operating and other sellers. Marathon picked up 51,500 net acres in the Delaware portion Lea and Eddy counties, New Mexico, for just over $18,000/acre. The price is close to what Exxon paid for acreage in its $5.6 billion acquisition of the Bass family's companies. The acreage is also near, and in many parts offsets, the position that EOG acquired in its $2.5 billion Yates acquisition last September. At press time, Marathon executed a $700 million expansion deal with PE-backed Black Mountain Oil & Gas for acreage that lies nicely within the BC deal and provides scale to its New Mexico portion of the Delaware Basin.

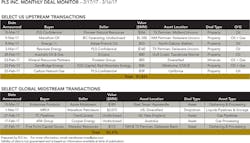

Exxon also participated in the March 9, $15 billion deal bonanza, acquiring a 25% indirect interest in Area 4 offshore Mozambique for $2.8 billion from Eni. The massive gas find in the Rovuma Basin is estimated to contain 85 Tcf. Exxon's interest will be held through Eni East Africa (70% and operator), which is also co-owned by Eni and CNPC. Portugal's IOC Galp Energia (10%), Korea NOC Kogas (10%) and Mozambique NOC ENH (10%) have direct interests in the project.

Rather than attempting a massive corporate merger as has been occasionally rumored, Exxon has made use of the downturn by individually picking up the global assets it wants. Since mid-2016, Exxon has spent over $10 billion to expand a Permian portfolio (Bass) and add gas assets for LNG development in Africa (Eni) and Papua New Guinea (InterOil acquisition).

Recent international upstream deal activity has also included assets in Russia, the Middle East, and West Africa. OMV acquired Uniper's 25% participating interest in a giant Siberian gas field for $1.85 billion. The Western Siberian field came online in 2009 and is operated by a JV between Gazprom and Wintershall. On the oil side, China Energy Company secured a stake in the ADCO concession onshore Abu Dhabi for $888 million. It joins fellow Chinese company CNPC along with Western majors BP and Total among other partners.

The largest recent oilfield services deal is also internationally focused, with John Wood Group acquiring Amec Foster Wheeler for nearly $4 billion. The London-based firm is focused on engineering and consulting across the energy space along with projects in mining, power generation and infrastructure. In the US oilfield service sector, companies are gearing up to capitalize on an increasingly robust market for frac sand. In the drive to provide local, high-quality 100 mesh sand, Hi Crush Partners bought the Permian Basin Sand Company, a former privately owned four-wheel drive park located within 75 miles of the Permian Basin, for $275 million. This works out to metrics of $5/ton for the raw resource and interestingly nearly $225,000 per acre.