What's new for goodwill measurement?

There are positives and downsides of the new FASB amendments

KEVIN CANNON, OPPORTUNE LLP, HOUSTON

In January 2017, the Financial Accounting Standards Board (FASB) issued amendments to its Accounting Standards Codification Topic 350, Intangibles: Goodwill and Other (ASC 350). ASC 350 describes the procedures to be taken to test goodwill (the excess of consideration paid for a business above the fair value of its identified tangible and intangible assets and liabilities) for impairment subsequent to its initial acquisition. The objective of these amendments to ASC 350 is to simplify the process of testing goodwill for impairment.

Companies with goodwill on their balance sheets will want to understand the evolution of goodwill impairment testing over time, the changes that the new amendments to ASC 350 will bring, and the potential impacts these changes will have for companies in the energy industry.

GOODWILL IMPAIRMENT TESTING: A TIMELINE OF CHANGES

In June 2001, the FASB issued Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets (SFAS 142), which ended the practice of amortizing goodwill (over 40 years, previously) and subsequently required companies to test goodwill for impairment at least annually, or as triggering events dictate, to determine if an impairment loss exists.

SFAS 142 also set forth a two-step test for measuring goodwill impairment. Step 1 compares the estimated fair value of a reporting unit with its carrying value, including goodwill, typically at the equity level. If the carrying value exceeds fair value, Step 2 is performed, in which the implied fair value of goodwill is compared with the goodwill's carrying value. The implied fair value of goodwill under Step 2 is estimated by allocating the fair value of a reporting unit to all its assets and liabilities (measured at fair value), similar to a purchase price allocation. The excess of the fair value of a reporting unit over the amounts assigned to its assets and liabilities under Step 2 equals the implied fair value of goodwill. SFAS 142 was superseded in July 2009 by ASC 350, which retained the two-step goodwill measurement process.

Many companies found that the cost and effort of this two-step process led to undue complexities and inefficiencies. In September 2011, the FASB moved toward simplifying the goodwill testing process when it released an amendment to ASC 350, allowing for a qualitative assessment to effectively bypass the Step 1 analysis. Commonly referred to as "Step 0", this update allows an entity the option to estimate whether it is more likely than not (a greater than 50% likelihood) that the entity's fair value is less than its carrying value. Qualitative factors include general macroeconomic conditions, industry and market conditions, and the reporting unit's overall financial performance.

January 2014 initiated an even more substantial effort at simplifying goodwill testing. At that time, the FASB amended ASC 350 to allow privately-owned companies the option of amortizing goodwill over a period not to exceed 10 years. Further, when a triggering event occurs, a private entity exercising this option of measuring goodwill may first apply a qualitative "Step 0" test to determine whether the quantitative impairment test is necessary. If that assessment indicates that it is more likely than not that goodwill is impaired, the entity must then perform the quantitative test to compare the reporting unit's fair value with its carrying amount, including goodwill. Under this option the goodwill impairment loss, if any, represents the excess of the carrying amount of the reporting unit over its fair value. The goodwill impairment loss cannot exceed the reporting unit's carrying amount of goodwill. (See timeline in Fig. 1.)

2017 AMENDMENTS TO ASC 350

In a move to further simplify goodwill impairment testing in January 2017, the FASB eliminated Step 2 from ASC 350 for all private and public business entities on a prospective basis. Under the amendments, an entity would perform its annual or trigger event-based goodwill impairment test comparing the fair value of a reporting unit with its carrying amount in the same manner under Step 1, whereby entities will recognize an impairment charge for the amount by which the reporting unit's carrying amount exceeds its fair value, limited by the amount of goodwill allocated to that reporting unit. The "Step 0" qualitative assessment option will remain available to determine if the quantitative impairment test is necessary. The FASB has stated that it will evaluate the effectiveness of these new amendments before it considers implementing additional changes, which may include allowing the amortization of goodwill.

Effective dates for these amendments, as published by the FASB, are shown in Table 1.

Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017.

POTENTIAL IMPACTS TO THE ENERGY INDUSTRY

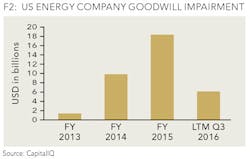

As a result of these recent changes to ASC 350, private and public companies will no longer perform Step 2 of the goodwill impairment test. For the energy industry, goodwill impairment is a topic that has received much greater focus in recent years. As shown in Fig. 2, the incidence of goodwill impairment has increased significantly among US-based, energy-focused companies with market capitalization of $100 million or greater, in tandem with the downturn in commodity prices that began in mid-2014.

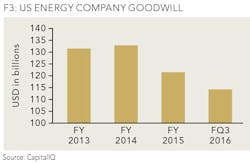

Yet, despite these historically high levels of goodwill impairment, significant goodwill balances remain on the books of energy-focused companies. Fig. 3 shows total goodwill on the balance sheets of US-based energy related companies with market capitalization of $100 million or greater over the past four years.

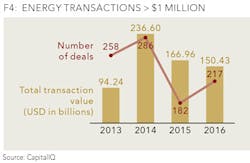

As Figs. 2 and 3 indicate, US-based energy companies impaired approximately $35 billion of goodwill from the beginning of 2014 through Q3 of 2016. However, the aggregate goodwill balance of these companies only declined by approximately $17 billion over this same timeframe. This means nearly $18 billion of goodwill has been created via transaction activity since the onset of the energy industry downturn. Fig. 4 shows the trend of US-based energy transaction activity and volume since 2013 (deal size of greater than $1 million) which has given rise to this goodwill.

Continued high levels of goodwill on the balance sheets of energy companies, in particular, those in the midstream sector, coupled with an increasing level of deal activity, means energy companies will need to sharpen their focus on properly accounting for and measuring goodwill. We can also expect a continued focus by auditors and regulators on defensible, supportable, and properly-estimated valuations that are used for the quantitative goodwill impairment test.

Positives of the new ASC 350 amendments include, most significantly, lower cost and complexity related to Step 2, which should simplify the process of goodwill impairment testing. However, a possible downside of the new amendments is the potential for greater variability in earnings. Under ASC 350 Step 2, the fair value of tangible and intangible assets (other than goodwill) in some instances may have limited the amount of goodwill impairment.

Under the new standard, a Step 1 impairment will result in a write down of goodwill equal to the excess of the carrying value of the reporting unit over its fair value. As a result, this could cause some companies to experience greater volatility in earnings.

ABOUT THE AUTHOR

Kevin Cannon is a director in Opportune LLP's valuation practice, based in Houston. He has 12 years of experience performing business and asset valuations and providing corporate finance consulting. His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, and tax planning purposes with a focus on oil and gas and oilfield services.