Learnings from the oil and gas downturn

What it means for technology adoption

PRANAV PATEL AND SUNIL JOSE, NORTH HIGHLAND, HOUSTON

WHAT DOESN'T KILL YOU makes you stronger. Organizations surviving the recent downturn in crude oil prices have found creative ways to streamline operations and improve efficiencies within all areas. At the center of this uptick in efficiency is technology and the capacity to effectively adopt it throughout the business. The ability to identify, assess, implement, integrate, and operate new technologies into an organization is not only critical to maintaining profitability through rough economic stretches, but also positions a company in better standing versus competitors as the climate turns more favorable.

Sometimes it takes looking at an issue from a different vantage point to understand the full context. While many segments of the oil and gas value chain do not intersect with the retail or healthcare industries, there is still something that can be learned from these other sectors by noting the strides made in developing and incorporating technology into standard practices.

Retailers are increasingly investing in security, mobility, and big data analytics to better understand their customers and provide the services they need at a more rapid pace than the competition. This requires integration with multiple platforms including specialized business tools and enterprise resource platforms. With the adoption of any new technology, multiple business processes may be affected and need to be re-engineered to optimize overall performance. While arduous at times, the resulting value has been an improved understanding of consumer needs and the ability to engage customers from multiple fronts.

Historically, healthcare has been portrayed as a service not willing to heavily invest in marketing or improve patient interactions beyond performing tests and medical procedures. More recently, the healthcare industry has put a substantial focus on using technology to enhance patient experiences. Demographic changes and new entrants into the market have caused some healthcare facilities to rethink the way they engage customers from the point of searching for a provider through follow-up visits. Technology involving mobility, more efficient scheduling, and virtual and telehealth follow-up consultation capabilities, along with improved patient communication, has been successfully implemented to increase the number of patients seen and reduce redundant administrative work and procedures that eat at margins.

Heavy investments in data analytics have helped many financial institutions better predict and manage their risk, understand threats, and better define their own risk appetites. Financial services has touchpoints across all industries and thus minor mistakes can have a greater impact. Executives in the sector are leading the buildout of highly structured and agile project management processes that encourage reaching fast and effective decisions. In many cases, the key to harnessing digital power is not the technology itself, but how well the management of selecting, sourcing, implementing, and developing a support structure for the solution is executed.

Noting trends in other industries helps to illustrate the fact that even sectors with strong performance and stable customer bases are seeing the advantages of staying ahead of their competitors by actively incorporating new technology solutions. Businesses that not only keep up with the technology curve, but surpass it through internal innovation and by testing and learning new approaches, are setting themselves up for success.

Despite these comparisons to other industries, Oil & Gas (O&G) has come a long way in terms of acceptance and adoption of new technologies. Traditionally O&G and the adoption of new digital solutions mixed as well as oil and water, but as the world has become more technologically connected, the O&G industry has been forced to pay attention. For decades, significant volumes of data and learning have been gleaned from the reservoir to the drilling rig to the refinery, but it is commonly believed that a significant amount of that data is never used in a meaningful way. As leaders become aware of the data gold mine at their fingertips and feel rising pressure from the effects of lower oil prices on their bottom line, the industry is beginning to see its own future through a digital lens.

The recently completed Baker Hughes and GE Oil & Gas (BHGE) merger clearly illustrates this change in industry perceptions. Perusing through the BHGE website you will find phrases such as "data driven productivity," "merging the digital and the physical worlds," and "from kilobit to kilowatt," peppered throughout the communications. One of the overarching value drivers for the merger is predicated on the company's bullish view on the future of digital technology across the O&G value chain.

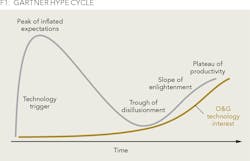

One useful way to understand the current state of the industry's views of technology is to plot the rise of O&G technology interest against the Gartner Hype Cycle (Figure 1). Technology driven companies such as Amazon or Google tend to stay on the left side of the curve and attempt to bring their customers along for the ride along the curve. O&G companies take a more conservative view on new technologies by understanding case studies from early adopters and watching the outcome as the adopters get out of the "Trough of Disillusionment" and into the "Slope of Enlightenment." As they witness this journey, O&G companies begin to assemble use cases and develop plans for pilots to test out the various hypotheses that may exist for the prospective technology.

This seemingly conservative journey through the hype cycle is primarily related to the complex nature of O&G operations as well as the crucial safety requirements that surround the industry. Technologies such as real-time process management and operations monitoring have been prevalent in the shipping, nuclear, and aviation sectors for years, but satellite and fiber telecommunication limitations, rig-side personal and equipment safety requirements, and the constant evolution of operational parameters and working conditions have necessitated a longer adoption curve. Today, as some of these barriers are addressed, real-time operations have become the standard for driving safe and efficient operations. Sensors automatically track data from various inputs and this real-time information helps inform current decisions as well as supports the building of models that help predict issues before they occur. With many of the existing use cases for digital technology focused on one aspect of the value chain, companies are beginning to explore the opportunities of digitally connecting all aspects of the value chain to drive exponential benefit and efficiencies.

The dip in the price of oil over the last two years has forced the O&G industry to take a long look at technology as the potential answer to improved margins. Nowhere is this more evident than in the upstream, onshore unconventional shale plays in the United States. Unconventional plays have increased in popularity over the last 10 years primarily due to the emergence of fracking technology, the repeatable nature of well construction steps in a formation, and the ease of ramping up or ramping down well construction based on economic and market drivers. In contrast, conventional plays are characterized by multi-year development timeframes, a small footprint of development, and heavy capital outlay. To unlock the potential of unconventional plays operators must create a repeatable, high velocity well construction process that allows them to evaluate, fund, develop, and produce from hundreds of wells concurrently across hundreds of thousands of acres in a relatively short timeframe.

Digital technology is the backbone for the future of unconventional well construction processes and will continue to impact other aspects of the O&G lifecycle for years to come. The benefits of digital technology adoption in O&G extend beyond upstream and are already impacting midstream and downstream players as well. Let's look at how a prominent liquefaction operation leveraged digital technology to improve employee efficiency. In collecting engineering specifications and operational procedures for the company's critical emergency response projects, maintenance, and facility upgrades, technicians were spending an inordinate amount of time searching for relevant project documentation in multiple sources that existed across the enterprise. The lack of a single, accurate source of truth for these critical documents prompted the company to commission a project to digitize and consolidate decades of paperwork that would be searchable using sophisticated document analysis technology. While the technology was the critical centerpiece in cleaning up the documentation issues, it certainly was not the only factor for a successful project. Just as in most technology adoption efforts, while the software utility was able to scan, categorize, and identify conflicts in documentation based on pre-configured algorithms, the people and processes surrounding the technology needed an overhaul if they were to truly succeed. Specifically, the company had to focus on training users and software administrators, integration to existing document management systems and ensuring that the requisite software infrastructure was architected and supported correctly.

The result was a new project document management system for maintenance and facility upgrades that allowed for document traceability and facilitated efficient search. Applying this new system to the most critical projects resulted in a projected savings of $1 million annually. Table 1 shows an example breakdown of resource hours used per work order to determine the loss in technician productivity. Note that the size of an operation has an exponential effect on the cost of searching for documents. The one-time project costs are typically recovered by the end of year one.

Beyond the savings related to technician productivity, this system created other benefits that combated productivity loss events such as equipment downtime, contractor contingency charges for high risk environments, costs related to recreating necessary documents, safety incidents, and fines due to compliance or audit failures.

While the case for being open to technological innovation is not a new concept, the current environment proves that simply engaging in the discussion is not enough. Organizations need to be able to adopt and efficiently integrate new technologies if they want to survive into the next generation. Building competency and strategy around this area can help transform a company at all levels.

ABOUT THE AUTHORS

Pranav Patel is a management consultant with the North Highland Company. He has experience leading technology-driven projects across the upstream and downstream segments of the Oil & Gas value chain including the areas of data management, business intelligence, and IT infrastructure. Patel holds an MBA from The University of Houston and an undergraduate degree in Electrical Engineering from The University of Texas.

Sunil Jose is a management consultant with the North Highland Company. Jose has multiple years of digital technology and operational experience in all aspects of the Oil & Gas value chain with specific focus on real-time drilling and production technologies. Prior to working at North Highland, he led the product management efforts of the digital oilfield division for a major oilfield service company. Sunil holds an MBA from The University of Houston and an undergraduate degree in Biomedical Engineering from Texas A&M University.