Independent research firm IHS Markit has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

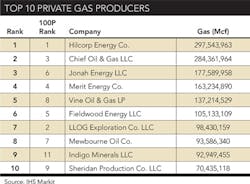

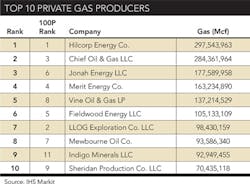

There isn't much movement to report in terms of the Top 10 private gas producers and Top 10 liquids producers lists when comparing the numbers to the April 2017 installment of the OGFJ100P. Vine Oil & Gas LP, again ranked No. 8 overall by barrels of oil equivalent (BOE), swapped places with Merit Energy Co. (ranked No. 4 overall by BOE) in the private gas producers list from No. 4 to No. 5. Sheridan Production Co. LLC jumped into the Top 10 private gas producers list for this installment, coming in at No. 10 and ranked No. 9 overall by BOE. Samson Investment was pushed out of the Top 10 gas producers list. The company held the No. 10 seat in April.

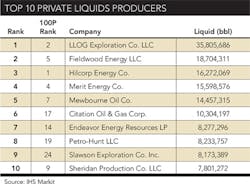

The theme was the same for the Top 10 private liquids producers where the only change was a flip-flop in the No. 7 and No. 9 spots from April, where, in this issue, Endeavor Energy Resources LP (ranked No. 14 by overall BOE) came in at No. 7 and Slawson Exploration Co. Inc. (ranked No. 24 by overall BOE) took the No. 9 spot.

M&A

We did see movement in the mergers and acquisitions space by private companies. Close to press time for this issue, Encana announced the sale of its Piceance assets for $735 million to privately-held Caerus Oil and Gas LLC.

Denver, CO-based Caerus sits at No. 31 by overall BOE in this installment, down slightly from its No. 29 spot in April. With the deal, Caerus gains 550,000 net acres and approximately 253 million cubic feet equivalent per day (MMcfe/d) of production (95% gas) and approximately 3,100 operated wells. With an implied sale price of approximately $2,900 per flowing MMcfe/d according to its calculations, Jefferies analysts say the price falls "in line with recent Marcellus asset sales (APC, NBL)" noting that a simultaneous midstream commitment reduction of $430 million likely impacted the sale price. Overall, the deal "brought forward value of an asset in which [Encana] was not investing" to fund other core projects. Caerus calls the Piceance a core area of focus for the company, and, according to its website, holds assets including over 800 producing wells and over 2,000 future drilling locations in the area.

The sale is subject to satisfaction of normal closing conditions, approvals, closing and other adjustments and is expected to be completed during the third quarter. BMO Capital Markets served as Encana's financial advisor for the transaction.

On May 31, 2017, Jonah Energy LLC closed on its acquisition of natural gas and oil producing properties in the Jonah and Pinedale fields and surrounding area from LINN Energy Inc. The contract price closed at $581.5 million and after customary closing adjustments and transaction costs, LINN Energy received net cash proceeds of approximately $561 million.

Under the terms of the agreement, Jonah acquires LINN's interests in over 1,200 producing wells and 27,000 net acres, of which more than 80% is currently undeveloped. More than half of the acquired wells are operated by Jonah Energy.

The acquired assets averaged over 150 MMcfe/d of net production in 2016. Pro forma for the transaction, Jonah Energy will produce over 450 MMcfe/d net from over 2,100 producing wells across over 145,000 net acres within Wyoming's Jonah and Pinedale fields and adjacent Normally Pressured Lance (NPL) area.

The transaction will be financed with a combination of equity from Jonah Energy's existing investor group and borrowings under its credit facility. In connection with closing, Jonah Energy upsized its revolving credit facility from a borrowing base of $825 million to $1.125 billion, and also raised additional equity capital from its existing investor group.

The Denver, CO-based company expects to begin development activity on the acquired assets during the second half of 2017, with three rigs planned by early 2018. The company also expects full year 2017 EBITDA from the assets to exceed $100 million as production growth replaces historical declines.

Evercore Group LLC served as Jonah's financial advisor for the transaction, and Vinson & Elkins LLP served as the company's legal advisor.

Created in the spring of 2014, Jonah Energy holds a top spot in the US-based private company list, coming in at No. 6 by overall BOE and at No. 3 in the Top 10 list of private gas producers. The company's investor group is led by TPG Capital LLC and includes EIG Global Energy Partners and management.

Prior to the acquisition, Jonah Energy appointed Patrick Welch as vice president and CFO, effective April 10. Welch previously served as executive vice president and CFO of JP Energy Partners through its merger with American Midstream Partners. He has also held CFO roles with Atlantic Power Corp. and a privately-held renewable energy company, and provided consulting services to various upstream and midstream energy companies. He holds a bachelor's degree in business administration from the University of Central Oklahoma, and is a Certified Public Accountant.

Another privately-held company on the buy side is Hilcorp Energy Co. As OGFJ's April issue went to press with the previous OGFJ100P listing, an affiliate of the Houston, TX-based company, ranked No. 1 by overall BOE, reached an agreement with ConocoPhillips to acquire interests in the San Juan Basin. The deal calls for total proceeds up to $3.0 billion, comprised of $2.7 billion in cash and a contingent payment of up to $300 million.

The cash portion of the proceeds is subject to customary closing adjustments. The contingent payment is effective beginning Jan. 1, 2018 and has a term of six years.

Full-year 2016 production associated with the San Juan Basin assets was 124 thousand barrels of oil equivalent per day, of which approximately 80% was natural gas. Cash provided by operating activities for 2016 was approximately $0.2 billion. Year-end 2016 proved reserves were 0.6 billion barrels of oil equivalent.

As of Dec. 31, 2016, the net book value of the assets was approximately $5.9 billion, which includes approximately $2.8 billion of step-up basis associated with the Burlington acquisition in 2006. The company expects to record a non-cash impairment on the assets in the second quarter of 2017. The transaction is subject to specific conditions precedent being satisfied, including regulatory approval, and is expected to close in the third quarter of 2017.

As PLS reported in the May issue of OGFJ, "the properties cover 1.3 million acres primarily in northern New Mexico with over 12,000 wells averaging 744 MMcfe/d during 2016. Privately held Hilcorp has largely eschewed unconventional assets following the successful sale of its Eagle Ford JV with KKR to Marathon for $3.5 billion in 2011. Instead, the company has focused on low-decline, conventional assets in Alaska, on the Gulf Coast, in Wyoming and in the Northeast to build a leading production profile among private companies including operating more gas production than any other private company."

On May 9, privately-held Bold Energy III LLC completed a business combination with Earthstone Energy Inc. Last fall, following the deal's approval by members of Bold on November 7, 2016, Seaport Global Securities broke down the deal from Earthstone's perspective, noting that, "applying a $40K/flowing boe multiple on existing production of ~2,320 boepd (~63% oil), and based on ESTE's 11/7 closing price of $8.98, we estimate the deal shakes out to ~$11K/acre," a "steal," they noted, compared to other Midland Basin deals priced north of $30K/acre. Bold contributes over 20.9K net acres in the area, primarily in Reagan County, in exchange for 36.1 million shares of Earthstone.

The combined company noted an increase in its borrowing base under its revolving credit facility to $150 million. Utilization currently consists of approximately $70 million of indebtedness. The facility matures on May 9, 2022. The combined company currently has approximately $10 million of cash on hand.

Later in the month, privately-held White Knight Production I LLC noted the closing of its combination with TXON-SCZ LLC, both portfolio companies of private equity firm Bayou City Energy.

After giving effect to the combination, White Knight controls more than 30,000 held-by-production net acres divided between the Fort Worth Basin of Texas and the San Joaquin Basin of California.

Capital

Finally, one equity commitment to note, Valorem Energy LLC received a $300 million investment from Kayne Private Energy Income Fund and members of the management team.

The Oklahoma City, OK-based oil and natural gas company was formed in 2017 to deploy over $1 billion of capital to acquire and operate large, producing onshore US oil and gas assets, with an emphasis on the Rockies and Mid-Continent. Valorem is led by CEO Justin Cope and COO Heath Mireles, former executives with Continental Resources.

Location

Tyler, Texas-based Mewbourne Oil Company opened a new regional headquarters for operations in Southeast New Mexico's Permian Basin. Founded in 1965 by Curtis Mewbourne, the company comes in at No.7 by overall BOE.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.