Gas deals grab headlines as crude prices waiver

ANDREW DITTMAR, PLS INC., HOUSTON

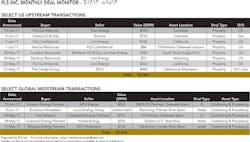

PLS INC. REPORTS that after being largely overshadowed by a land rush in the Permian during the last year, gas deals have staged a major resurgence and recently account for the majority of the largest upstream transactions. Remarkably, the four largest deals of Q2 as of the time of this article are for gas producing assets, along with all three Q2 deals that broke the billion dollar mark. This is a complete turnaround from Q1 when only one gas deal cracked the top 10 and then only in tenth place. Gas deals seemed due to capture more market share after a period of outsized dominance by the Permian. In addition, there may be fewer oil deals currently being struck given renewed uncertainty on crude prices.

The low-cost Marcellus is unsurprisingly the most active area for gas deals by a comfortable margin. Activity there was already robust during 2016, including a couple of billion plus deals. However, even the largest 2016 Marcellus deal (Rice Energy's $2.7 billion acquisition of Vantage) pales in comparison to Rice itself agreeing to be bought out by EQT for $8.2 billion including net debt. That deal sets a new record for US upstream transactions since the downturn began in earnest in late 2014 and is the third largest US upstream deal of the decade (trailing only the acquisitions of Plains E&P and PetroHawk for $16 billion and $15 billion, respectively).

EQT is launching itself into position as the largest domestic gas producer with pro-forma Q4 2016 output of 3.0 Bcfe/d, just ahead of ExxonMobil. The company is also getting over 250,000 net acres, the majority of which fits into EQT's current Marcellus development plans, along with cash flow generating pipelines and an interest in Rice's midstream MLP.

After backing out the value of production and the midstream components, PLS values the leasehold at just over $9,000/acre. While that is a full (and fair) valuation of the assets based on average Marcellus deal comparables, the acquisition has potential to create substantial value for EQT moving forward. EQT now expects to be able to develop many of its Marcellus locations with 12,000 ft. instead of 8,000 ft. laterals and boost returns from 52% to 70% based on $3.00 NYMEX gas. In a call discussing the transaction, EQT's CEO Steve Schlotterbeck outlined a transition to a new version of shale development. Instead of pursuing breakneck growth, going forward his company will focus on a measured pace of drilling while staying within cash flow and returning value to shareholders.

The efficiencies and scale from the merger help make those goals far more achievable. Some shareholders were already calling for consolidation, including recommendations from a hedge fund for EQT to merge with one of its competitors. With the recent exception of EQT, the idea has yet to take hold in the shale patch. The Marcellus is still largely fragmented with operations by Antero, Range, and Cabot, among others. Public Permian drillers potentially have even more to gain from consolidation. According to data published by Bloomberg, the top 10 most active operators in the Delaware and Midland basins run only 53% and 55% of rigs, respectively. This fragmentation helps drive the Permian's current fierce competition for acreage and escalating competition for services.

Quality gas assets outside of the major shale plays are also finding buyers, with Encana striking a deal to sell its Piceance Basin assets in Colorado to Caerus Oil & Gas for $735 million. The assets have long-life, stable production of 250 MMcfe/d and YE16 proved reserves of 814 Bcfe. Caerus, which is backed by Oaktree Capital and Anschutz Investment Co., joins fellow private companies Hilcorp (San Juan Basin) and Jonah Energy (Green River Basin) as a buyer of Rocky Mountain gas fields. In contrast with hot shale plays, these assets are generally acquired for the value of production with upside from optimizing fields and potential increases in prices down the road.

On the midstream side, buyers are still highly focused on the hottest (or they hope soon to be hottest) upstream areas. Increasing volumes in the Delaware Basin make it about as safe a bet as energy markets provide, and a number of buyers are looking to capitalize on future demand there. Howard Energy Partners is one example, inking a JV with WPX Energy that will see a consortium of capital providers invest $432 million in cash and carry to build out midstream infrastructure. Taking a slightly riskier approach (with the potential to be an early mover), midstream companies are also increasing bets on the Powder River Basin. After falling sharply during the downturn, upstream activity has been picking up there again with some operators reporting extremely impressive wells.

In the oilfield services sector, companies are also looking at consolidation to help drive future profitability. Offshore driller Ensco is acquiring Atwood Oceanics for $1.7 billion and adding nine existing offshore drilling units plus two ultra-deepwater drill ships under construction to its fleet.