Lifelines

US producers boost oil hedges to backstop accelerated capital investment

TOM BIRACREE FOR RBN ENERGY

EDITOR'S NOTE: This article was originally published on RBNEnergy.com on May 7, 2017, as part of the Daily Blog and is reprinted with permission.

AFTER REDUCING CAPITAL expenditures by 70% in 2014-16, US exploration and production companies (E&Ps) have collectively taken their foot off the brake and stomped on the gas, boosting 2017 capital outlays by an impressive 42% to kick-start production growth. At first glance, the move may seem somewhat reckless. After all, E&Ps just weathered a crisis caused by plunging oil prices partially through impressive capital discipline, and the price for benchmark West Texas Intermediate (WTI) crude oil has once again drifted below $50/bbl over concern that US output may be rising too fast. But as we've learned from a new report by our friends at Bloomberg Intelligence (BI), most major US oil producers paired their increased investment with significant oil-price protection, aggressively snapping up hedges in late 2016 as oil prices were buoyed by the announcement of planned OPEC output cuts. Today we review BI's examination of the efforts by many E&Ps to lock in $50/bbl-plus prices for much of their 2017 production.

The surge in hedging activity by US E&Ps is another indicator of an ongoing transformation of the E&P sector that we analyzed in depth in Piranha!, a new market study of 43 representative US E&Ps. Of that universe of companies, 21 focus on oil (60%+ liquids reserves), nine are gas-weighted producers (60%+ natural gas reserves) and 13 are diversified producers. All major US shale/unconventional plays are represented in the combined portfolios of these firms. In a previous blog, Very Particular Places to Go, we discussed the purpose and organization of our analysis, which included an examination of the strategies that E&Ps are adopting to thrive in a $50/bbl world; a look at merger and acquisition (M&A) activity by basin; and a review of each company's financial condition, capex plans, geographic focus, M&A strategies and a general assessment of the company's position in today's US E&P industry.

Then, in the blog Jump!, we took an initial look at the 2017 capital spending plans of the three peer groups of E&Ps-oil-weighted, gas-weighted, and diversified. We took a deep dive into the oil-weighted peer group in the blog Higher Ground, considered the gas-weighted group in the blog Let It Grow, and zeroed in on the diversified E&Ps in the blog Reinvent the Wheel.

Now, thanks to a great new offering from Bloomberg Intelligence (based on research by BI's Matt Hagerty and Peter Pulikkan), we can add another perspective on the financial effect of the E&P's 2017 investment plans by looking at the resurgence in oil hedging. First, a little background on hedging for those not steeped in this tool many oil producers use for "price insurance." Producers constantly weigh the certainty of locking in a price for future production, which protects against price drops, with the risk of giving away substantial revenue or paying out "floor" options premiums if prices rise. The percentage of volumes hedged tends to decline when the outlook for rising oil prices is strong, such as the "peak oil" period in 2006-08, and when declining future curves make locking in attractively high prices difficult, such as the period from late 2014 to early 2016. Price protection becomes much more attractive when oil prices are threatened on the downside and investment is increasing-like now.

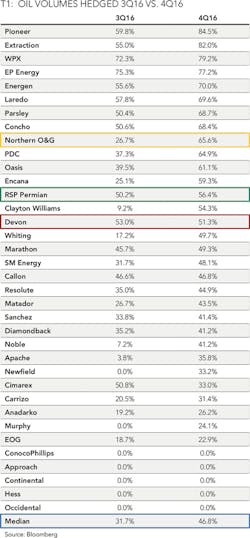

Year-end 2016 data reviewed by Hagerty and Pulikkan shows that many US oil producers stampeded into the hedging market in the fourth quarter of last year, when the announcement of OPEC production rollbacks drove WTI oil prices from about $48/bbl in early October 2016 to nearly $55/bbl in late December. As shown in Table 1, the median percentage of 2017 oil production hedged by 37 significant US oil producers examined in the Bloomberg report soared from 31.7% at the end of the third quarter of 2016 to 46.8% at year-end 2016 (blue rectangle at bottom). Thirty-two of the 37 E&Ps had 2017 hedges in place as this year started, with 15 of those protecting more than half of their projected output and 29 companies protecting at least one-quarter of production.

All but two E&Ps (Clayton Williams and Newfield Exploration being the exceptions) either increased the hedged portion of their production during the fourth quarter or held steady at 0% hedged, according to the Bloomberg report. Those that increased their percentages of hedged production the most include Northern Oil & Gas (gold rectangle), RSP Permian (green rectangle) and Devon Energy (red rectangle).

The percentage of output hedged is even higher in the Permian Basin, where RBN Energy's Piranha! study showed 32% of total US capital spending has been allocated. A dozen Permian-focused E&P companies have protected fully 64% of their 2017 output, the highest percentage of any region.

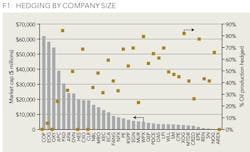

Risk tolerance varies widely from company to company. Historically, the largest and financially strongest companies have put in place no or minimal hedging, while smaller producers have been much more aggressive in protecting future revenues. This trend is reflected in the year-end 2016 data in Figure 1, in which the market capitalization of 37 E&Ps is shown by the gray bars (left axis) and the percentage of the companies' 2017 production that is hedged is shown by the gold squares (right axis) directly above each company's three- or four-letter stock symbol.

Five of the 10 largest E&Ps (by market cap) -ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Hess Corp. (HES) and Continental Resources (CLR) -have none or very little of their 2017 production hedged. However, seven of the 10 were unhedged at the end of the third quarter of 2016, and two others had less than 20% of their output protected. In the fourth quarter of 2016, Apache Corp. (APA) and Anadarko Petroleum (APC) moved from no hedges to 33% and 24% production protected, respectively, while Noble Energy's (NBL) hedging percentage jumped from 4% to 36%.

The obvious outlier among the largest E&Ps is Pioneer Natural Resources (PXD), which has the largest acreage position of any E&P in the Permian's Midland Basin. While our universe of E&Ps was cutting capital expenditures by an average 51% from 2015 to 2016, Pioneer maintained relatively level investment, which drove a 14% production increase. To support that investment, the company had nearly 60% of output hedged going into the fourth quarter of 2016, then boosted that to 84% by the end of last year-the highest in our group-to support a 27% increase in 2017 investment to generate a 17% output increase.

In line with the historical trend, 16 of the 19 smallest companies had 40% or more of their 2017 production hedged by the end of 2016. Some smaller E&Ps had substantial hedges in place prior to the price rise in the fourth quarter of 2016; for example, the percentage of production protected at the end of the third quarter was 75.3% for EP Energy (EPE) and 72.3% for WPX Energy (WPX). The most dramatic increases were RSP Permian (RSPP; 9% to 54%), Northern Oil & Gas (NOG, 27% to 66%) and Oasis Petroleum (OAS, 40% to 61%). The outlier in this group is the small Permian producer Approach Resources (AREX, to the far right), which took a very different strategy after renegotiating part of its substantial debt. This producer hedged 85% and 50% of its 2017 natural gas and NGL production, respectively, while aiming for higher returns from totally unhedged oil output. It remains to be seen how this strategy works out.

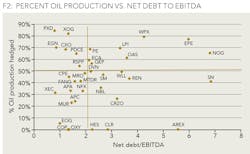

Approach Resources' strategy is not only different for a company of its small size, but also for a company with high leverage. Bloomberg compared the percentage of oil production hedged with the net debt-to-equity ratios for the 37 companies in our group, as shown in Figure 2.

It's no surprise that one-third of the companies in the bottom-left quadrant, which have net debt-to-equity ratios of below 2X, have relatively lower levels of hedge protection. Their strong balance sheets provide a cushion against price volatility.

All of the companies in the upper left quadrant, which have more than 50% of output protected despite solid balance sheets, produce from the Permian Basin, which is receiving the highest level of capital investment in 2017. They want to protect against lower oil realizations, which would erode or erase the profit margin from the production growth they are expecting to generate. As you might expect, the vast majority of the companies with higher debt-to-equity ratios (to the right of the vertical gold line) are relatively well-hedged. These producers can least afford taking on additional debt to fund a significant gap between spending and cash flow should prices drop. Again, the exception is Approach Resources, the strategy of which we discussed previously.

A second major issue to discuss in analyzing oil hedging, beyond the percentage of production protected, is the average strike price of the transactions. In this regard, this new period of renewed hedging activity is very different from those bygone days of $100/bbl crude oil prices. Now, the futures curves are largely flat, so the average futures price from now to December 2022 is $49.60/bbl (May 5's close). The good news, as we explain in our Piranha! study, is that many E&P companies operating in the right geographies can generate healthy returns at that price level after narrowing their focus to core areas of the most productive resource plays and taking advantage of lower service costs and rising drilling efficiencies. Two-thirds of 2017 E&P capital investment is allocated to just five plays: the Permian, Eagle Ford, SCOOP/STACK, Marcellus, and Bakken. Drilling and completion and lease operating expenses (LOEs-see RBN Energy's LOE-down series) have fallen more than 50% since year-end 2014 in these plays. As a result, most E&Ps have been able to balance spending and cash flow; in 2016, the median company investment exceeded cash flow by just 5%. The increase in 2017 hedging protection will help protect producers and allow them to fund their higher capital investment to drive production growth.

It is unclear, however, if this protection will be available in 2018 and beyond. Only 21 of the 37 companies our friends at Bloomberg examined currently have any 2018 oil hedges in place, and those average less than 10% of expected output. Negligible production is protected in 2019 and 2020. The ability to strike acceptable hedge deals in future years will depend on the future global supply demand balance. We'll continue to keep an eye on E&P investment trends and hedging activity.

If you have a Bloomberg terminal, check out Bloomberg BI's new report that provides the source data for this blog. It is a customized, granular look into the hedging strategies of the 37 largest US E&P companies.

ABOUT THE AUTHOR

Tom Biracree is currently a director at Oil and Gas Financial Analytics LLC. He was Senior Principle Editor at John S. Herold Inc., then IHS Inc., for 15 years. He led the senior editorial team for IHS Energy Insight research and was responsible for structuring and content editing valuation and transaction research. Biracree wrote the Herold Oil Headliner, a daily newsletter aimed at senior industry and financial executives. He was co-author of the Global Upstream M&A Review and contributed to the Global Upstream Performance Review. He can be reached at [email protected].