North American shale taking over the world?

FUJUN WU, STANDARD LIFE INVESTMENTS

THE GROWTH of US shale has an important effect on global oil supply and hence the profitability of large parts of the industry.

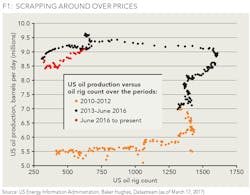

There is never a dull moment in the oil market. From 2003 to 2008, oil markets went through the age of resource scarcity when demand was driven upward by Chinese growth, and supply was constrained by underinvestment and contracting OPEC spare capacity. In June 2008, these conditions drove oil prices to $140 per barrel. Shortly thereafter the global financial crisis brought demand and prices crashing down. As the economy recovered in 2009, the US shale oil industry started blossoming. The rig count grew from 876 in June 2009 to 1,931 in November 2014, and US oil production nearly doubled from 5.1 million barrels per day (MMb/d) in January 2009 to 9.5 MMb/d in December 2014. US shale has been a game changer for the US oil industry and turned the US into a crucial player in global oil supply. Pad drilling, longer laterals, and increased intensity led to better well productivity and lower cost per barrel for US shale producers.

Increasing US importance in global oil

US shale has become the world's swing producer because it sits lower on the cost curve and has a shorter lead time than other global producers (six to eight months versus three years). For these reasons, US exploration and production (E&P) companies are becoming more important in global oil supply and will provide significant production growth. Within US shale, the Permian Basin has been at the forefront of the revolution. In fact, Rystad Energy stated that the US could now hold more oil reserves than Saudi Arabia due to the potential resources in the Wolfcamp area of the Permian Basin; estimates suggest more than 150 recoverable billion barrels of oil equivalent remain.

Indeed, from a cost curve perspective, the Permian Basin was the only US major shale formation to see production growth since the downturn began in November 2014. We continue to expect strong growth out of the Permian Basin, from around 2 MMb/d today to some 4 MMb/d in 2019. As a result, we are increasingly positive on US E&P companies.

For this reason, we hold CXO, which owns considerable acreage in the Delaware Basin. One prominent Permian-focused E&P company commented that despite significant gains in well productivity we are "still in the early days" of productivity gains (see Figure 1). For example, most E&P companies are just beginning to use predicative analytics and artificial intelligence across their operations.

battle between OPEC cuts and the North American ramp up

The outlook for oil prices is constructive due to a tightening supply and demand balance in the near term. This tightening is driven both by strong demand and slower growth in supply. On the demand side, reporting agencies revised their global demand growth estimates upwards, expecting an increase of 1.6 MMb/d in 2016 and 1.4 MMb/d in 2017.

On the supply side, there is a battle between how accurately OPEC complies with its cuts and the magnitude and speed of the US shale recovery. As of this writing, OPEC compliance has come in between 90-100%. The Energy Information Administration (EIA) estimated US production was 8.9 MMb/d in 2016 and forecasts it to grow to 9.2 MMb/d in 2017. We believe US production will be greater than EIA's estimate, as the EIA underestimates improvements in shale productivity.

In addition, weak investment internationally paints a bullish picture in the medium term - most international production today is depleting reserves without reserve replacement, creating a hole in production that could emerge by 2018. In the long term, prices may be range-bound around $55-$65 per barrel given the ample runway of low cost US shale.

In our US equities portfolio, we own E&P companies EOG and CXO. We also own Halliburton.

ABOUT THE AUTHOR

Funjun Wu serves as senior vice president, US equities, at Standard Life Investments. She joined the firm from Goldman Sachs Asset Management and holds a bachelor's degree and an MBA from Wharton, University of Pennsylvania.