Beyond the short term

Discoveries and their impact on oil prices 10 years down the road

SONA MLADA, RYSTAD ENERGY

AS THE OIL INDUSTRY ENTERED into the oil price crisis, operators were forced to re-think their future budgets. One of the affected areas was investments dedicated to new exploration. As a result, lower volumes of oil have been discovered every year since the oil price downturn began. This lack of discovered resources might have a significant impact on the oil price in the long term, as it may transform into a supply deficit some 10 years down the road.

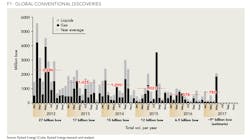

During 2016, the total average discovered conventional resources per month were merely 580 MMboe (liquids and gas combined). This is the all-time low volume of discovered resources since the 1940s. As Figure 1 indicates, since 2012, the total volume of discovered conventional resources demonstrated a declining trend year over year; towards 2016, the total discovered resources declined by 30% per year, on average.

At the same time, as the figure indicates, the discoveries during 2015 and 2016 were more gas prone compared to the previous years. In fact, in 2016, the average liquids content of the discovered resources was merely ~40%.

Two thousand and seventeen has started at slow pace similar to 2016. The mediocre results of the first four months averaged at ~425 MMboe of newly discovered resources monthly. However, May 2017 “saved the day” with the large deepwater gas discovery, Yakaar, offshore Senegal. In fact, May 2017 was the best month since August 2015 in terms of discovered conventional volumes.

Below is an overview of the most significant discoveries since the oil price collapse in November 2014:

• Zohr – Zohr is a supergiant gas field discovered in August 2015, located in the deep waters of the Mediterranean Sea offshore Egypt, operated by Eni. Given the size of the field, Zohr could potentially change the geopolitical situation in the region.

• Greater Tortue area – This area is located in the ultra-deep waters offshore Mauritania and Senegal. In early 2015, Kosmos drilled its first exploration well offshore Mauritania resulting in the largest gas discovery offshore Africa. Over the following year, four additional exploration and appraisal wells were drilled across the fairway, stretching 80 km north and 80 km south from the maritime border between Mauritania and Senegal. In December 2016, Kosmos Energy entered into a partnership with BP, which assumed named operatorship and acquired a 62% working interest in Kosmos’ licenses covering blocks C6, C8, C12, and C13.

• Liza – The largest oil field discovered since the oil price downturn, Lisa’s Liza-1 exploration well was completed in May 2015 in the ultra-deep waters offshore Guyana. Appraisal wells Liza-2 and Liza-3 have been completed successfully, showing positive results; Liza-4 is expected to be completed in July 2017. The Liza discovery is operated by ExxonMobil.

• Katambi – Operated by BP, Katambi is a gas-condensate discovery made in April 2016 in the deep waters offshore Angola, in Block 24.

Why is it important to focus on discoveries? Even though a lot of attention is paid to the short-term imbalances between oil supply and demand as they influence the current oil prices, in the long term, the supply from discoveries will be the key to meet the global demand.

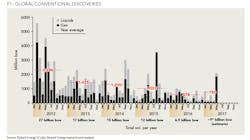

By 2027, the global conventional supply of oil and gas has the potential to reach as high as 143 million barrels of oil equivalent daily. As Figure 2 indicates, approximately 66% of this supply comes from fields that are currently producing (depicted in black in Figure 2), while the gold portion represents the projects that have already been sanctioned. We can consider these volumes as “secure,” given the fact that the operators are committed by their final investment decision (FID). By 2027, approximately 10% of the global conventional supply will be represented by the sanctioned projects.

However, it is the potential future supply from discoveries (depicted in green in Figure 2) that will decide whether the future supply of oil and gas will remain flat going forward. This will depend both on the investment decisions of the operators of the already discovered fields, as well as future new finds going forward. Towards 2027, the total supply from discoveries could reach as high 32 million boe/d and represent approximately 22% of the total global conventional supply. Only half of this potential supply has a breakeven price (BEP) below 55 USD/boe, meaning a higher oil price will be required for many of the discoveries to be developed in the future.

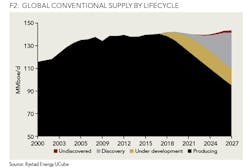

In the past five years, we have witnessed a declining trend of global exploration investments (Expex), as observed in Figure 3. The total Expex reached approximately 130 billion USD in 2013, driven primarily by Brazil and the United States (principally the Gulf of Mexico). The total Expex has been declining year over year, reaching as low as 50 billion USD by 2016 (an average yearly decline of 27% year over year since 2013). In 2017, we expect the global Expex to decline by a further 12%, falling close to 40 billion USD.

About 70% of the global Expex is directed to offshore drilling, split relatively evenly among shelf, deepwater, and ultra-deepwater exploration.

A lack of exploration capex could represent a threat to the discovered volumes in the coming years as it adds fuel to the vicious circle. In the past couple of years, the total discovered volumes were at all-time low levels, which lead to disappointment and an unwillingness to invest in exploration by operators. The operators revised down Expex budgets downward, resulting in fewer exploration wells to be drilled, which will eventually lead to even lower discovered resources in the near future. The impact of these “missing volumes” will not be immediate, as discoveries have a relatively long lead-time. It could take roughly 5-10 years for a discovery to come on-stream, depending on the discovery’s location (onshore or offshore), its size, water depth, required facility, and proximity to infrastructure, among other factors.

On the positive side, however, there are still numerous prospects that could hold billions of boe that are expected to be drilled in the near future. An overview of these prospects is shown in Figure 4.

According to our analyses, there are some 1.4 trillion boe of undiscovered conventional resources globally. The key to unlocking these resources lies in continuous exploration and appraising activities by the E&P industry. Otherwise, we may witness the global conventional oil and gas supply start to decline post 2027.

ABOUT THE AUTHOR

Sona Mlada is a senior analyst at Rystad Energy. Her main responsibility is the analysis of upstream E&P activities in North America, with a specific focus on shale asset modeling. She is the project manager for the monthly North American Shale Report, published by Rystad Energy. In addition, she is responsible for analyzing the global discoveries and estimating the recoverable resources. Sona holds a degree from the University of Economics in Bratislava, Slovakia, including a graduate exchange program at Universidad de Granada, Spain.