Industry must respond to challenges

To compete and thrive, energy executives must address a myriad of difficult issues

NILOUFAR MOLAVI, PWC, HOUSTON

Over the past 20 years, CEOs have witnessed tremendous upheavals as a result of globalization and technological change, where greater convergence has come with greater divergence. The last two decades have seen trade flows quadruple, an exponential rise in global online traffic with tech giants connecting more people across borders than ever before, and a new middle class emerge as more than a billion people have been lifted out of extreme poverty worldwide. However, the other side of this tech-driven, global reality has also seen inequality among classes of wealth and poverty rise, growing mistrust in business, increasing social instability and an ever-changing political landscape.

In particular, the technological advancements in the oil and gas industry, such as horizontal drilling and hydraulic fracturing, completely reshaped the onshore industry, bringing about the shale boom, and later, a supply glut that contributed to a crash in oil prices. Today, as executive leadership looks around the corner at the next five to ten years, preparing for what lies ahead will require the aid of a new lens; one that factors in both the opportunities and challenges of exponential technological innovations and globalization.

PwC's 20th Annual CEO Survey interviewed 83 oil and gas CEOs from 39 countries to find out what keeps them up at night and where they see opportunities to grow in the new globalized economy. The results revealed that CEOs are standing at the crossroads of competing in an age of divergence, managing man and machine, gaining from connectivity without losing trust, and figuring out how to make globalization work for them.

THREATS TO GROWTH PROSPECTS

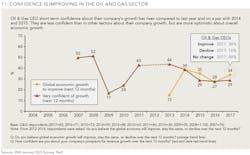

Across industries, CEO short-term confidence in global economic growth and in their companies' own revenue growth prospects, has risen over the last year, and is on par with confidence felt in 2014 and 2015, according to the survey results. This indicates that uncertainty has become a way of life, as sentiments changed little despite the downturn in late 2014.

In the oil and gas industry, CEO short-term confidence reflects the broader upward-trending results, but they are less confident than in other sectors about their companies' growth, yet more optimistic about overall economic growth. The duration of 2017 will continue to be a challenging year for the oil and gas industry, but operators should make the most of this time by optimizing portfolios and getting back to core competencies, while others should focus on re-emerging from bankruptcy and improving profitability. See Figure 1.

As leadership examines the economic, political, social, and environmental threats to their organizations' growth, the survey also found that concerns about the speed of technological change, changing consumer behavior, cyber threats, and lack of trust in business saw the greatest rise over the last two decades.

SPEED OF TECHNOLOGICAL CHANGE

The top concern keeping oil and gas executives up at night is not surprising considering the high value placed on driving down costs in a lower for longer price environment. The crash in oil prices may have sparked a renewed importance in digital technology to automate more processes and maximize production outputs, but executives must also be mindful of cyber threats to proprietary data and customer information, adequate training of employees on new digitized processes, and optimal times to perform equipment maintenance and conduct safety checks.

While keeping pace with the new digital reality can be challenging, the advancement of this technology in the oil and gas industry will no doubt continue to create opportunities for more automation and better insights on efficiency and productivity from data and analytics, making operations in a depressed market more economical and profitable.

CHANGING CONSUMER BEHAVIOR

The global push to reduce emissions and bring on more renewable energy to the generation mix has put increased pressure on oil and gas companies to highlight how they fit into a more environmentally-conscious world, keep fuel costs competitive with renewables, and boost trade and infrastructure investments in regions of the world that still lack basic electricity or demand more energy. Balancing profitability with competitiveness and sustainable natural resources development will continue to be top of mind for oil and gas executives, especially as public trust in business declines.

GROWTH OPPORTUNITIES

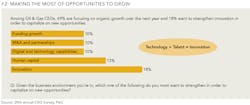

Among oil and gas CEOs, 69% are focusing on organic growth over the next year, and 18% most want to strengthen innovation in order to capitalize on new opportunities. As innovation is driven by a combination of talent and technology, it's no surprise that the second and third highest focuses after innovation were human capital and digital and technology capabilities. See Figure 2.

While technology is a key catalyst for innovation, 64% of oil and gas CEOs are also worried about key skills shortages. Despite 52% of all interviewed CEOs indicating they intend to increase headcount this year, less than half of oil and gas CEOs plan to do so. For many, 2017 will continue to be a challenging year. Although we will see some headcount increases, they will be very strategic and opportunistic. With the introduction of new technologies and automation, the talent needed will look different, and that is something most oil and gas companies are still trying to understand. Finally, companies will continue to be faced with low morale after a couple of tough years, so they will need to focus on how they can address those issues with their existing talent.

It will not be enough for companies to automate and incorporate new technology to keep competitive market shares and profit margins. Investments in innovation must also align to the important problems at the core of the business's purpose, and factor in agility and resilience against the backdrop of a low-growth global economy. This means companies must be willing to divest unremarkable, or underperforming business sectors, and focus instead on portfolio optimization, and where they are exceptional and drive the most value.

Leadership will also need to redesign business processes so that employees are best placed to work seamlessly with automation and create new value. They must consider artificial intelligence and automation as a means towards a better competitive advantage, yet realize that key skills such as leadership, creativity and adaptability will be required from talent in order to innovate and build brand differentiation. As cybersecurity risks increase, oil and gas CEOs must also consider how the technology they're investing in today will affect how their stakeholders trust them tomorrow, how they plan to protect proprietary, employee, or customer data from theft, loss or misuse, and what protocols need to be in place for when systems go down.

As the economic and geopolitical winds shift, CEOs must also evaluate global tax strategies to consider the impacts of public and government views on tax obligations. They must balance the need to compete with local and national priorities, collaborating more with government entities and regulators to expedite system change.

Exemplifying the survey results, one CEO from Austria commented during a deep-dive interview, "In the context of globalizing the business, I do think that the economic aspects will also convince politicians that we should go more for free trade. It is a huge opportunity for all of us. Interconnecting the world also on an economic basis."

These sentiments and survey results confirm that a better understanding of global dynamics will be necessary for executives to better plan for the future-including re-evaluating tax strategies, hiring new talent, and digitizing and upgrading systems to the cloud.

CONCLUSION

As oil and gas executives plan for growth in the coming years, careful consideration of how globalization and continued digital innovations will impact business opportunities should be made. From competing in an age of divergence, to balancing man and machine, to gaining trust from greater connectivity, CEOs must take an active role in addressing and leading the challenges that plague the industry today to ensure their companies are positioned for growth tomorrow.

ABOUT THE AUTHOR

Niloufar Molavi serves as PwC's Global and US Energy Leader, leading a practice comprised of over 6,000 professionals serving Global energy clients in the oil and gas industry and is responsible for all client services - assurance, advisory and tax. She previously served as the Market Managing Partner for the geographic markets of Houston, Tulsa, Oklahoma City and New Orleans. Prior to that she served as the energy leader within PwC's Tax practice and as the firm's US Chief Diversity Officer. With 25 years of tax experience with PwC, Niloufar has served a wide range of energy companies both in the US and abroad, advising clients on international and US tax structuring, mergers, acquisitions and potential public offerings.