Oilfield services

Private equity looking for deals

RAUL CORAL, KYLE WEST, ROB MCCENEY, MILE MILISAVLJEVIC, PWC, HOUSTON

FROM 2008 to 2014, and particularly between 2011 and 2014, private equity funds invested heavily in the oilfield services sector. However, since oil prices collapsed in late 2014, few private equities have monetized investments. Now, many of these companies remain in private equity (PE) portfolios and are aging past the normal investment holding period.

PwC's proprietary research identified over 210 oilfield service companies with a collective valuation of up to $10 billion that may be looking for new owners over the next 12-24 months. Private equity owners face a market where bids don't match the returns on investment they seek, largely because of the spread between oil prices when companies were purchased ($90/bbl) and where they are today (below $50/bbl).

As owners seek to monetize their investments while preserving acceptable returns, they have four options, in declining levels of attractiveness to the seller: successful trade sales, IPOs, recapitalizations, and selling at a loss. Although strategic investors are looking for deal opportunities, there are few targets in PE portfolios with the synergies to justify the transaction value. Similarly, many financial buyers are not finding deals with valuations that can produce a good return. If current market conditions persist, we expect M&A activity with respect to PE investing in oilfield services to remain slow overall in the near term. However, certain sub-sectors of the OFS space may present short-term value creating opportunities (e.g. fracturing equipment).

Private capital invested heavily in oilfield service companies

After the financial crisis and Great Recession of 2008 pushed crude oil prices down by two-thirds, the US oil industry went through a growth cycle propelled by horizontal drilling and hydraulic fracturing that added millions of barrels of daily production from unconventional formations. Oil prices went from the $50 per barrel range in 2009 to over $100 for about 30 months prior to collapsing in 2014 (see Figure 1). Oil prices have stabilized around $50 per barrel this year and there are not strong supply or demand indicators that can point to further price increases.

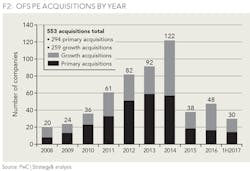

According to PwC's research and analysis, private equity firms made over 550 acquisitions across the oilfield services sector since 2008. These include over 290 platform acquisitions and nearly 260 growth or bolt-on acquisitions that acted as rollups to support growth.

Private equity firms were especially active in the oilfield services sector during 2011-2014. Many were trying to ride the price run-up and rapid innovations in drilling that boosted production from shale formations. About 75% of the current PE company inventory was acquired between 2011 and 2014 when oil prices averaged $90 per barrel.

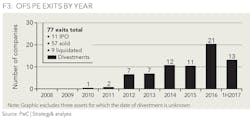

The global oil supply glut and price collapse of 2014 caught oil markets by surprise, drying up deal flow in North American oilfield service companies. M&A and IPO activity came to a halt and it has been gridlocked since 2015. Poor market conditions in 2014 through the first half of 2017 have largely prevented private equity firms from exiting their investments.

Of the nearly 550 acquisitions in the space between 2008 and 2Q2017, only 77 were exited and 259 were rolled into other platform companies, leaving 217 platform companies still held by the owner. We estimate these platform companies represent over $10 billion in enterprise value.

These 217 oilfield service companies left in PE portfolios have been held an average of four years as of 2Q2017, in the middle of the desired three-to-five- year holding period. Additionally, many of the oilfield service companies are approaching debt maturity dates at a time when credit markets have turned less favorable.

While these factors underscore the desire for an exit, these companies are unlikely to fetch prices that generate the returns seen in private equity investments made prior to the price run-up of 2011-2014, principally because the prevailing price of oil at the time was $90 per barrel compared to the current sub $50 per barrel environment.

Seeking a 'Goldilocks' exit: Not too soon, not too late

Some owners are in a better position to hold onto their acquisitions because of the funds' size, which can offer some diversification. Our data shows that about 50% of the oilfield service companies in private equity hands belong to large funds, defined as assets exceeding $1 billion, or mega funds, defined as assets exceeding $20 billion. This type of owner provides a safety net of resources, diversification, and potentially more patience on the part of the limited partners.

About 64% of the company group we studied is owned by a diversified or industrial fund. Poor performance in oilfield service companies can be offset from other investments, granting more time for currently challenged oilfield service investments.

About two thirds of the companies held by private equity funds have new drilling activity as their primary driver for growth. Across North America, rig counts have risen continuously through the first half of 2017, increasing about 50% over their June 2016 level. Firms relying on new drilling activity have seen their values rise during the first half of 2017. If the "slow but steady" growth trend in operating rigs continues for the remainder of 2017, PE companies will likely be in a better position for an IPO, and they should be well rewarded for their patience.

When readying an IPO, timing is everything. About 60% of the privately held oilfield service companies are in the well services or drilling and consumables segments. Private equity sponsors have a strong incentive to wait for continued improvement in market conditions to enhance their returns.

But even the most patient capital has its limits. Most assets have been in the portfolio for about four years, meaning the end of the typical holding period is drawing near. While pressure to exit is building, we think owners could be better rewarded if they can hold on and wait for market conditions to improve.

Options for private equity firms to monetize their holdings

Private equity owners have three ways to profitably monetize their oilfield service assets - trade sale, IPO, or recapitalization. A fourth option, selling at a loss, while not desirable, is also possible.

Whatever its form, a successful transaction will require recalibrated expectations of the private equity returns in the OFS space. The years of 40% annual gains are a thing of the past.

Here are the broad options available to private sponsors looking to exit oilfield services:

Trade sale

Trade sale to a strategic or a financial sponsor, in the past, has been the most profitable options to consider. Since we are still observing a large bid-ask spread between buyer and seller expectations, however, we don't foresee a lot of trade sales over the next 12-24 months. However, in some select situations, there is still some opportunities for mutually beneficial transactions.

Strategic buyers can strengthen their portfolio of services by acquiring niche players that can scale up quickly. We see the artificial lift and asset integrity sub-segments as attractive spaces to a number of strategic and financial buyers. Alternatively, a company may have developed distinctive intellectual property in a critical area, such as in directional drilling, completions tools, or subsea well interventions which merits consideration by another operator. Potential strategic buyers will be seeking acquisitions to enhance their portfolios and create compelling revenue and cost synergies, which would benefit the current private equity owners.

Overall, though, we expect trade sales to be far less common than IPOs and recaps. There are only a handful of PE-owned oilfield service companies that have either the size, right niche, or distinctive intellectual property to get their asking price through a trade sale. And while we have not seen foreign capital rushing into oil services, private sponsors should consider foreign investors as a potential partner or exit option.

IPOs

In our client work, we have seen an uptick in owners using a dual-track exit strategy: simultaneously exploring IPOs and trade sales.

During 1Q2017, IPOs were the more profitable and desired outcome for private equity firms. Our work with clients, prior research, and news reports, suggest a high volume of deals may be forthcoming over the next 12-24 months if market conditions permit. Oil price volatility during 2Q2017, has slowed down IPO plans. An IPO's success depends on market confidence, realistic valuation, strong storytelling, and transaction execution.

Many of the OFS PE portfolio companies lack sufficient scale to access public markets in an IPO. Some firms are clamoring to reach scale by buying up unrelated businesses. Our view, however, is that IPO candidates should have a compelling value proposition and growth strategy. Simply combining unrelated businesses in an effort to reach the minimum size for an IPO won't be successful in the long run. We believe that capital markets may be offering a better return as they can take a longer-term view on oilfield services.

Recapitalizations

If the market does not support an IPO at a profit, extending the holding period of the investment may be a firm's second-best option. Finding partners to spread the equity risk as well as to improve debt terms can give companies in a bind more time and flexibility. In this option, oilfield service companies may stay in private equity portfolios for five to seven years if owners succeed at finding firms willing to invest patient capital.

Recapitalizations also open a window for credit specialists to profit from buying debt positions in distressed assets. The market has seen recapitalization deals where an energy fund receives an infusion of capital from a distressed investment fund. In some cases, both equity and debt funds can be owned by the same firm.

There are other alternatives. For example, large private funds holding on troubled companies can recapitalize the investment by swapping their bonds for equity and use their resources and expertise to turn the troubled company around.

Selling at a loss

There will be a number of private sponsors that will just have to settle for with smaller than expected returns, or selling at an outright loss. Funds in this unenviable position tend to be smaller funds lacking energy industry expertise, some of whom bought at the top of the market. Oilfield service companies in commoditized market segments with limited scale are especially vulnerable. We see a good number of these players across the well services and consumables sub-segments.

Oilfield service corporate players and private equities looking to capitalize on this potential buying opportunity should consider smaller funds with limited depth in energy services. We think they are more likely to sell first.

Investing in oFS will get much harder

Although there is no shortage of PE capital to invest in energy, upstream oilfield service is unlikely to see a healthy rebound in M&A activity in the short term. Those PE investors looking to grow platforms in this space will have to look harder for good deals and invest in business development to find opportunities ahead of the pack and outside traditional auction processes.

Sourcing a deal will become a critical choke point. Companies with superior management, solid balance sheets and a record of lowering a driller's cost per barrel draw multiple bidders in competitive auctions, driving up the price and therefore, all else equal, lowering the acquirer's returns. We have observed competitive bidding processes where strong companies are awarded large premiums.

Going forward, we see organic growth, in-house technology development and operational improvements as taking center stage, as roll-ups and bolt-ons will be harder to come by.

Over the next 12-24 months, we also expect private equity investors will develop deeper subject-matter expertise in the various sub-segments of the oilfield service industry to stay ahead of competitors and pick winning investment strategies. To be successful, private equity shops will need a deeper bench of expertise across the deal continuum, starting with business development and deal sourcing, extending to deep diligence and deal execution, and concluding with operational improvements and distinctive commercial strategies to run their businesses.

ABOUT THE AUTHORS

Raul J. Coral serves as Director - Deals Strategy at PwC. Coral is a leader of the Houston Deals Strategy team where he serves financial and strategic investors across different questions on growth strategy, commercial diligence and M&A. He focuses on service and manufacturing oriented businesses working for upstream, midstream and downstream players. He has served as an advisor in both large and small M&A transactions in energy and industrials. Coral received his Bachelor and Master degrees in engineering from the Massachusetts Institute of Technology, and his MBA from Wharton at the University of Pennsylvania. He previously worked at McKinsey & Company, IHS, and Goldman Sachs.

Kyle West is a Director in the Transaction Services practice based in Houston. He specializes in financial, economic and accounting analyses involving complex business transactions. His experience includes a range of M&A issues including financial due diligence, value drivers, purchase agreement negotiation, and sell-side diligence. He transaction experience spans oilfield services, downstream, midstream, and upstream transactions. He received his Bachelor of Business Administration in Accountancy from the University of Notre Dame and his MBA from the University of Texas. He is also a Certified Public Accountant in Texas.

Rob McCeney is a Partner in the Transaction Services practice based in Houston. He specializes in providing acquisition services in the oil and gas industries and works closely with financial sponsors. McCeney leads buy and sell-side financial due diligence services, quality of reported earnings, and sell-side advisory services. He also has significant experience in cross-border transactions in the US, UK, Chile, and Canada, among others. He has worked in PwC's Santiago, Chile, and Seoul, South Korea offices. McCeney received a Bachelor of Science in Business Administration and is a Certified Public Accountant in New York, Texas, and Virginia.

Mile Milisavljevic is a Partner with Deals Strategy based in Houston and is the leader of Natural Resources Deals Strategy efforts in the US. Milisavljevic's expertise is in working with financial and strategic investors in driving transformative change through M&A. He has more than 10 years of strategy consulting experience across different industries. Milisavljevic received his PhD from the Georgia Institute of Technology and his MBA from Wharton at the University of Pennsylvania. Prior to joining PwC Deals Strategy, he was with Bain & Company.