Permian gas

Analysis focusing on key market drivers within the basin

JASON FERGUSON, RBN ENERGY

EDITOR'S NOTE: This article, introducing RBN Energy's NATGAS Permian Report, a weekly natural gas fundamentals analysis focusing on the key market drivers within the Permian basin, originally appeared on RBN.com on August 2 as part of the Daily Blog series. It has been edited and reprinted with permission.

THERE IS NO DOUBT that the epicenter of US associated natural gas production growth is the Permian, where dry gas output has increased from 3.5 Bcf/d in 2012 to more than 6.5 Bcf/d today. And there is a lot more where that came from. RBN's Growth Scenario indicates that as much as 12 Bcf/d of natural gas production could be surging out of the Permian by 2022, with less than 1 Bcf/d of that needed for local demand. All of that incremental production will need to move out of the region, either on existing or new pipelines. Permian gas is such a big deal that RBN has developed a weekly report (NATGAS Permian Report) focused specifically on the topic - how much is produced, where it is processed, its destination markets, how it is priced and, most importantly, how the Permian gas market will balance out, both today and in the coming months.

All things Permian - crude oil, associated natural gas, natural gas liquids (NGLs), takeaway capacity, etc. - have been an important focus of the RBN blogosphere for the past couple of years. And it is very likely that the Permian will continue to draw special attention - it's that big a deal. In recent months, we've issued two Drill Down Reports on the play, the first focusing on crude oil production growth and takeaway capacity and the second on natural gas. We've also looked at the challenges faced by Permian producers as they quickly ramp up production; at the increasing volume of Permian crude being exported out of Corpus Christi; at new gas pipeline hubs being developed to help move Permian gas to Mexico and other markets; and at the potential for constraints on NGL takeaway out of the Permian.

While the Permian may be the hottest drilling location in the US - if not North America and possibly the world - trying to decipher natural gas dynamics in the basin is far from straightforward. For starters, the area is huge, stretching across 70,000 square miles from east of Midland to near the Mexican border and over dozens of counties that most traders, analysts and developers have never heard of. The scale of natural gas infrastructure is daunting, with legacy gathering and processing systems built on top of each other over the past 60-plus years only complicated by recent new projects and a wave of others to be added over the next two years. The interstate pipeline system in the area most resembles a spaghetti bowl that might be untangled more quickly if not for the presence of the Texas intrastate pipelines, those denizens of the analyst world that are allowed to post no data at all and make up almost half of the Permian's gas takeaway infrastructure. Throw on top of this situation the buildout of export pipelines to Mexico, where data sources are harder to come by and almost always in Spanish, and you may find yourself searching for the Advil or your favorite tequila.

But not to worry, because we have just rolled out our latest market report, titled NATGAS Permian. The analytical foundation and models that underpin the report are based on RBN's extensive work over the past couple of years evaluating natural gas fundamentals in the Permian. The weekly report, issued before the market opens on Monday morning, provides the latest available data collected from a myriad of sources and organizes that data to highlight the key fundamental drivers affecting the natural gas market in the Permian. It also provides a projection of supply, demand and pricing for this critical natural gas region.

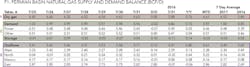

Current Permian market supply/demand balance

Before getting to our outlook and projections, we first look at the supply/demand balance in the Permian today, starting with just how much natural gas the basin is producing. Our estimate is included in the first row of Table A (#1 red circle and red rectangle in Figure 1), which is shown on the first page of the report. This table includes the most recent seven days of data, the month-to-date (MTD) average and the seven-day averages for 2017 and 2016. We arrive at our daily estimates using a model that integrates well-level data from the Texas Railroad Commission (TRRC) provided by our friends at Drillinginfo (DI) with pipeline flow data from Permian processing plant and gathering system flows published on the interstate pipelines' electronic bulletin boards (EBBs). We've taken special care to make sure all of our production flow points are really that and not, say, a compressor or Farmer John's local tap. At times this is no easy task, considering that some Permian processing plants bear extra-cryptic names such as IROCKDOV and IZORRO. If you were wondering, those are the points on the El Paso Natural Gas (EPNG) system for Enterprise Products Partners' South Eddy plant and EnLink's Lobo plant, respectively, but who would know it at first glance?

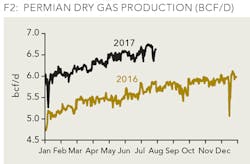

The result of our analysis is shown graphically in the report and in Figure 2. As of July 31, Permian production is up to 6.63 Bcf/d, which is higher by 13.5% over the same week last year, or an increase of about 800 MMcf/d. All of the increase in production must be either used or stored within the basin, or transported to markets on intrastate and interstate pipelines.

The second step (#2 green circle and green rectangle in Figure 1) of our supply/demand analysis involves estimating demand and storage injections/withdrawals within the Permian, both of which are usually relatively small numbers. We separate demand into two categories in this table: gas used for power generation and demand from all other markets. Permian gas can be stockpiled within several small storage fields, mostly operated by pipelines in the region. We estimate daily demand and storage injections/withdrawals using a combination of data gleaned from the EBBs, the US Department of Energy's (DOE) Energy Information Administration (EIA) and the TRRC.

After estimating demand and storage, we get to the third step of our process - the calculation of natural gas outflows segmented into four corridors: West, North, Mexico and East (#3 purple circle and purple rectangle in Figure 1. We estimate the amounts flowing in the West and North corridors primarily from the interstate pipeline EBBs. The other two corridors are tricky due to less data transparency. The Mexico corridor is estimated by using a combination of EIA export data and Mexico pipeline EBBs. Mexico recently began requiring pipelines within the country to post volumes to public websites similar to the EBBs that interstate pipelines post to on the US side of the border. IEnova, a subsidiary of Sempra Energy, recently developed EBBs for its two pipelines in Mexico that are receiving gas from the Permian (the San Isidro-Samalayuca Pipeline, which sources supply from Energy Transfer Partners' Comanche Trail Pipeline, and the Ojinaga-El Encino Pipeline, which is connected to Energy Transfer's Trans-Pecos Pipeline). Fermaca's Tarahumara Pipeline doesn't yet have an EBB, so we still estimate those flows from EIA monthly export data.

The East flow path is actually the least transparent, mostly because it involves a number of (data-free) intrastate pipelines flowing out of the Permian into interior regions of Texas. The flows in this corridor are calculated by subtracting demand, storage and the other outflows from dry gas production in the Permian. Note that about half of all outflows currently are moving East on intrastate pipelines to Texas markets (including Katy and the Houston Ship Channel), just over 40% is moving West on the El Paso and TransWestern systems, only about 6% is moving North and a tiny 3% is moving to Mexico. As we've noted previously, volumes moving to Mexico will be increasing significantly over the next couple of years.

Permian market supply/demand balance forecast

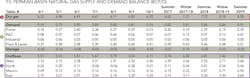

Having established the current state of affairs regarding Permian natural gas supply and demand drivers, we then move to the more interesting and infinitely more valuable piece of the fundamentals puzzle: forecasting where we see production, outflows, and prices heading through the end of 2019. In Table B in the report (See Figure 3. We show our monthly dry gas production forecast in the first line (#1 red circle and red rectangle). Table B includes monthly averages of actual data beginning in April of this year through the month preceding the current one. This table also provides projected monthly averages through October 2017 (current month plus the next two months) and then rolls up the other forecast months into seasons (inside the big gray-dashed rectangle to the right) - the summer months are April to October and the winter months are November through March.

Our production forecast is built using history, well counts and type curves from DI, combined with our view of well completions in the Permian through December 2019. We also forecast demand through the end of 2019 and summarize our forecasts in Table B, lines 2 through 6 (#2 green circle and green rectangle). Here we break out the "other" demand as shown in Table A into the following categories: residential and commercial (R&C), industrial, and plant and lease. Our forecasts of demand assume seasonal weather patterns and account for any new infrastructure (power plants, petrochemical plants, etc.) that would lead to base demand growth. Outflows (historical and projected) are shown next (#3 purple circle and purple rectangle).

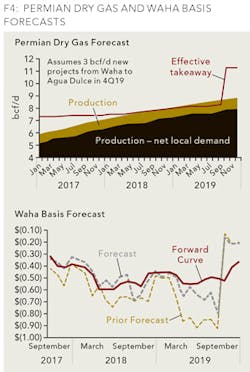

Permian pipeline takeaway capacity and basis projection

Finally, we add up the effective pipeline takeaway in the basin, plug it into our gas flow model and estimate forward basis at the most liquid point in the Permian, the Waha Hub. The results of this process are summarized in the report and shown here in Figure 4. The Permian Dry Gas Forecast (left) shows our production forecast compared to takeaway in the basin. The red line on the chart is our estimate of effective pipeline takeaway capacity in the basin, while the black-plus-gold shaded area shows total Permian production and the black shaded area is equal to Permian production net of local demand (in other words, the need for pipeline takeaway). As you can see, the volume of gas that needs to be moved out of the Permian and the play's effective takeaway capacity are rapidly converging and this has affected prices in the region.

The graph to the left is our forecast of Waha basis pricing. Basis is the differential between the Henry Hub price and the local price, in this case Waha. Our current forecast shows Waha basis expanding to an average 50-cent/MMBtu discount to Henry Hub in 2018 and remaining near that level until late 2019, when new pipelines increase takeaway capacity and relieve takeaway constraints. This forecast has a number of important implications for both producers and midstream companies that we track in the NATGAS Permian Report.

Note: RBN Energy has been updating its basis outlook each week, taking into account current forward basis in other regions, its production forecast, and infrastructure developments. The tables and figures in this article are a representative sample of the complete NATGAS Permian Report. For more information, visit: https://rbnenergy.com/products/permian-natgas/contact.

ABOUT THE AUTHOR

Jason Ferguson is a Manager, Energy Fundamental Analysis, with RBN Energy where he focuses on natural gas market analysis. Ferguson has over 18 years of energy industry experience across a broad range of disciplines. He began his career as a chemical engineer with ExxonMobil before starting his finance career as an equity analyst with Petrie Parkman/Merrill Lynch. He has subsequently served as gas macro analyst on the buy-side with Goldfinch Capital and as a basis analyst with Shell and Koch. Ferguson holds a Bachelor of Science in chemical engineering from the University of Arkansas and an MBA from the Kellogg School of Management at Northwestern University. He is a CFA charter holder.