Vaca Muerta

Improving well performance and attracting new investment

BIELENIS VILLANUEVA TRIANA, RYSTAD ENERGY

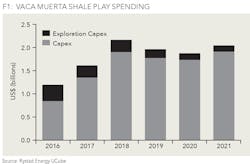

VACA MUERTA is the most developed shale play outside North America and has attracted over 9 billion USD in capital investments since 2010 to drill nearly 700 wells in the play. Even though this level of activity and spending does not seem relevant when compared to shale plays in North America, it is of utmost importance for Argentina and the shale industry in general. More so, when earlier this year major companies signed commitments to invest further in the play. BP/Total/Wintershall/YPF have signed agreements to invest US$1.15 billion in the play over the next four years, and Tecpetrol plans to invest US$2.3 billion over the next three years to further increase their production in the play. By including this and other companies' spending commitments in the play going forward, Figure 1 shows how the spending in Vaca Muerta is expected to increase yearly 35% in both 2017 and 2018 to reach approximately US$2 billion per year.

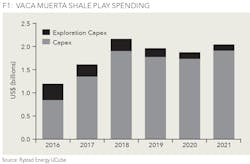

Such increase in investments going forward will lead to increasing production, particularly of gas, as shown in Figure 2. In the coming years, the production from the play is expected to increase 32% annually to reach 165 kboe/d in 2020 with ~65% gas content. In fact, two of the largest most recent deals in the play (mentioned above), are mainly targeting the gas window of the play. Recent gas price incentives in place for "new" gas, including gas from unconventional development, makes a difference in the economics of new wells, leading to lower breakeven prices.

Lower breakeven prices have also been communicated by YPF from recent wells. Indeed, recent YPF operated wells in the Loma Campana area have shown significant well curve improvement since 2016, as shown in Figure 3. YPF has managed to slow down the sharp initial decline rate of such wells and after 12 months of production, 2016 wells produce 23% more volume than the previous year. These wells are mostly targeting oil and Rystad Energy estimates breakeven prices for such wells range between US$65-US$70/bbl.

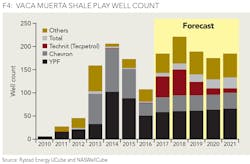

YPF is expected to continue as the largest operator in the play with ~60 net wells per year, followed by Chevron, as shown in Figure 4. However, in 2017 and 2018, Tecpetrol is expected to be the second largest operator in the play. As per the deal released in early 2017, Tecpetrol will drill 150 wells through 2019 and has already drilled 15 wells in 2017 (eight spudded in May).

Overall activity in the Vaca Muerta shale play is expected to continue increasing in 2017 and 2018, while companies continue derisking more areas of the play with intense spending. It is expected that activity will then resume to more stable levels once the company's focus in the most prolific areas of the play.

ABOUT THE AUTHOR

Bielenis Villanueva Triana is the global lead client analyst at Rystad Energy. She previously led the global shale team with a focus on North and South America. Her main responsibility is the analysis of upstream E&P activities to deliver insights to Rystad Energy clients and the industry. She holds a Master of Science in Petroleum Engineering from the University of Oklahoma.