Oilfield business personal property

Are you over-taxed by 400% to 1,000%?

PATRICK O'CONNOR, O'CONNOR AND ASSOCIATES LP, HOUSTON

IN GENERAL, personal property tax valuations are likely two to five times too high for equipment. For oilfield equipment, personal property tax valuations are typically four to 10 times the correct value, due to systemic valuation errors by appraisal districts. This excess valuation by tax assessors is causing owners of oilfield equipment to pay more than $3 billion of excess property taxes annually. The exception would be if oilfield equipment is rendered based on market value instead of cost.

Appraisal district errors in valuing business personal property

Personal property taxes are based on the market value of tangible personal property. Historically, personal property valuation by appraisal districts is based on receiving a list of assets purchased by year and using straight-line depreciation schedules to value the assets.

There are four major errors in the methodology used by appraisal districts in valuing business personal property, including oilfield equipment:

1. Straight-line deprecation is not consistent with the market value of used equipment.

2. Straight-line depreciation only considers physical deterioration (and not functional or external obsolescence).

3. Appraisal districts encourage property owners to include the costs of freight, setup costs and specialized buildings.

4. Appraisal districts make no effort to separate tangible and intangible personal property. Tangible business personal property is subject to property taxes. However, intangible personal property is not subject to property taxes with few exceptions. No state is known to tax the intangible personal property component of equipment.

Industry background

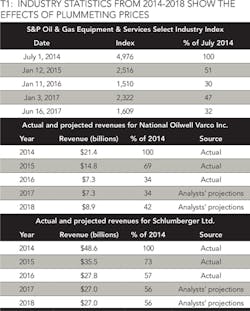

The carnage caused by oil prices plummeting from over $100 per barrel in mid-2014 to under $50 in mid-June 2017 is well understood by the industry. Table 1 is an excerpt of recent history, showing statistics from the S&P Oil & Gas Equipment & Services Select Industry Index, as well as actual and projected revenues from two related businesses-National Oilwell Varco and Schlumberger.

Total annual property taxes for oilfield equipment

Total valuation of business personal property is estimated at $3.5 trillion in the US. Business personal property valuations for oilfield equipment manufacturers is estimated at about $200 billion or about 5.7% of the US total. This estimate is based on considering extrapolating the personal property assets of large oilfield service firms and the portion of GDP for oilfield equipment and service providers. Based on a 2% tax rate, annual business personal property taxes for oilfield equipment providers total $4 billion. However, accurately valuing oilfield equipment personal property would likely result in taxes of $400 million to $1 billion. The primary factors causing excess property taxes for oilfield business personal property are:

1. not considering external obsolescence;

2. using inaccurate straight-line depreciation tables;

3. not separating tangible and intangible personal property; and

4. including the costs of freight, setup costs and specialized buildings in property tax renditions.

Freight, setup costs and specialized buildings are typically considered in developing depreciation schedules for IRS tax reporting. However, they are not tangible personal property and should not be included in renditions for business personal property.

Components of value for oilfield equipment valuation

Personal property, including oilfield equipment, is typically valued based on depreciation tables. Using depreciation tables to value personal property is reasonable if the tables are based on market value. There are three major components to consider in valuing oilfield equipment:

• Initial cost should include only tangible personal property.

• Initial cost should not include freight, setup costs and specialized buildings to house equipment.

• All types of deprecation, including physical, external and functional should be considered.

Tangible versus intangible personal property

Only tangible personal property is subject to property taxes in the US, with limited exceptions. The primary exception is at least one state taxes the market value of stocks, bonds and mutual shares which are intangible personal property. However, no state is believed to tax the intangible component of personal property.

Tangible personal property

Tangible personal property can be seen, moved, touched and felt. Examples of tangible personal property include chairs, desks, equipment and inventory. Inventory and work-in-progress are two types of tangible personal property less likely to be grossly over-valued.

Intangible personal property

Intangible personal property is not real estate and can't be seen, felt, touched or moved. Examples of intangible personal property include stocks, bonds, accounts receivable, other financial assets, contracts, software, patents, trade secrets, and other types of intellectual property.

Extracting intangible personal property from assets with both tangible and intangible components

A Cisco phone system is a good example of the complexity of separating tangible and intangible personal property. The purchase of a Cisco phone system includes hardware, a maintenance contract and installation.

In 2016, Cisco's cost of goods sold was $18.3 billion versus $49.2 billion in sales - COGS were only 37% of revenue. Based on the writer's experience, the cost of hardware is less than half the cost of a Cisco phone system. The maintenance contract and installation exceed half of the cost. The maintenance contract is not tangible personal property. The cost of installation will need to be capitalized for federal tax purposes, but is not tangible personal property. Only a portion of the cost of equipment is tangible personal property subject to personal property taxes.

There is not a simple way to separate the tangible and intangible components of the equipment for a complex system such as a Cisco phone system.

Freight, setup costs and specialized buildings to house equipment

The cost of freight, setup costs and specialized buildings are included in federal tax depreciation schedules. These costs should be excluded before attempting to value the tangible personal property.

Valuation of personal property based on cost approach

Personal property is valued on the cost approach. The cost new less depreciation. Types of depreciation include physical, functional, and external.

Following is a summary of each of the three types of depreciation:

• Physical depreciation - This is caused by wear-and-tear, or the normal aging process that negatively impacts the value.

• Functional depreciation - This is caused by errors in design or changes in technology.

• External depreciation - This is also known as external obsolescence. For real estate, it is defined as anything outside the real estate parcel that causes a reduction in value.

For oilfield equipment, the sharp drop in the demand for oilfield services has led to auction sales of large amounts of oilfield equipment. This equipment is selling for much less than the price indicated by a straight-line depreciation schedule.

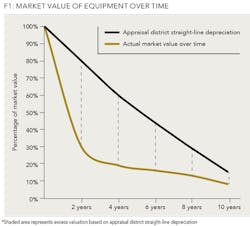

For equipment in general, external obsolescence is the reason that used equipment does not sell for a value based on straight-line depreciation tables. Most appraisal districts use a seven to 10-year life for office equipment. Hence, a one-year-old chair that cost $300 new would be valued at $252 to $270 based on straight-line depreciation. However, the market value is likely only $25 to $100 - the difference between the straight-line depreciation value and the market value is caused by external depreciation (assuming there is no functional obsolescence). See Figure 1.

Appraisal district/tax assessor rendition instructions

Appraisal district instructions for rendering tend to encourage property owners to render cost and year of acquisition. However, they do not clarify that this information will be used to calculate an estimate of market value using straight-line depreciation which no state-licensed appraiser could credibly use to estimate value.

An examination of rendition instructions from more than 30 appraisal districts or state personal property manuals uncovers consistent errors.

Rendering cost versus market value

Property owners are advised to render market value if allowed by statute. Some states require rendition of actual costs. However, many states allow the property owner to choose between rendering cost or market value. Property owners who render cost will receive a notice of assessed value based on inaccurate straight-line depreciation tables. Once the appraisal district has generated a value using their table structure, it is much more difficult to conclude to a value based on market value.

renditions for regulatory compliance or property tax reduction?

Many companies treat personal property tax renditions as a regulatory compliance issue. Penalties of 10% to 50% are common for taxpayers who do not render. A reasonable approach when filing personal property renditions for regulatory compliance is to start with the balance sheet and depreciation schedules. However, the depreciation schedules for federal taxes include:

1. tangible and intangible personal property;

2. freight;

3. setup costs; and

4. specialized buildings to house equipment.

A simple rendition process based on transferring data from depreciation schedules to rendition schedules is guaranteed to generate a business personal property tax assessment in excess of market value.

Suggestions to reduce business personal property taxes

There are three steps to minimize business personal property taxes:

1. Eliminate depreciation schedule costs that are not relevant for personal property taxation, such as freight, setup costs and specialized buildings to house equipment. Using schedules by asset class is a reasonable manner to address this, combined with a focus on high-value items.

2. Review depreciation schedules and fixed asset listings for opportunities to extract the cost of intangible personal property from total costs. Any equipment with software includes intangible personal property that should be excluded from the personal property subject to property taxes.

3. Estimate market value for the tangible personal property, after excluding items addressed above. This can be accomplished several ways. The traditional approach is to attempt to value item by item. For many companies, this is a daunting task and could also be quite expensive. The valuation could be done in-house or using an independent fee appraiser. A simpler approach is to develop depreciation tables for each class of asset, such as furniture, office equipment, phones, heavy equipment, computers, computer mainframes and others. Finally, individual attention should be given to the largest items.

Adjustments are needed for some sub-classes, such as oilfield equipment due to the external obsolescence. These tables sharply reduce the time to prepare an appraisal of business personal property.

Oilfield business personal property is over-valued during times of prosperity when owners render using cost. However, oilfield business personal property is grossly overvalued during downturns in the oilfield due to the external obsolescence created by difficult times. Excess personal property taxes for oilfield equipment exceed the correct and fair value by $3 billion per year, based on current market conditions. Excluding costs other than tangible personal property and valuing the tangible personal property based on market value, instead of straight-line depreciation schedules, offers substantial property tax savings.

ABOUT THE AUTHOR

Patrick O'Connor, MAI is president of O'Connor and Associates LP, a tax reduction firm headquartered in Houston. O'Connor is actively involved in appraising commercial real estate properties, property tax reduction, and federal tax reduction.