INDUSTRY BRIEFS

LINN to sell Washakie properties for $200M, increases share repurchase authorization

Linn Energy Inc. has signed a definitive agreement to sell its interest in properties located in Wyoming to an undisclosed buyer for a contract price of $200 million, subject to closing adjustments. The board of directors has also authorized an increase in the previously announced share repurchase program from $200 million to a total of $400 million of the company's outstanding shares of Class A common stock.

The properties to be sold consist of approximately 163,000 net acres in the Washakie Field in Wyoming with second quarter net production of approximately 66 MMcfe/d, proved reserves of ~226 Bcfe and proved developed PV-10 of approximately $102 million (Proved developed reserves are as of year-end 2016, rolled forward to the effective date of August 1, 2017 and updated with pricing of $3.00 per MMBtu for natural gas and $50.00 per bbl for oil. PV-10 represents the present value, discounted at 10% per year, of estimated future net cash flows. The company's calculation of PV-10 herein differs from the standardized measure of discounted future net cash flows determined in accordance with the rules and regulations of the SEC in that it is calculated before income taxes with the pricing and timing assumptions noted). Annualized field level cash flow on these properties is approximately $35 million (annualized field level cash flow calculated from actuals over the past eight months (January 2017 through August 2017), which does not include estimated annual general and administrative expense of ~$4-5 million. For the fourth quarter of 2017, the company had budgeted approximately $3 million of capital for the properties.

The sale is expected to close in the fourth quarter of 2017 with an effective date of August 1, 2017. This transaction is subject to satisfactory completion of title and environmental due diligence, as well as the satisfaction of closing conditions. Jefferies LLC acted as sole financial advisor and Kirkland & Ellis LLP as legal counsel during the transaction.

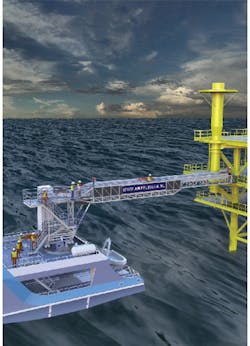

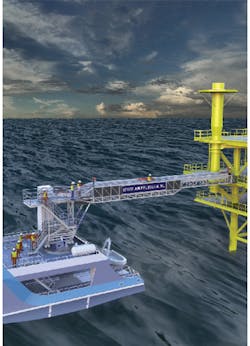

Ampelmann partners with Seaqualize

Ampelmann has partnered with Seaqualize, a Dutch marine motion technology innovator, to collaborate on the development of its latest S-type gangway. Ampelmann develops and manufactures motion compensated offshore access systems and its latest gangway solution, the S-type, is designed specifically to be fully integrated into large, high speed vessels and dedicated to long-term crew change operations.

The S-type is designed to safely compensate the challenging motion characteristics of these vessels when in dynamic positioning alongside the platform.

The full-scale prototype is funded by a subsidy of the Dutch Ministry of Economic Affairs. While targeted predominantly towards the crew change market, the offshore wind market will also hold opportunity for this new generation of gangway, due to the reduction in power requirements and weight.

Production is due to start on the S-type in early 2018. In total, the cost of operators using the system will be around 30% cheaper than helicopters. For the global oil and gas market where volume of crew is high and the sea state can be severe, the S-type can continuously transfer 50 people and luggage in five minutes in significant wave heights.

Ampelmann and Seaqualize will collaborate on the development of the S-type gangway, designed to be integrated into large, high speed vessels for offshore access.

Lovell Minnick and Tortoise Management to acquire Tortoise

Tortoise Investments and Lovell Minnick Partners have signed a definitive agreement for a buyout of Tortoise. Terms of the private transaction were not disclosed. As part of the transaction, ongoing management and employees are expected to increase their ownership of Tortoise. Employees will retain a significant equity interest, with many investing additional capital alongside Lovell Minnick, who will purchase the equity stake held by Mariner Holdings and retiring co-founders of Tortoise. Tortoise will maintain its independence and autonomy with its brand, investment processes and day-to-day portfolio management remaining unchanged. Members of Tortoise's senior management and its portfolio managers have signed long-term employment agreements to remain with Tortoise. Three co-founders, Zachary Hamel, Kenneth Malvey and Terry Matlack, will sell their remaining interest in Tortoise and retire from Tortoise upon closing of the transaction. Co-founder David Schulte, who left Tortoise in 2015, will also sell his remaining interest in Tortoise. Lovell Minnick is joined by a premier group of institutional investors, including HarbourVest Partners, AlpInvest Partners, and several additional limited partners, who are supporting the transaction. BMO Capital Markets acted as exclusive financial adviser to Mariner Holdings and Evercore acted as exclusive financial adviser to Lovell Minnick. Key Strategic Advisors advised management on the transaction. UBS and Credit Suisse are providing committed debt financing for the transaction. Independent directors and the full boards of Tortoise's registered funds have approved new advisory agreements as a result of the transaction. The transaction is expected to close by the end of the first quarter of 2018, subject to standard regulatory, client and fund shareholder approvals.

Sparrows Group, Hydra Group launch joint venture in Ghana

Sparrows Group has formed Sparrows Offshore Ghana Ltd. a joint venture with local partner Hydra Group Ltd. to deliver crane, lifting, and inspection services in Ghana. The JV creation was supported by Scottish Development International (SDI), the international arm of the Scottish Government and Scotland's enterprise agencies.

Drillinginfo acquires DataGenic

Drillinginfo, a SaaS and data analytics company serving the energy industry, has acquired London-based DataGenic, a provider of software solutions for enterprise data management and business process automation. DataGenic services oil, gas, power, commercial, and industrial clients globally and specializes in data-agnostic technologies and complex forward-curve construction. Generating millions of forward curves per day for a single client, with granular audit trails, flexible reporting, and data validation, DataGenic accelerates interoperability for real-time decisions in the commodity trading business. Austin, TX-based Drillinginfo's energy decision platform provides market intelligence on nearly 200 countries covering the Middle East, Africa, Asia, Australia, North and Central Europe, and Latin America.

Carrizo agrees to sell Marcellus Shale assets

On October 5, 2017, Carrizo Oil & Gas Inc. entered into an agreement to sell its assets in the Marcellus Shale to a subsidiary of Kalnin Ventures LLC for $84 million in cash, subject to customary closing terms and conditions. Additionally, Carrizo could receive contingent payments of up to $7.5 million in aggregate based on natural gas prices exceeding certain thresholds over the next three years. Net production from the assets averaged more than 40 MMcf/d of natural gas over the first nine months of 2017. The effective date of the transaction is April 1, 2017, and the transaction is currently expected to close by the end of November 2017.

Ward sells SCOOP and Hoxbar assets

Ward Energy Partners LLC (WEP) has sold assets located primarily in Stephens and Grady Counties in Oklahoma to an undisclosed buyer. The assets are prospective for the Woodford, Mississippian, and Springer reservoirs in the SCOOP and Hoxbar oil trend. Pro forma for this sale, WEP will continue to own and operate assets in the STACK play in Oklahoma and the Denver-Julesburg basin in Colorado. WEP is an oil and gas exploration and production company formed in July 2014 by Ward Petroleum Corp., a diversified exploration and production company based in Oklahoma and Colorado, and Trilantic Capital Management LP, a private equity firm based in New York and Texas. RBC Richardson Barr acted as a financial advisor to WEP on the transaction. Vinson & Elkins LLP acted as legal advisor to WEP.

Emerson to acquire Paradigm

Emerson has agreed to acquire Houston, TX-based Paradigm, a provider of software solutions for the oil and gas industry, for a purchase price of $510 million, reflecting a multiple of 13 times expected 2017 EBITDA. Paradigm, joined with Emerson's existing Roxar software business, creates an exploration and production software portfolio with offerings spanning seismic processing and interpretation to production modeling.

Rowan, Saudi Aramco launch ARO Drilling

ARO Drilling, a 50/50 joint venture between Rowan Companies plc and the Saudi Arabian Oil Company (Saudi Aramco), commenced operations on October 17, 2017. As part of the initial startup of ARO Drilling, Rowan, and Saudi Aramco contributed equal amounts of cash into the joint venture. Following these contributions, Rowan sold three of its jack-up drilling rigs to ARO Drilling, including the J.P. Bussell, which was previously idle, and Saudi Aramco sold one of its jack-up drilling rigs to ARO Drilling. Following the purchase of these drilling rigs, ARO Drilling distributed excess cash in the amount of approximately $88 million to each of Rowan and Saudi Aramco maintaining each party's 50% ownership interests in the joint venture. Pursuant to the ARO Drilling shareholders' agreement, Saudi Aramco will sell an additional jack-up rig in 2017 to ARO Drilling and Rowan will sell an additional two jack-up rigs to ARO Drilling once they complete their current contracts in late 2018. ARO Drilling also now manages the operations of Rowan's seven remaining jack-up rigs currently in Saudi Arabia. Rowan and Saudi Aramco have agreed that ARO Drilling will purchase 20 future newbuild rigs that will be constructed by a Saudi Aramco manufacturing joint venture and are expected to be delivered between 2021 and 2030. Each newbuild is expected to have a 16-year drilling commitment upon delivery to ARO Drilling.

Goodrich Petroleum enters New Credit Facility, agrees to Acreage Swap

Goodrich Petroleum Corp. has entered into a $250 million Senior Secured Revolving Credit Agreement with JP Morgan Chase Bank NA (Joint Lead Arranger, Sole Bookrunner and Administrative Agent) and SunTrust Bank and SunTrust Robinson Humphrey Inc. (Syndication Agent and Joint Lead Arranger, respectively). The credit facility has an initial borrowing base of $40 million and contains customary terms and conditions, including semi-annual borrowing base redeterminations. The company had $31.1 million of cash on hand as of September 30, 2017 and has $23.3 million currently available under the credit facility. Additionally, the company has entered into an additional swap of undeveloped acreage on a portion of its core North Louisiana Haynesville Shale acreage. Goodrich swapped approximately 900 net acres out of its Metcalf area of central Caddo Parish for a similar amount of acreage in its Bethany-Longstreet area in southern Caddo Parish. The swap, that increased its inventory of long laterals and operated acreage which carries lower gathering fees, equates to an increase in proved undeveloped reserves of 25.5 Bcfe based on the year-end 2016 SEC Reserve Report with SEC Henry Hub spot price of $2.481 per MMBTU and $42.75 per barrel West Texas Intermediate pricing.

Continental sells 1M barrels of Bakken oil for export to China

Continental Resources Inc. noted its first-ever sale of Bakken oil specifically for delivery overseas. The company has sold 1,005,000 barrels of Bakken crude oil for November delivery to Atlantic Trading and Marketing (ATMI), which intends to export the oil to China. Daily sales transactions of 33,500 barrels per day in November will take place in Cushing, Oklahoma. ATMI then plans to transport the oil for loading on tankers at Texas ports. In December 2015 the US lifted its ban on oil exports, allowing foreign sales to be transacted without a license. Oil exports have grown steadily in the past two years, primarily to foreign refineries configured specifically to process light sweet crude oil.

Burns & McDonnell joins ISME as founding partner

The International Society for Mexico Energy (ISME), a non-profit energy business advocacy group formed three years ago in Houston, is launching its Mexico City chapter with an inaugural meeting to be held on Nov. 14 at the EGADE Business School in Mexico City. Burns & McDonnell is a founding partner of ISME, an organization chartered to help businesses navigate Mexico's evolving energy and power markets in the wake of deregulation and partial privatization of its power and energy sectors. Mexico has implemented far-reaching reforms of its power and energy industries, opening both sectors up to private investment in 2013 after decades of monopoly control by state-run enterprises PEMEX and Comisión Federal de Electricidad. The reforms are creating a surge of attention among both US and international businesses. ISME is chartered to help serve as a clearinghouse of best practices and accurate information for businesses and others looking for business opportunities. Founding partners of ISME are Burns & McDonnell, Kansas City Southern Railroad, Emerson, and Siemens Financial Services. Founding academic partners are Tulane University Business School in Houston and the EGADE Business School at Tecnologico de Monterrey in Mexico City. With the start of the Mexico City chapter, ISME will rotate its monthly meetings between Mexico City and Houston. Each monthly meeting features a series of educational sessions updating members on latest developments within Mexico's energy sectors along with other items of interest from around the world.

Gordon Technologies sees investment from Pelican Energy Partners

Pelican Energy Partners has invested in Gordon Technologies LLC, an independent provider of Measurement-While-Drilling (MWD) technology to the oil and gas industry. Headquartered in Scott, LA, with a service facility in Midland, TX, Gordon was founded in 2014 by Terry Frith, a veteran of the MWD sector with more than 30 years of experience. Gordon's product offerings were designed to specifically address needs in today's challenging drilling environments, namely MWD failures due to high shock and vibration, as well as high temperature environments. Founded in 2011, Pelican Energy Partners is a specialized private equity firm based in Houston. The team, focused on making investments in energy services and manufacturing companies, has raised $330 million of committed capital and is investing out of its second fund.

WorleyParsons completes AFW UK Acquisition

WorleyParsons has completed the acquisition of AFW Oil and Gas UK Ltd. (AFW UK). AFW UK is a provider of engineering and construction, operations and maintenance and hook-up services markets in the UK oil and gas market. AFW UK has over 45 years' experience operating in the North Sea providing services across the full asset lifecycle. The business represents the majority of Amec Foster Wheeler's former UK upstream oil and gas operations, to be divested as a remedy to competition concerns raised in relation to the John Wood Group's acquisition of Amec Foster Wheeler.

CONSOL board gives approval to separate coal, E&P businesses

The board of CONSOL Energy Inc. has given final approval of the company's previously announced separation into two publicly-traded companies-a coal company and a natural gas exploration and production company. The current parent CONSOL Energy will change its name to CNX Resources Corp., and will retain its ticker symbol "CNX" on the NYSE. CoalCo will change its name to CONSOL Energy Inc., and its common stock will trade on the NYSE under the ticker symbol "CEIX". CNX Coal Resources LP will change its name to CONSOL Coal Resources LP. CNX Coal Resources will change its NYSE ticker symbol to "CCR" from "CNXC", and its common units will continue to be listed on the NYSE.