Hybrid approach to debt-equity structure

© Bacho12345 | Dreamstime

A DATA-DRIVEN APPROACH DELIVERS ACTIONABLE INSIGHTS AND

HELPS DRIVE PRUDENT DECISION-MAKING ON THE OPTIMAL DEBT-EQUITY MIX

PATRICK NG, REAL CORE ENERGY, HOUSTON

GEOFFREY WONG, IAM LEGACY, HONG KONG

Whether the oil price will be $80 or $50 by 2020, two challenges are here to stay. They are: 1) reduce variability, and 2) create a finance program that can weather "lower for longer" oil price scenarios.

In our previous article in the December 2016 issue of OGFJ ("Operating profitably with $50 oil"), we demonstrated how alpha-seeking portfolio adjustment works. While pruning a portfolio can enhance return on the edge, adjustment in itself may not suffice to move the needle. By extension of the hybrid's bottom-up, highly granular, asset-level well economics modeling and top-down portfolio simulation, we illustrate how a data-driven approach delivers actionable insights and helps drive prudent decision-making on the optimal debt-equity mix. When coupled with improved acreage and margins, the hybrid helps reduce variance and strengthen execution.

USE CASE

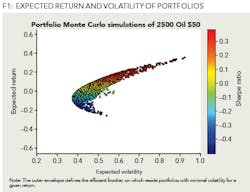

First we simulate the universe of portfolios with different weights of the underlying assets. Figure 1 shows the expected return and volatility of portfolios. Next, express the incremental gain in return with respect to volatility as pseudo capital-market line, and finally determine the optimal debt-equity mix.

FIRST PRINCIPLE

We equate reducing variability to narrowing the spread of returns. It can be accomplished by upgrading acreage and, or adjusting portfolio allocation. While portfolio adjustment can do only so much, heavy lifting will come from more impactful acquisition which often requires financing.

The key is lower cost of capital. More concretely, quantify how the weighted average cost of capital (WACC) varies with debt/equity ratio. For the purpose of illustration (Figure 2), we use a reference interest rate of 2.5% and equate the cost of equity to the expected return of portfolio.

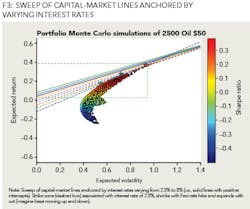

As evident in Figure 3, for rates higher than 8%, there is no tangent portfolio for the underlying assets. When there is no tangent portfolio, borrowing works for borrower, but is sub-optimal for lender. Within the pseudo capital-market line sweep on positive rates (solid lines), there exist viable portfolios along the efficient frontier. For each suitable reference rate, there is one and only one portfolio on the efficient frontier that is tangent to the capital-market line, and the tangent portfolio offers the best risk-adjusted return with optimal financing. For completeness, dashed lines (negative reference rates) are out of bound for optimal debt-equity analysis.

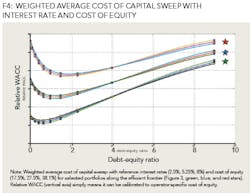

When we iterate on the weighted average cost of capital (WACC) versus debt-equity ratio, increasing leverage (higher debt-equity ratio) drives WACC lower up to certain point (Figure 4). For the three portfolios, the optimal debt-equity ratio varies from around 0.5 to close to 2 (in line with that of coal, renewables, and oil and gas industries (from Cost of Capital by Sector analysis, NYU, January 2017).

"Will oil be $50 or $80 by 2020? Investing in new high-impact projects is about making probabilistic inference with imperfect information about unknowable events in the future. With the advent of data analytics and machine-learning algorithms, we will get past using averages for major investment decisions, better exploit the spread, and explore the "data" more fully and efficiently."

INTERPRETATION

The use of debt at the tangent portfolio can be optimal for both the borrower and the lender, at an appropriate reference rate. This makes the hybrid a quick strike-zone scanner and viable loan optimizer, especially for recurring semi-annual redeterminations (see "Billions of dollars of bad oil and gas loans" by Laura Freeman, September 2017 OGFJ).

The hybrid approach can help guide an operator moving closer to the tangent portfolio along the efficient frontier, as well as the lender "redetermining" a loan portfolio's "sweet spot" - i.e., arc span on the efficient frontier within the strike zone. The transparency afforded by using the hybrid facilitates borrowers and lenders to arrive at a win-win outcome, namely, lowering the cost of capital, executing the "right" projects, and delivering a higher risk-adjusted return.

With a Fed rate hike, leading to higher reference rates, debt-equity financing's sweet spot will shrink accordingly. On the other hand, with a Fed rate cut, the sweet spot will grow. For example, during a period of historical low Fed fund rates from 2010 to 2014 with oil prices hovering above $80, borrowing mushroomed and junk-rated debts peaked in Q2 2014. This scenario is elaborated by the hybrid approach.

What happens when we have access to better acreage and margins? The universe of portfolios will migrate northwestward to the upper left and the capital-line sweep captures more positive intercepts (i.e., fewer dashed lines). As a result, the debt-equity sweet spot expands.

SUMMARY

Will oil be $50 or $80 by 2020? Investing in new high-impact projects is about making probabilistic inference with imperfect information about unknowable events in future.

With the advent of data analytics and machine-learning algorithms, we will get past using averages for major investment decisions, better exploit the spread, and explore the "data" more fully and efficiently. As continuous improvement we can only get better with data, reasons being:

• Financial technology - efficient frontier, debt-equity calculus, faster what-if and visual risk-return dynamic, constitute the first line of defense against irrational exuberance.

• Deeper learning - at the junction of first principle and learning algorithm, the hybrid approach bodes well to incorporate oil and gas production data at the well and asset level, develop actionable insights and a robust strategy to thrive in the new normal "lower for longer" world.

When we have access to more data and train machines to learn, it will be possible to minimize the avoidable bias, i.e., closing the gap between how well an experienced practitioner can do versus a machine. Our ultimate goal is to digitize prudent decision-making by capitalizing on the advances in algorithm and computing, come up with a better way to quantify and manage risk, as well as optimize debt-equity funding. Connect strategy to execution and move the needle.

ACKNOWLEDGEMENT

We thank Rystad Energy for providing the production data for portfolio simulation and analysis.

ABOUT THE AUTHORS

Patrick Ng is a partner at Real Core Energy in Houston. Ng has a focus on acquisitions and divestitures. He held operations and technology leadership positions at WesternGeco and Fugro, developing and bringing solutions to market at the intersection of data and technology. He earned his MS in geology and geophysics from Yale University and has an MBA from the University of Houston.

Geoffrey Wong, CFA is a portfolio manager at IAM Legacy, a family office in Hong Kong. He has worked previously as an analyst and a portfolio manager for several major financial institutions and boutique investment banks in New York, London, and Hong Kong. He received a BA from the University of California, Berkeley and an MEng from Cornell University.