Exports are changing crude oil logistics

© Leon Viti | Dreamstime

NEW OPTIONS CREATE A MORE COMPLEX LOGISTICS PUZZLE

FOR MIDCONTINENT PRODUCERS AND MARKETERS

RICHARD MURPHY, ALLEGRO DEVELOPMENT CORP., DALLAS

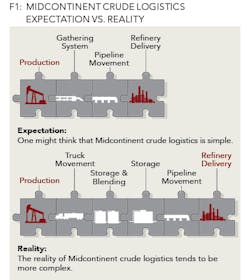

Crude oil logistics in the Midcontinent region (AR, LA, KS, NM, OK, and TX) seems to be a simple puzzle with few pieces. Because all crude oil has to be refined, companies typically transport it from Midcontinent production locations to the closest refineries, which are most often located along the Texas and Louisiana Gulf Coast, via the most efficient mode of transport (MOT).

The most efficient MOT is gathering systems and pipelines. In reality, however, blending and large amounts of crude oil being transported by truck make the puzzle more complex. Additionally, the exporting of crude oil in the United States, most of which will originate in the Midcontinent, promises to complicate the Midcontinent logistics puzzle even more. While there are complexities associated with Midcontinent oil logistics, there are solutions that can help your organization complete an export logistics puzzle. (See Figure 1.)

CRUDE OIL EXPORTS

Beyond the stabilization of WTI crude prices in the $50 range, the most impactful event for midcontinent crude oil is probably the recent changes to federal law allowing the export of crude oil. Exporting crude oil brings into play a host of elements that have not been considered in Midcontinent crude oil operations since the late 1960s and early 1970s, thereby eliminating some pieces of the logistics puzzle and adding others.

US exporting is happening for two primary reasons. First, most Gulf of Mexico refineries are optimized for relatively heavy oil (low API gravity). Due to this, light crudes like those found in the Eagle Ford and other Midcontinent basins command higher per-barrel prices on the world market than they would if they just delivered to Gulf Coast refineries. These crudes are often blended down in quality to meet refinery feedstock specifications.

Secondly, transportation via ocean-going vessels is very efficient. The smaller crude oil tankers, like PANAMAX vessels, can transport around 300,000 Bbls of crude oil on a single journey. One can transport a barrel of crude via a large crude oil tanker thousands of miles for less than the cost to transport the same barrel fewer than two hundred miles by truck. So, though the distance the crude oil is transported may go up 10, 20, or 30 times; the transportation costs increase at a fraction of the distance increase. As US port facilities get cleared for on-loading to super tankers that can transport more than 1.7 million Bbls at a time, the economics will improve even more.

Currently, the differential between the value of light crude oil at Gulf Coast refineries and its value at East Asian refineries is so wide that it is more profitable to transport the crude oil thousands of miles to Asia and sell it rather than transport it hundreds of miles to refineries in Texas and Louisiana.

In June of this year, crude oil exports from the US had grown to 1.3 Million BOPD (Bbls of oil per day). Many think this level could double in the next two to five years and the Midcontinent, with its close proximity to Gulf of Mexico ports, stands to benefit the most from this exporting trend. Should exports double, the US will be exporting near the same level as Kuwait or Nigeria. These countries' economies are almost entirely dependent upon crude oil exports, which means US exports can be expected to change a lot more than Midcontinent logistics in future years.

EXPORT LOGISTICS - A NEW LOGISTICS PUZZLE

For some grades of crude, exporting means that the blending step can be eliminated, resulting in cost reductions and fewer management headaches such as the need to balance light and heavy crude movements across stations to facilitate blending. Similarly, if one's light crude is already trucked directly to Gulf Coast refineries, it could be trucked a few more miles to offload to a tanker (if the tanker is onloading). The ports that export crude oil are located in the same cities as the Gulf Coast refineries that much of the Midcontinent crude oil traditionally flows to. So, except for blending in some instances, all of the existing pieces of the Midcontinent Logistics Puzzle remain.

New pieces of the logistics puzzle are added for vessels as existing pieces like railcars may be used differently and the pieces may be re-arranged. Exporting Midcontinent crude oil can be very profitable, but it also presents organizations with a very complicated transportation puzzle. Since storage facilities near the ports are generally dedicated to feedstocks, crude may be stored at existing stations for longer periods of time as it waits for tankers. Another option is to use railcars for the leg to the port and store the crude in the railcars while it awaits a tanker. Ocean-going vessels are an entirely different transportation method than trucks, railcars, pipelines, or even barges. They have different processes, regulations, cost structures, and terminology than trucks, railcars and pipelines. This all has to be internalized by the logistics organization to enable effective operations.

Tankers also open up an entirely new set of destinations for crude oil and the possibility of multiple destinations on the same logistics movement. Instead of an organization having to consider, at most, a few dozen refineries when marketing the crude and planning the logistics, it now can potentially consider hundreds of potential refineries in several dozen countries. This makes marketing and logistics planning cycles much longer. With exporting, one has to decide which puzzle they are building before they even begin to assemble the pieces. (See Figure 2.)

Going from a purely domestic logistics operation to an international one also brings additional challenges that impact logistics. The foreign currency implications alone, if not properly managed, could completely change the economics of a deal. Finally, there is the timing consideration. With traditional Midcontinent operations, most production in a given month could expect to be settled and paid for in the next month. When utilizing crude oil tankers (which, aside from their long journey times and multiple destinations), the process can take several days to load and unload at each destination, one might not receive payment for two to three months or more after production. This, in turn, makes credit even more important in determining where the crude is delivered.

A MODERN SOFTWARE SOLUTION IS CRITICAL IN BUILDING YOUR PUZZLE

There is no doubt that putting together the puzzle of Midcontinent crude oil logistics exports is extremely challenging. Logistics in the Midcontinent is significantly different than it was just five years ago, and we are only seeing the beginning of the changes that will be brought about by the exporting of US crude oil. Yet, as frustrating and challenging as the management of the logistics can be, it is critical to do so because of its large financial impact.

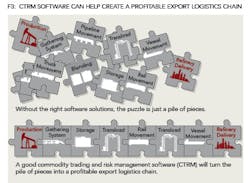

Thanks to a heavy reliance on trucking, Midcontinent logistics costs can be $5, $10, or more per barrel. Vessels will only raise these costs further. With logistics costs of $10 per barrel, even a 5% improvement could yield $0.50 or more per barrel of cost savings. Even at very low export volumes, say 250,000 barrels a month, could save a producer or marketer $1.5 million a year. (See Figure 3.)

A comprehensive and adaptable CTRM solution for tracking, evaluating, and managing logistics is essential to handling crude oil exports. It is important to be able to evaluate multiple origin/destination combinations using multiple movement legs with multiple transportation methods. This capability is required to be able to effectively track and manage the exporting of crude oil from the Midcontinent. In fact, these types of software solutions are necessary to properly evaluate export opportunities and determine possible export logistics costs and the P&L impacts of the export strategy.

Similarly, when exporting crude oil, it is critical for the CTRM to be comprehensive and capable of considering international options. Capabilities such as handling vessel expenses in multiple currencies, calculating international taxes, and calculating the best hedge for the volumes being transported become very important in making such endeavors profitable.

Finally, the CTRM solution should be flexible and adaptable. As the last decade has shown, the crude oil business can change significantly. The most adaptable systems can implement new products and functionality in a few days or weeks, even when utilizing company resources to do so, and can be tailored to precisely meet one business model. Having such a solution to facilitate logistics operations can enable Midcontinent companies to effectively capitalize on these new export opportunities and realize higher margins from more efficient logistics operations.

ABOUT THE AUTHOR

Richard Murphy is the product manager for crude oil and refined products at Allegro Development Corp., a provider of commodity trading and risk management (CTRM) software. After four years as an ICBM missile launch officer, he has spent 25 years helping companies solve strategic, tactical, and technological problems. Some 17 of those years were spent solving problems at 40 different energy companies. For the last eight years, his major focus has been utilizing technology to better manage crude oil logistics. Murphy has a BSBA in finance and banking from the University of Missouri and an MPA from the University of Wyoming.