Seismic changes ahead for MLPs

Barbara Spudis de Marigny,Gardere Wynne Sewell LLP, Houston

There are approximately 95 partnerships that are publicly traded on exchanges today. The majority of these publicly-traded partnerships, more commonly referred to as master limited partnerships or MLPs, conduct energy-related businesses.

A key attraction of MLP form is that, unlike corporations, MLPs pay no federal income tax at the entity level. Instead, earnings are taxed to the holders of the MLP interests. Because the MLP is unburdened by entity-level tax, it is able to make larger distributions to its owners than could a publicly-traded corporation with comparable earnings and, in turn, it may experience a lower cost of capital.

The tax law narrowly circumscribes the nature of the business that an MLP can conduct without losing its favorable tax status. These restrictions can make it difficult to operate in MLP form since, in order to feed the incentive distribution rights typically granted to the general partners of MLPs and to grow the size of distributions to their interest holders, MLPs generally are constantly in acquisitive mode, looking for new businesses to acquire.

Good news for MLPs

The good news for the MLPs is that developments in the tax law have expanded the permissible businesses for MLPs.

In order to qualify for MLP tax treatment, at least 90% of the MLP's income must be derived from the conduct of certain specifically defined business activities and such activities must be conducted with respect to "minerals or natural resources." Congress put these restrictions in place in 1987 in order to prevent all of corporate America from converting to MLP form and essentially removing corporate taxation from the tax base. As a result of this legislative intent, the IRS has very strictly interpreted both the permissible MLP business activities and the definition of "mineral or natural resources."

Under the applicable Internal Revenue Code provision, qualifying natural resource activities include exploration, development, mining or production, processing, refining, transportation (including pipelines, ships and trucks), storage, marketing and distribution, but not retail sales. Qualifying natural resources, in general, consist of oil, gas, petroleum products, coal, and other minerals.

Even though these rules have been strictly interpreted, there has been, over the years, a gradual relaxation in the restrictions on MLPs as a result of amendments to the Internal Revenue Code and some interpretive rulings from the IRS. These developments give MLPs the opportunity to think more creatively about their acquisition targets. A short list of some of these developments would include:

Legislative:

- 2008 legislation that expanded the definition of natural resources to include industrial source carbon dioxide.

- 2008 legislation that expanded certain qualifying activities with respect to ethanol, biodiesel, and other alternative fuels.

- 2009 Bill (HR 2828) would include income from the transmissions of electricity as qualifying income (not law yet but demonstrative of the industry's goals).

- 2009 Bill (S 826) would include income from wind energy (again, not law yet).

IRS rulings that qualified activities include:

- Marketing propane to retail end users.

- Operation of refined product terminals and pipelines owned by others (not the MLP).

- Fracturing services, fees for removing or recycling flowback fluids.

- Well servicing.

- Fees for storage at terminals and addition of additives.

- Asphalt processing and adding additives to asphalt.

- Acquisition and licensing of land and marine seismic data.

The last ruling in the list above is very recent and is a most remarkable ruling in that it interprets "exploration" to include income derived from acquiring and licensing seismic data. The ruling was a private letter ruling requested by an undisclosed taxpayer and addressed solely to that taxpayer, meaning that other taxpayers technically are not entitled to rely on the ruling. Nevertheless, the release of the ruling signals that other MLPs could obtain a similar ruling or, if they take the same position without a ruling, that the IRS may be less likely to attack the position.

In order to obtain the ruling, the taxpayer represented to the IRS that the relevant facts were as follows: The taxpayer employed geoscientists to consult with oil and gas producer clients. The taxpayer's acquisition of new data was typically partially paid for by the exploration company interested in the area. No other commercial use existed for the seismic data other than for purposes of oil and gas exploration. A significant portion of the taxpayer's income was based on the success of the licensee in drilling based on the data. Producers of oil and gas do not conduct their own seismic exploration and, instead, almost uniformly purchase such information from seismic companies. Based on these facts, the IRS determined that seismic services are integral to the exploration of natural resources and therefore constitute a qualified MLP activity.

This ruling gives MLPs an additional business area into which they may now consider expanding to satisfy their unquenchable demand for growth. A pipeline MLP could now acquire a seismic services company without fear of losing its MLP status.

The broader import of the ruling is that it suggests that the IRS is open to determining that an activity is a qualified MLP activity if it is integral to the exploration and production of natural resources, even though the activity is ancillary to exploration or production activity and even though the income does not arise directly from the exploration or production activity.

It will be interesting to see whether a parade of MLPs or MLP–wannabes now approach the IRS for a determination that other business activities, although not directly exploration or production activities, are sufficiently important or integral to a qualified activity to qualify.

For seismic companies that are not in MLP form but are looking to raise capital, an MLP offering, with its possibly lower cost of capital, is now an alternative to a corporate IPO. In addition, for seismic company owners that have been evaluating their exit strategy or otherwise considering the market for a sale of their business, there is now a whole new category of potential acquirers: MLPs.

MLPs can never put their qualified status at risk by engaging in activities that may not be qualified. Now, an MLP is able to consider seismic company acquisitions.

Potential 2010 tax rate increases may enhance MLP tax advantages

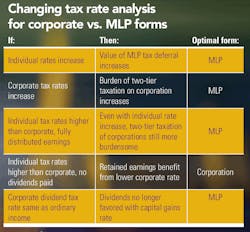

We can expect tax legislation in 2010 and such legislation is likely to increase tax rates for either corporations or individuals or both. How would tax rate changes impact MLPs?

An increase in corporate rates will increase the advantage of MLP tax treatment over corporate tax treatment and, the better the MLP tax treatment, presumably, the lower its cost of capital. Because MLPs do not pay tax at the entity level, the MLP structure escapes corporate tax. The higher the corporate tax rate, the more tax avoided. The more tax avoided, the better an MLP investment looks.

An increase in individual rates will increase the tax deferral benefit offered by MLPs. Because the amount of MLP income on which an interest holder pays tax is only a fraction (usually around 20%) of the cash distribution an interest holder receives, tax on the other earnings (the 80%) is deferred until the interest holder sells the interest. A higher tax rate means that the amount of the taxes deferred is increased. In other words, increased benefit for MLP investors.

If individual rates are raised significantly above the corporate rate, wouldn't an MLP structure, in which earnings are taxed to the individual owners at their individual rates, be disadvantageous? Not necessarily. No matter how low the corporate rate becomes, even the lowest entity-level tax would mean that, on a fully-distributed basis, the tax paid by investors in corporate structures will always be greater than the tax paid in MLP structures that do not have such entity-level tax.

On a non-fully-distributed basis, lower corporate rates are more attractive than the higher individual tax rates applied to earnings passed directly through by an MLP. But MLP investors are looking for growth and income. So corporations that do not distribute earnings would not be an investment candidate for most MLP investors anyway.

A more subtle but very interesting potential tax change relates to the taxation of dividends. According to informal comments of Congressional staffers, it is highly likely that there will be a de-coupling of the dividend rate and the capital gains rate.

Since 2003 qualified dividends have been taxed at the same low rate as capital gains, whereas MLP distributions have continued to be taxed according to the type of revenue earned by the MLP at the entity level, usually ordinary income. If the tax on dividends were de-coupled from the tax on capital gains however, dividends would presumably return to their ordinary income characterization, with resulting taxation at ordinary income rates. Such a de-coupling would cause the two-tier tax burden suffered by investors in corporations to be heavier than it currently is – again disfavoring corporate form.

Summary

Qualifying businesses – now including seismic businesses – that are looking for a buyer, may find an MLP knocking on their door. Tax legislation is likely to enhance the tax benefits of investing in MLPs.

About the author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com