Survey results: 70% plan to automate OTC derivatives post-trade processes

OpenLink Financial Inc. has released the results of a survey of senior operations professionals at investment firms involved in OTC derivatives trading. The survey looked at the relative importance of risk management concerns faced by these professionals in the growing electronic environment.

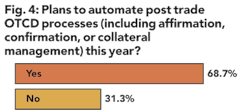

A majority of respondents indicated they plan to automate post-trade OTC derivatives processes, with nearly 70% answering that they will do so in 2010. This automation includes affirmation, confirmation, or collateral management.

"As OTC derivatives markets grow rapidly, it is clear that organizations are transforming their settlement operations through automation, and that organizations are at different states in this process," said Ken Knowles, executive vice president of financial and risk solutions at OpenLink, which provides cross-asset trading, risk management, and operations processing software for companies engaged in the trading of financial products and commodities, including energy.

"These initiatives become change management exercises via solutions that ultimately lead to better workflow efficiencies and controls," said Knowles. "We conducted this survey in part to better understand how to translate the market's challenges into solutions which enable them to innovate and succeed in this rapidly changing landscape."

The survey also revealed that respondents varied widely in their utilization of electronic OTC affirm/confirm processing. Approximately one third (28%) stated that most (more than 75%) of their affirmation, confirmation, or collateral management processing is conducted electronically. About one quarter stated that electronic processing comprised 50% to 75% of that activity, (23%) conducted these activities electronically 25% to 49% of the time, with the remainder of respondents at under 25%.

The survey was conducted during an OpenLink webinar entitled: Perspectives on OTC Trade Processing: Mitigating Risk through Operational Workflow Efficiencies. Participants included professionals who are looking to understand the impact of increasing volumes and upcoming regulation that will have a bearing on the future of trade processing.

When asked what areas of OTC they are most interested in learning about, the top three results were as follows:

- 31% want to learn about operational efficiency

- 21% are interested in risk management

- 17% are interested in counterparty risk management

Finally, participants were asked to rank the level of counterparty review across asset classes achieved by their organizations as "High," "Medium," or "Low." While a little more than half selected the level at their firms as "Medium," a little over a third noted that they have observed a high level of review. Only 11% stated that the level of review was "Low."

"The need for transparency underlies all of these statistics," said Fritz McCormick, senior analyst with Aite Group. "Gaps remain in affirmation/confirmation processes and counterparty review. Automating these areas, among others, will boost transparency, crucial for risk management, regulatory mandates and operational efficiency."

A new report from Aite Group focusing on multi-asset portfolio systems elaborates on this need for transparency. The report suggests that, in the context of steady growth in the OTC derivatives market, demand is strong for portfolio and accounting solutions to support these instruments.

Founded in 1992, OpenLink is headquartered in New York with offices in Houston, London, Singapore, and six other major cities. The company's global client base includes 12 of the top 25 commodity and energy companies, eight of the largest financial institutions, and 11 of the largest central banks, as well as major hedge funds, commodities companies, and public utilities.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com