Post oil spill: why risk mitigation is now a top-line driver

Mike Haney, Athens Group, Houston

Post oil spill, drilling contractors and operators are increasing their risk mitigation efforts to meet new offshore industry and governmental regulations and avoid the punishing penalties, public outcry and exorbitant costs associated with health, safety, and environmental (HSE) incidents.

The industry has always had a zero-tolerance goal for safety incidents, and risk mitigation has always been viewed as a bottom-line contributor. But especially now, with an over-supply of high-specification offshore assets (24 uncontracted newbuilds in shipyards and many existing contracts coming up for renewal), three areas of risk mitigation are being viewed as strategic to securing and renewing contracts. With the average value of a five-year offshore drilling rig contract being US$727 million, leading drilling contractors are focused on:

- Tightening contracts so that they more clearly define requirements and accountability

- Starting risk mitigation efforts earlier in the newbuild/refurbishment lifecycle, and

- Increasing audit frequency during operations

The bar has been raised on the financial impact of an HSE incident and the term "risky asset" has been redefined. The costs of going after "hard-to-get" oil are even higher, so operators and drilling contractors are taking additional contractual steps to protect themselves. For drilling contractors and equipment vendors, the ability to prove to the end customer that the equipment or asset being accepted meets full Performance, Quality, Health and Environmental (PQHSE) requirements will improve market share and provide a strategic competitive advantage.

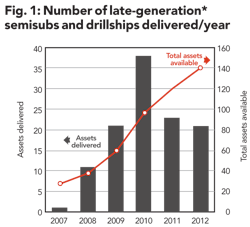

Double whammy: increased accountability and the demand/supply swing

As a consequence of the oil spill, the future economics of the international oil and gas industry will be driven by new regulations that are forcing the need for greater accountability, and will continue to be shaped by the demand and supply changes that are creating a more competitive market for high-specification drilling assets. Between End-of-Year (EOY) 2008 and EOY 2012, there will have been a 274% increase in the number of high-specification deepwater drilling rigs that are available, for a total of 142. This does not include the 28 drillships projected to be built for/by Petrobras.

As a result of this supply swing, utilization rates are decreasing. According to our analysis of just five of the15 largest drilling contractors, 50 high-specification drillships and semisubmersibles will become available (newbuilds plus expiring contracts) over the next five years. Given that the average value of one five-year contract (based solely on day rate) is approximately US$727 million, these 50 assets represent US$36 billion in potential revenue - that is, revenue to be gained or lost depending on whether operators believe the asset they are considering leasing is fit for purpose and meets all of the new regulations. 1

We are already seeing drilling contractors and operators proactively respond to this supply swing, newly developing offshore safety standards, and the increased demand for clear, indisputable accountability throughout the industry. The remainder of this article will address the three strategies that drilling contractors are implementing and why they are key to both top- and bottom-line performance.

1. Industry-Wide, stronger contracts define accountability

Per the Bureau of Ocean Energy Management, Regulation, and Enforcement (BOEMRE) directive issued in June 2010, lessees and operators drilling in the Outer Continental Shelf (OCS) are now required to show certification by the operator's CEO that they are conducting their operations in compliance with all operating regulations and that they have tested their drilling equipment, ensured that personnel are properly trained, and reviewed their procedures to ensure the safety of personnel and protection of the environment. This is like the Sarbanes-Oxley of oil and gas.

In response to this directive, operators are contractually specifying their PQHSE expectations in more detail, requiring increased access to assets under construction and ensuring that their contracts contain strong wording which clearly describes expectations for vendor processes, and systems auditing and testing.

In order to meet operators' new requirements, drilling contractors are making certain that ongoing PQHSE expectations are specified in their contracts with shipyards, and with systems and equipment vendors. This contractual language helps to ensure that vendors understand requirements for the system or equipment being delivered, that vendors' development processes are audited, that the system undergoes third-party verification, and that expectations for ongoing performance and regular audits are clearly defined.

The following excerpts illustrate the more specific language that is replacing the previous, more ambiguous contractual language.

Prior contractual language:

"The supplier shall allow third-party attendance at testing milestones."

New contractual language:

"The supplier shall provide complete test plans for the following test milestones as defined in IEEE1012: Integration Test, System Test, and Acceptance Test. Test plans shall be provided four weeks prior to the test execution date. Test plans must specify the requirements that will be tested and the pass/fail criteria for each test. Supplier will allow modification of the test plans by the purchaser if deemed necessary by the purchaser to sufficiently test a requirement. Supplier will allow third-party witnessing review of the test plans and witnessing of the tests."

2. Earlier risk management pays high dividends

Within the industry, it is commonly accepted that it is six to eight times more expensive to correct issues during operations as opposed to during routine maintenance events. Our experience with newbuilds shows that it is six to eleven times more expensive to correct issues at startup than in the shipyard.

Many times, when issues are identified during operations, remediation may be difficult or cost-prohibitive. In addition to high costs, insufficient risk management during the early stages of a newbuild/refurbishment project can cause serious safety risks to be overlooked.

Drilling contractors are responding to the potential safety impact of inadequate risk management by hiring third parties to ensure that requirements and design documents address all PQHSE needs and standards and to verify that Factory Acceptance Testing (FAT), commissioning testing, System Integration Testing (SIT), and acceptance test plans address all system requirements, are executed correctly and that all issues are resolved in a timely manner.

Implementing risk management initiatives early in the lifecycle, during the design phase, enables all hardware and software requirements to be identified and gathered in one place making it easier and quicker to identify any gaps. This step also significantly improves the quality of all testing and increases the probability that requirements-related issues will be detected and remediated prior to startup.

3. Increased audit frequency improves operational safety and efficiency

All equipment degrades over time, making regular audits and maintenance a necessity. While control systems do not degrade with time per se, defects that surface are addressed with patches from the vendor and these changes introduce risk.

When control system configuration is not properly managed and plans for hardware maintenance and end-of-life have not been established, serious safety incidents and downtime can result. For example, mismanagement of software configuration can lead to an inability to restore control systems to a safe state after a failure or power outage. Systems and processes for software configuration should be audited twice per year to help avoid such situations.

Software configuration changes and the installation of new systems can result in altered alarm states and priorities. This can cause assets to fall out of compliance with regulatory standards and affect safe operations. For example, when alarms are not properly prioritized, calibrated and mapped, drillers may not respond to critical alerts because they are overwhelmed by a flood of nuisance alarms or because some alarms are "buried" or never reach the driller's chair.

To help prevent alarm system failures and ensure compliance with safety standards, comprehensive alarm philosophy documentation should be established and alarm systems and processes should be audited semi-annually.

From a hardware perspective, post-delivery modifications, configuration changes or upgrades to equipment and tools may prevent equipment from operating as originally designed. Recent regulation changes require increased oversight of well control equipment. This includes third-party verification of BOP equipment, including the control system. To comply with these regulations, thorough audits must be conducted before the spudding of each new well.

Conclusion

Following the Gulf of Mexico spill, the oil and gas industry launched four task forces to focus on offshore operating procedures, offshore equipment, subsea well control and containment, and oil spill response. Additionally, the Research Partnership to Secure Energy for America (RPSEA) plans to manage long-term research efforts to help the industry prevent or respond to such events.

Combined with the competitive market for high-specification assets, the new recommendations and standards that result from initiatives such as these, and from governmental directives, will have a worldwide and lasting impact on the oil and gas industry.

We are already seeing drilling contractors and operators respond by writing tighter contracts with clear PQHSE expectations, initiating risk mitigation and remediation efforts earlier in the newbuild/refurbishment cycle, and increasing audit activities during operations. At present, these strategies are a competitive advantage. They will soon become the norm in order to maintain or gain market share and protect profitability.

About the Author

Footnotes

1. The five major drilling contractors included in this analysis are: Pride, Diamond Offshore, Seadrill, Transocean, and Noble Drilling. The value of one five-year contract is $412K per day x 96.5% uptime x 365 days x 5 years (Note: day rate was calculated as of 10/1/10, using the average of deepwater drillship and semisub day rates as listed by RigZone)

*5th and 6th Generation and DP Enabled

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com