AN INTERVIEW WITH APACHE CORPORATION

OIL & GAS FINANCIAL JOURNAL: Apache has long been considered one of the most successful US independents. How has the company changed over the past 10 years, and what will Apache look like a decade from now?

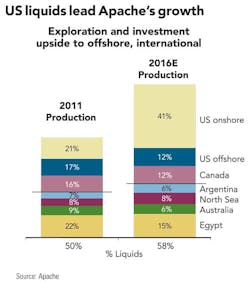

STEVE FARRIS [Chairman and CEO]: We're like the overnight pop star who worked for years to be discovered. Apache has been able to build a lot of financial and operational strength since the company was founded in 1954. The portfolio may change, but the principles that guide us have not: We're going to continue to be portfolio-balanced and rate-of-return-focused. We've gone through a lot of cycles in our company. Today's is probably the most exciting. We have expanded liquids plays in North America, we have global exploration, and we are developing two LNG projects.

Steve Farris, chairman and CEO, Apache

OGFJ: Apache has assets all over the world. Recently, I've noticed that you have put a great deal of emphasis on your assets in the Anadarko Basin and in the Permian. What is occurring in those areas that merits this kind of attention?

FARRIS: We've been working on these positions for about two and a half years, and we now find ourselves with a very good position. Onshore US horizontal drilling and multi-stage fracture stimulations have opened up a number of previously uneconomic plays. We think it's a good time to drill. Today, there is more equipment available at more reasonable prices than we've seen in the last five years. Just 18 months ago, we couldn't find a frac crew in the Permian Basin; now they are all over the place.

OGFJ: What specific plays in those basins are you most enthusiastic about and why? What is Apache's activity level?

FARRIS: Apache's current worldwide booked reserves are 3 billion barrels, yet in just these two North American areas we have identified an additional 68,000 drilling locations representing nearly 9 billion barrels of resource potential. The opportunity set is deep.

JOHN CHRISTMANN [Vice President – Permian Region]: Our Permian acreage spans 3.5 million gross acres, or 1.6 million net acres, and we have a presence in nearly every play across the region. In the Midland Basin, we have 17,816 locations in our vertical program and a resource of 1.7 billion barrels of oil equivalent; 2,321 locations and 642 million boe in the Cline shale, and 971 locations and 347 million boe in the Wolfcamp shale. In the Central Basin platform, we have almost 10,000 locations and 691 million boe of resource. In Eddy County, New Mexico, we have almost 1,800 locations and 100 million boe in the Yeso. We're also excited about the Delaware Basin, where we have 1,800 locations and 284 million boe. Apache is one of the most active operators across the Permian. We plan to average at least 32 rigs in 2012 and drill 760 wells.

ROB JOHNSTON [Vice President – Central Region]: The western Anadarko Basin has been the foundation for our region for more than 30 years. The Granite Wash has been a big part of this, and today horizontal drilling has changed the landscape. We have almost 2 million gross acres in the Anadarko, about half of that net. We have identified a total of nearly 33,000 locations across the Central Region with 5 billion boe of resource potential.

Five formations make up about 80% of those locations. Apache has 22,800 locations and a resource of 4.5 billion boe across 718,000 gross acres (350,000 net) within the Granite Wash, which is mainly Pennsylvanian sand that runs from about 13,000 feet. With horizontal drilling, the Tonkawa is one of the best formations we have. We have 2,800 locations and 202 million boe of resource across 634,000 gross acres (310,000 net). The Marmaton extends all the way from Ochiltree and Hemphill counties in Texas down to Oklahoma. Apache has 662,000 gross acres (512,000 net) with 1,593 locations and 161 million boe of resource. Apache has drilled several wells in the Cleveland with initial production exceeding 1,000 barrels per day. We have 527,000 gross acres (268,000 net) with 2,302 identified locations with 195 million boe of resource.

Outside the Anadarko Basin, about 50 miles to the west, Apache has 141,000 gross acres (93,000 net) in the Canyon Wash – an area called the Whittenburg Basin. We have identified 1,016 locations with net resource of 101 million boe, and we plan to start drilling horizontal wells very soon. Across the region, we've got 23 rigs running and we expect to get a couple more soon.

OGFJ: Please talk a little about some of Apache's new ventures – the Liard play in British Columbia, considerable acreage in the Mississippian Lime in Oklahoma and Kansas, and others.

JOHN BEDINGFIELD [Vice President – Worldwide Exploration and New Ventures]: Steve talked about the theme of balance, and exploration is no different: We have a balanced approach. Apache's new ventures provide a new engine for growth, pushing Apache to look outside of its traditional areas for new opportunity. We try to have a range of opportunities from higher-risk to more modest-risk exploration, from frontier basins to new plays in more mature basins.

The Liard discovery in British Columbia is an example of Apache's exploration abilities. We have discovered what is, in my estimation, the best known shale gas reservoir in the world. Like all North American gas prospects, Liard is challenged by today's gas prices, but it provides great optionality for the future. What's critical here is the size of this resource: We have a commanding position with over 400,000 acres in the heart of the play. The gas-in-place – 210 trillion cubic feet – is huge. We wind up with 48 tcf of sales gas. We have drilled three wells. One of them is a fairly short horizontal that tested over 21 MMcf per day from six fracs after 30 days. On a per-frac basis, this is one of the most prolific wells I've ever seen in this sort of play.

These wells are already connected to the pipeline grid. There is also an option to connect Liard to the LNG market. This is a tremendous resource that will be important for Apache in the future.

We are also excited about the unconventional opportunities in Argentina, where Apache has over 900,000 net acres in the Vaca Muerta shale play with about half of that in the liquids window. Our resource assessment is about 800 million barrels. This has the potential to be a world-class shale play – good thickness, good pressures in this part of the play, and low clay. In 2012, we are transitioning to drilling for oil in this play.

In the US, Apache has built a position in the Mississippian Lime play in Kansas and Nebraska. We've picked up over 580,000 net acres, and we have pretty much finished our leasing activities. The Mississippian Lime is a good porous limestone. Above that is a Cherokee section, and above that is an upper Pennsylvanian section. We think horizontal drilling will work well in this play.

In the Williston Basin, we achieved first-mover status with more than 300,000 net acres in Daniels County, Montana. In total, we see about 1,900 locations for Bakken and Three Forks with estimated recovery of approximately 1 billion barrels.

We've also established a good position in Alaska's Cook Inlet, where we have access to more than 1 million net acres. This is a proven basin with material oil potential. The heyday was back in the 1950s and 1960s, when about 1.4 billion barrels of oil was discovered. After Prudhoe Bay was discovered, everybody left Cook Inlet. Only a handful of fields have been discovered there, but the field size distribution strongly suggested that there's at least another 1.3 to 1.4 billion barrels of oil yet to be discovered in this basin. We believe that 3-D seismic is going to be the key to unlocking the basin's potential. We're very excited about getting our first wells drilled this year.

Kenya is a frontier, deepwater play in the Indian Ocean. We are planning to spud our first well, the Mbawa oil prospect, later this year. We believe this is a very high-potential block. The prospect has a mean value of 200 million to 300 million barrels, and it is part of a much larger 40,000-acre closure with a lot of running room.

These are all high-quality exploration opportunities, projects that set the stage for future reserve and production growth. We are also continuing to fill our opportunity funnel with others.

OGFJ: Can you bring us up to date on the Wheatstone LNG project with Chevron in Australia and the Kitimat project in British Columbia?

ROD EICHLER [President and COO]: The Wheatstone LNG project gives Apache the ability to monetize large gas reserves we discovered in the Julimar-Brunello complex on the Northwest Shelf of Western Australia. Chevron is operator of the project – two trains with capacity of about 8.9 million tons per annum (mtpa) of LNG or about 1.2 billion cubic feet of natural gas per day output. We have already placed 80% of the capacity with four Japanese utilities. We're moving forward with the development and anticipate the first LNG delivery will be late in 2016. We have a 13% working interest in the project.

The Kitimat LNG project is the first greenfield LNG export project proposed in Canada, also to supply LNG to the Asian markets. This project is designed to be one train followed by a second train in a short time period. The design capacity for the first train is 5 mtpa – a little over 700 million cubic feet of gas per day. We'll be the operator of the project with a 40% working interest. We've already received approval for a 20-year export license as well as other significant environmental approvals. We're doing all the work necessary to lead up to a final investment decision – marketing to line up off-take customers, finalization of the front-end engineering and design cost estimates for the plant and pipeline construction, and completing all the necessary approvals from the British Columbia government and the First Nations that occupy the plant location and the pipeline rights-of-way. From the time we take FID, we expect it will take about 55 months to the first cargo of LNG.

OGFJ: What do you mean when you say Apache is rate-of-return focused and lives within its means? What are Apache's financial strengths?

ROGER PLANK [President and Chief Corporate Officer]: All our investment decisions are based on exceeding a hurdle rate. It takes the politics out of it and results in good decisions around the world. It also translates to among the best per-share earnings and cash flow in the business. Year-in and year-out, our ROE and ROCE have consistently been in the top quartile.

We plan to live within our cash flow. We've learned over many years that it is unwise to continue to add debt and outspend your cash flow to drill wells because you can only do that so long until you hit the wall. We are in a very good position because our financial strength enables Apache to act when others can't.

We have been able to maintain our portfolio balance, increase drilling investments, expand our footprint in North America, and fund major projects that give us visibility on future growth.

OGFJ: Apache is a large offshore operator as well, with a recently expanded footprint in the deepwater Gulf of Mexico. Can you provide a brief overview of some of those projects for our readers?

EICHLER: Although we have only been active in the deepwater Gulf of Mexico since 2010, Apache has 750,000 lease acres under 148 federal lease blocks and some significant projects. We are operator on a number of exploration prospects and we added to our acreage position in the government's recent lease sale.

We have interests in Lucius and Heidelberg, two big projects operated by Anadarko.

Lucius is a subsea development principally located in Keathley Canyon 874 to 875 blocks. This is a Pliocene and Miocene subsalt oil development in 7,000 feet of water consisting of six initial oil producers that will be tied back to a spar-type facility, with first production anticipated in 2014. We have 11.7% interest in Lucius, which is an estimated 300-million-barrel oil field, gross.

The partners are evaluating development plans for Heidelberg, which is principally located in a five-block unit in lower Green Canyon. This is also middle Miocene oil against salt. We have a 12.5% interest in the project. Our net share of this estimated 200 million-barrel resource would be about 25 million barrels.

OGFJ: Apache is involved in projects all over the globe, yet onshore US seems to be the fastest-growing part of your portfolio. Why are you bullish on North America?

FARRIS: We started with two premises back in 2009 that weren't so obvious at the time. The first was that the maturity curve of gas and the maturity curve of oil in the world are two different things. For the foreseeable future, I think they are going to be de-linked. Second, the world uses between 85 and 90 million barrels of oil per day – over 30 billion barrels of oil per year. That's a lot of demand – more than Prudhoe Bay, and more than the estimates of the tertiary in the deepwater Gulf of Mexico. Based on these facts, we decided to focus on our oil prospects and oil drilling inventory.

OGFJ: Finally, everyone likes to talk about their successes, and Apache is obviously a success story of the first order. However, I'd like to ask what is the most difficult situation the company has faced in the last few years and how you dealt with it.

FARRIS: Apache has a portfolio of assets for the exact reason that you can't predict what will happen around the world, but you need to be able to sustain the business over the long haul. Take Egypt: They have had a lot of turmoil over the last 18 months, but we have a strong, long-term position that will continue to provide economic benefits for Egyptians and value for our shareholders. Meanwhile, commodity prices remain volatile, regulatory environments change, and technology advances and changes the economics of what we do. Just look at the impact horizontal drilling and multi-stage fracture stimulations have had on the industry – and on North American natural gas prices – over the last four or five years. The public holds us – rightfully – to very high standards for safe and environmentally responsible operations. There are plenty of challenges in our business. If you remain true to your principles, there are also opportunities.

What really motivates me every morning is the opportunity to work with the most-talented, hard-working group of people that has ever worked for Apache. We are very goal oriented. We push responsibility and accountability throughout the organization. It gives members of the Apache team a real sense of ownership because they all know that the best answers win. This is what makes Apache successful.