Second Quarter 2012 deals slow to $25 billion globally

Ronyld Wise, PLS Inc., Houston

PLS Inc. reports that global M&A activity for upstream deals slowed to $25.3 billion for Q2 2012 in 136 separate transactions. This compares to $37.8 billion in 190 deals in Q1 2012 and $31.7 billion in Q2 2011. Declines in WTI spot oil price from a recent March peak of $108/bbl to $78/bbl in late June, early concerns that U.S. natural gas storage might reach capacity, and a roughly 10% downward move in the stock market from early May to early June all contributed to the decline. Regionally, based on dollar value, the US market declined 44% in Q2 versus Q1, Canada fell 31% and the rest of the world slipped 14%.

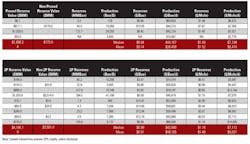

In the United States for Q2, PLS tallied 61 deals for $10.5 billion compared to 81 deals for $18.6 billion in Q1 2012 and 112 deals for $17.1 billion in Q2 2011. In terms of transaction types this quarter, asset deals account for 62% of value, corporate takeovers 21% and acreage, joint ventures, overrides and VPPs collectively total 17%. The preference for asset deals reversed a trend over the prior three quarters where corporate takeovers took over 50% of deal value.

Linn Energy's late June $1.025 billion purchase of BP's interest in Wyoming's Jonah field (shown in the table below) was the largest US asset deal of the quarter and an excellent example of the type of asset MLPs are seeking. The assets (730 Bcfe, 56% PDP) have a low and predictable decline rate of 14% and are liquids rich (145 MMcfed, 27% liquids). In addition, the acreage is HBP with upside available, once domestic gas prices recover, to capture another 1.2 Tcfe of resource potential from ~650 drilling locations. The deal provides a good valuation benchmark for today's market for similar assets in the US, coming in at $1.40 per Mcfe proved and $7,000 per daily Mcfe of production.

In Canada, PLS's deal count totaled 31 for $7.0 billion. This compares to a Q1 2012 count of 61 deals for $10.2 billion and a Q2 2011 count of 54 deals for $4.1 billion. For the quarter, five deals were corporate takeovers. Malaysia's national oil and gas company Petronas scored the largest Canadian (and global) deal of the quarter with its $5.4 billion purchase of Progress Energy, announced June 28. Petronas' offer price of C$20.45 per share represented a 77% premium to the prior day's closing price of Progress. PLS's evaluation of the transaction yields metrics of about $1.00 per Mcfe for 1.9 Tcfe of 2P reserves (of which 1.1 Tcfe are 1P, 12% oil) and ~$6,700 per daily Mcfe of production. Additionally, PLS values Progress' Montney undeveloped acreage (736,500 net acres) at $3,350 per acre or $2.5 billion.

Internationally, outside of North America, Q2 2012 saw 44 transactions for $7.8 billion. This compares to 48 transactions for $9.0 billion in Q1 2012 and 38 transactions for $10.4 billion in Q2 2011. Besides Argentina's nationalization of YPF via expropriation of 51% of YPF's shares owned by Repsol, the highlight was late April's $2.0 billion purchase, jointly led by Mitsubishi and Mitsui, of a 15% interest in an offshore Australia LNG project sold by Woodside Petroleum.

Deal making in the North Sea remains a global highlight with the quarter's activity increasing to 14 deals for $1.9 billion versus Q1 2012 activity of 10 deals for $1.4 billion.

Despite Q2's lull, looking forward strong buyers including Asian firms, MLPs and private equity firms remain active. At press time, China's CNOOC bought Calgary-based Nexen for $17.9 billion. This is the largest E&P buy by a Chinese firm and the largest E&P deal since ExxonMobil bought XTO for $41 billion in late 2009. Also, China's Sinopec struck a $1.5 billion deal in the North Sea with Talisman. The market remains well supplied with several billion dollar plus deals recently put into play