Income up 4% year over year in 1Q2012, but revenue is flat

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

Revenues in the first quarter of 2012 rose just 1% from the previous quarter and fell by 1% over the same quarter in 2011 for the group of publicly-traded, US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal. Net income for this same group of companies increased 26% compared to the previous quarter, but grew by a modest 4% year over year compared to the first quarter of 2011.

The number of reporting companies rose slightly, from 117 to 123, in the first quarter of 2012. For these companies, total revenue was $303.1 billion, down $1.5 billion from the same quarter in 2011 but up $2 billion over the prior quarter. So the 1% change either way means that revenue growth has been essentially flat for several quarters.

Net income for the group increased $5.5 billion from the previous quarter, and was up $898 million from the first quarter of 2011.

Year-to-date capital spending stood at nearly $48 billion for the first quarter of 2012 compared to $37.7 billion for the first quarter of last year. This represents a 28% increase.

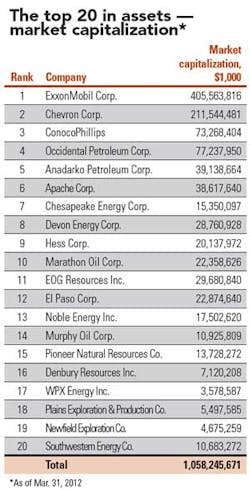

Total asset value for the combined OGJ150 group of companies grew to $1.35 trillion from $1.24 trillion year over year, representing about a 9% jump. Assets climbed by $49.8 billion from the previous quarter, approximately a 4% increase.

Stockholder equity for the entire group rose by $17.3 billion to $647.5 billion (a 3% increase) from the fourth quarter of 2011. The figure grew by $48.8 billion (a 9% increase) from the first quarter of 2011.

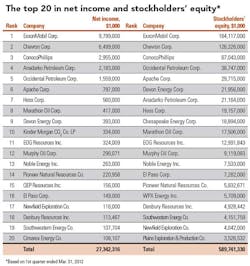

Largest in net income

The 20 largest companies ranked according to net income had $27.3 billion in collective net income for the first quarter of 2012. This compares with $24.3 billion in the previous quarter and $27.0 billion for the same quarter last year.

Once again, the $27.3 billion in net income for the top 20 companies is greater than the $23.1 billion in collective net income for the entire OGJ150 group of companies because the remaining 103 companies collectively had a net loss of approximately $208 million. Economies of scale and other factors clearly seem to work in favor of larger producers.

Of the 123 companies in the group, 40 showed a net loss in the income column. Among the larger companies reporting losses: $3 million by Chesapeake Energy; $40 million by WPX Energy (spun off from Williams); $73.3 million by Plains Exploration & Production; $216 million by Sandridge Energy; $41.8 million by Range Resources; and $60 million by Quicksilver Resources.

Seven companies dropped from last quarter's top 20 list – No. 8 Chesapeake; No. 11 Consol Energy; No. 13 Ultra Petroleum; No. 16 EQT Production; No. 17 Plains Exploration & Production; No. 18 Callon Petroleum; and No. 20 Whiting Petroleum. Taking their place in the top 20 are No. 4 Anadarko Petroleum; No. 7 Hess; No. 12 Murphy Oil; No. 13 Noble Energy; No. 14 Pioneer Natural Resources; No. 15 QEP Resources; and No. 18 Denbury Resources.

ExxonMobil's net income of $9.8 billion amounted to approximately 37% of the total net income for the entire group of 123 publicly-traded companies. The top three companies in net income – ExxonMobil, Chevron, and ConocoPhillips – together accounted for nearly $19.3 billion in net income, or 71% of net income for the entire group.

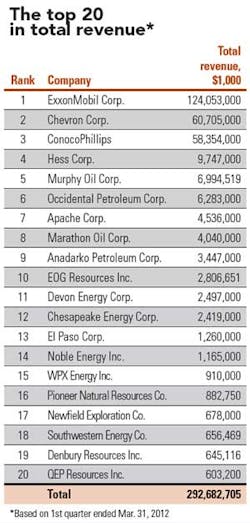

Largest in total revenue

The list of the top 20 companies in total revenue generally doesn't change much from quarter to quarter. Together, these companies accounted for nearly $292.7 billion in revenue compared to $303.1 billion for the entire group. That's roughly 97% for the 20 largest and 3% for the remaining 103 companies in the group.

This quarter, the only company to drop out of the top 20 in revenue was No. 13 Consol Energy. The company was replaced by Denbury Resources, which entered the top 20 at No. 19.

Interestingly, seven of the top 20 companies by revenue showed declines over the previous quarter. No. 3 ConocoPhillips fell by $1.5 billion. No. 9 Anadarko declined slightly by $93 million. No. 11 Devon Energy dropped by $88 million; No. 12 Chesapeake Energy decreased by $309 million; No. 15 WPX Energy fell by $82 million; No. 19 Southwestern Energy dropped by $88 million; and No. 20 QEP Resources declined $250 million.

Top spenders

Spending by the top 20 companies in the first quarter continued to surge. It was up 27% compared to the first quarter of 2011. The top 10 spenders were, in order: ExxonMobil ($8.4 billion); Chevron ($5.9 billion); ConocoPhillips ($4.3 billion); Chesapeake Energy ($2.6 billion); Occidental Petroleum ($2.4 billion); Devon Energy ($2.1 billion); EOG Resources ($1.9 billion); Hess ($1.9 billion); Apache ($1.7 billion); and Anadarko Petroleum ($1.7 billion).

Fastest-growing companies

The three fastest-growing companies, ranked by stockholders' equity, were Evolution Petroleum Corp. (up 34.8%), EV Energy Partners LP (up 29.7%), and Earthstone Energy Inc. (up 21.8%). Evolution and EV Energy Partners are based in Houston. Earthstone Energy is headquartered in Denver.

Click here to download the PDF of the "OGJ150 Quarterly" Quarter ending Mar. 31, 2012