Asian investors look to North America

Jason Martinez, Nomura Securities Inc., Houston

The trend of Asian equity capital flowing into private North American oil and gas companies over the last four years is well documented. Through 45 transactions, almost $70 billion of capital has been committed from Asian strategics such as Sinopec, Itochu, KNOC, CNOOC, Mitsui, Marubeni, and Reliance.

The investments have spanned from Western Canada's oil sands and burgeoning liquefied natural gas complex, to West Texas unconventional shale assets, to Gulf of Mexico investments through participation in buyout consortia, which provides joint venture capital and preferred equity investments into corporations. Despite the different asset bases, structures, returns, and counterparties, the investments generally have three common themes: learning leading edge onshore drilling techniques, establishing incumbency in attractive asset bases and achieving strong returns. The overriding investment rationale has been resource capture of natural resources assets, be they natural gas or oil. The invested capital represents approximately 12% of the reported aggregate market values of the strategic and financial investors.

Asian public institutional equity investors are now following Asian private investment trends of the last several years by turning their attention to North American oil and gas opportunities in the hopes of making attractive growth and returns investments. Over the last 10 years, in the US, Canadian, and European markets, private equity investments have been dwarfed by subsequent institutional public equity investors by a factor of three to one.

If a similar trend evolves with Asian public equity investors following private investors from their region into oil and gas asset bases, the capital flow could represent $210 billion of incremental investment, or 21% of the aggregate market value of the North American independent upstream sector.

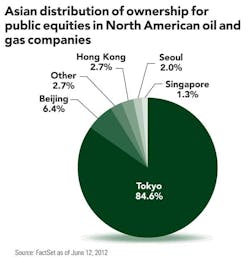

The current public equity holdings in North American upstream companies certainly imply there is an opportunity to accelerate investment into the sector. Overall, Asian institutions are currently underweight in North American oil and gas investment with investments totaling $7.3 billion, almost 85% being from Japan. In analyzing the latest reported holdings for eight independent upstream companies, only six Asian investors were among the top 300.

No Asian investor was in the top 30 investors, with the largest ranked 35th. While the top 10 overall investors hold $30 billion of stock in these upstream companies, 27.9% of the aggregate market value, the six Asian investors only hold a total of $1.7 billion, or 1.7% of the aggregate market value.

In bellwether North American oil services names, the underweighting was even more pronounced with the top 10 overall investors holding assets worth almost 20 times as much as those of the six identified Asian investors.

In addition to seeking energy markets for the abundance of natural gas and liquids production, North American companies are now also looking east to diversify their shareholder base. And the market depth across the more active Asian investors is large enough to warrant increasing cultivation of potential shareholders. Asian institutions have over $109 billion in oil and gas assets under management.

Top oil and gas investment managers reside in Tokyo, Hong Kong, Shanghai, Beijing, Mumbai, and Bangkok. Between Hong Kong, Beijing and Shanghai there are $30 billion of assets under management through China Life, China Fund, China Investment Corp, and China Asset Management Corp, among many others. Singapore provides incremental demand from Temasek and GIC while Mumbai provides access to several insurance companies.

Today, Tokyo represents over $28 billion of assets under management in Asian oil and gas investment funds from the likes of Nomura Asset Management, Mitsubishi UFJ, Sumitomo Mitsui Trust, and Blackrock Japan. With a large pool of investment funds, Japanese institutions are actively looking for opportunities in North America.

Japan is the second largest single-country capital market in the world which totals $22 trillion, with approximately $700 billion invested in foreign equities, of which 44% is into North America . This doesn't include $16.4 trillion of Japanese retail assets and $10.7 trillion held in cash.

In this context, earlier this summer, Nomura Securities held its 4th annual "North America Investor Event" in Tokyo to present leading North American companies to the Japanese investment companies. More than 15 companies visited with over 40 investors over a two-day period. Companies participating were Canadian Natural Resources, Suncor, Microsoft, Cisco, Starwood, among others. Investors included Nomura Asset Management, DIAM, Mitsubishi UFJ, Sumitomo, and several others.

The mandates of these asset managers have grown to include more oil and gas investments with a weighting towards North American opportunities. The asset managers are increasingly utilizing fundamental asset analysis to assess investment opportunities. Strategically, Asian institutional investors can add exposure to North American energy companies, who are transforming the North American liquefied natural gas industry and overall natural gas sector, and through Western Canada and the Gulf Coast, which are set to supply Asia's growing demand for natural gas. Additionally, US, European and, Asian private investments into North American public companies, at the asset or corporate level, can help validate Asian institutional investment interest in North American companies. Ultimately, investing in the public equities of North American oil and gas companies is consistent with many of the private transactions: secure exposure to oil and gas companies with outsized growth and return thresholds in leading edge geologic plays.

In order to educate Asian institutional investors, several North American companies have conducted non-deal road shows in Asia. While each company has taken a tailored approach to its meeting schedule, the majority has prioritized stops in both Tokyo and Hong Kong. Each market can provide five to six one-on-one investor meetings and a group investor lunch for interested investors. Beijing, Seoul, and Singapore have typically each generated a few one-on-one meetings or conference calls as well as a group lunch meeting, each accomplished with one-day visits.

With its critical liquefied natural gas industry increasingly being a supplier of choice to the Asian end markets, Australian institutional investors are also beginning to look towards North American companies. A day each in Sydney and Melbourne could result in similar meetings. In order to maximize effectiveness, a single trip could be arranged over four to seven business days to accomplish these investor meetings.

To best meet the objectives of the company, the hosting securities firm will have direct conversations with investors in order to gauge genuine interest and arrange the most productive set of meetings. This vetting process helps securities firms cull investors who have biases against certain sectors, have challenges monitoring North American investments, or have a desire to "rent" versus own stock. The presenters typically will include the investor relations lead and appropriate c-level executives who can both tell the operational story to investors and use the trip to the region for discussions with customers or counterparties.

Globalization within the North American oil and gas is accelerating and enjoys a growing operational and financial partnership with Asian counterparties. The next natural step in the evolution is institutional equity investing into North American oil and gas companies. OGFJ

About the author

Jason Martinez is a managing director with Nomura Securities Inc., a global investment bank focused on corporate finance and advisory work. As the Nomura Houston office lead, Martinez's primary focus is the oil and gas sector. He is a graduate of Rice University and Harvard Business School. He began his career in investment banking at JPMorgan and spent several years building the Deutsche Bank Securities oil and gas investing banking business in Houston before joining Nomura in 2010.