Eagle Ford remains significant

All things Eagle Ford continue to grow except, perhaps, production

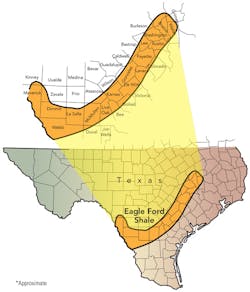

The Eagle Ford Shale, with its liquids-rich hydrocarbon offerings, remains a significant asset for the energy industry. The formation, between the Austin Chalk and the Buda Lime at depths between 4,000 to 12,000 feet, is high in its carbonate shale percentage— upwards of 70% in south Texas—making it a prime candidate for hydraulic fracturing.

Demand for oil-rich resource plays such as the Eagle Ford helped the unconventional resources sector reach a record $62 billion in deal activity in 2011. In the largest corporate M&A deal in the US last year, Kinder Morgan acquired El Paso Corp. for $37.8 billion, creating North America's largest midstream company. And, while deal activity waned somewhat year-over-year, 22 deals worth $6.7 billion in 2011 versus 30 deals for $9.5 billion in 2010, according to PLS Inc., the Eagle Ford remains a sought-after play.

What started with the play's first well, drilled in 2008 by Petrohawk, has ballooned into boom towns with shortages in housing and skilled labor as companies drilled nearly 1,700 wells in 2011. A recent report by the University of Texas at San Antonio says $25 billion was spent in and around various South Texas towns where nearly 48,000 jobs were created in 2011.

According to The Railroad Commission of Texas, 2,827 drilling permits were issued in 2011—more than twice the 1,010 permits issued in 2010. Permits issued this year are on track to beat that number as 2,297 permits have already been issued in the Eagle Ford through June 2012.

The number of producing leases continues to grow, as well. The Railroad Commission of Texas notes 368 producing oil leases on schedule in 2011; 72 producing oil leases in 2010; and 40 producing oil leases in 2009. There were 550 producing gas wells on schedule in 2011; 158 producing gas wells in 2010; and 67 producing gas wells in 2009.

One facet of the Eagle Ford not growing, according to The Railroad Commission of Texas, is production. The Commission reports declining production since April 2011—a finding in dispute by energy market analytics company BENTEK Energy.

"BENTEK's Texas Observer reports Texas natural gas production is growing. The state's increased natural gas production is being driven primarily by growth in the Eagle Ford, which has seen a 1.6-Bcf/d increase in production compared to June 2011. BENTEK expects Texas production to continue growing gradually as horizontal rigs continue to move into the area and as processing capacity additions relieve constraints in the basin," noted BENTEK.

For the week of July 16-20, the number of horizontal rigs running in the region stood at 271. Karnes County, the consistent leader, was the home of 42 rigs, while La Salle stood at 36 rigs. The other top counties for rigs that week were McMullen (31), Dimmit (28), Webb (26), Gonzales (20), DeWitt (20), Atascosa (13), and Live Oak (12).

The top five operators in terms of number of rigs running for the same week were Chesapeake (31), EOG Resources (22), Petrohawk (BHP Billiton) (25), Marathon Oil (Hilcorp) (20), and ConocoPhillips (16).