7 shale plays currently driving US drilling and development

Anadarko, with their Mitsui JV, is one of the players in the Marcellus Shale.

Photo courtesy of Anadarko Petroleum

Spending in these plays will exceed $54 billion this year

Don Warlick, WarlickEnergy, Houston

It has rarely happened in oil and gas history: Today just a handful of resource plays, mainly shales with an abundance of crude oil and liquids targets, accounts for a major share of all spending for land drilling and development in the United States. In fact, it adds up to an astounding $54 billion for just seven resource plays in 2012.

This is reminiscent of the 2006-2009 era when operators were ramping up activity in gas shales, and this required an ever-growing number of rigs and equipment. As it turns out, oil and liquids plays are somewhat different from natural gas plays in that production from these prolific shales has begun to displace crude oil imports into North America. Conversely, the supply-and-demand situation is out of kilter for natural gas, so US and Canadian operators with gas-weighted production currently find themselves with a sizable supply overhang.

Certainly there has been slippage in crude oil prices since February 2012 and at this writing, early summer 2012, there appears to be potential stabilization of prices (WTI is in the $80s), so there could be a more predictable path forward in wet play development, but only time will tell.

WarlickEnergy has evaluated US and Canadian unconventional resource development over the years and evaluated details, drivers, and potentials in existing and early-stage plays. Our research and proprietary reporting helps to identify and make sense of trends as well as to focus on those areas where market dynamics call for attention.

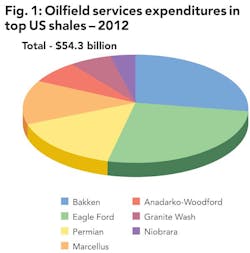

Our recent analyses focused on the seven big shale plays that account for over $54 billion in oilfield services expenditures to drill and complete high-cost but productive shale play wells. Figure 1 indicates the relative expense in developing the seven big shales, with the Bakken and Eagle Ford together accounting for slightly more than half of the $54.3 billion total.

All these shale plays are focused on recovering oil or gas liquids with one exception, the Marcellus where the majority of wells drilled are dry gas completions but where a growing share of liquids development is taking place in the southwestern corner of Pennsylvania, led by Range Resources.

All activity, just as in other oil and gas development in North America, is based principally on oil prices (liquids pricing tracks that of oil), and then comes the economics of individual plays – costs, downhole conditions, geologic characteristics, risks in multi-year development, etc.

There are several characteristics beyond the price of hydrocarbons in these plays that also support and drive future activity. WarlickEnergy has developed proprietary reporting on each of these shales (plus the early-stage Utica) and forecasts drilling in all. In doing so we pay attention to various metrics and characteristics in each shale to help make sense of the path forward.

One important characteristic is who's there – which E&P players lead individual shales into the future and who among them accounts for most of the activity. It is those drilling and development leaders who play a large role in driving a play forward, typically operating within a long-term strategy that can result in multi-year successes. In other words, as the bigs go in each shale, so goes the shale.

One of 26 rigs now working for BHP Billiton Petroleum in the Eagle Ford.

Photo courtesy of BHP Billiton Petroleum

Accordingly, the following is a brief summary of the major players in each of the leading shale plays. These companies help characterize and harness the directions of the seven big plays of consequence discussed in this article:

- Anadarko-Woodford – Also called the Cana Woodford, the Anadarko-Woodford is a growing crude and liquids play in West-Central Oklahoma running up within the Anadarko basin. Devon Energy is the unchallenged leader here, accounting for more than 40% of all drilling activity. Four other companies follow with another 40% or so of new wells including Cimarex Energy, Continental Resources, Marathon, and ExxonMobil. It's a relatively deep horizontal play with depths ranging from 11,500 to 14,500 feet. Average drilling and completion costs/well can be ~ $8.5 million.

- Bakken – The Bakken shale play is one of the biggest oil discoveries in recent history. Long known since the early days of drilling in the Williston basin, the Bakken shale was largely ignored until technology came along to make it economic to develop. Since then, it has become a huge success. Seven E&P companies will account for about 65% of Bakken drilling this year. In rank order they are: Continental Resources, Hess, Whiting Petroleum, Statoil/Brigham, Oasis Petroleum, Marathon, and EOG Resources. At present, Continental and Hess are together running ~ 40 rigs. Each is developing ways to become more efficient and reduce drilling days/well to somewhere in the mid-20s. These wells will be around 10,000-foot TVD and cost over $9 million each.

- Eagle Ford – About 400 miles in length and stretching from Southwest Texas into East Texas, the Eagle Ford shale is a very interesting play with oil, liquids, and dry gas windows with 60% to 70% carbonate content and a more brittle geology that's good for fracturing. Four companies account for around 45% of all drilling here: Chesapeake Energy, EOG, Conoco Phillips, and Marathon. But there are other very aggressive players including Pioneer, Anadarko, Talisman/Statoil, and BHP (which paid $12 billion for Petrohawk and gained significant Eagle Ford holdings). Most are drilling $6.5 million to $7 million wells with focus on the Eagle Ford's oil and liquids windows.

- Granite Wash – A collection of several "wash plays" in the Texas-Oklahoma Panhandle are alluvial placers formed by mineral particles and deposits set down by ancient streams, involving a number of stacked oil and gas formations at depths of 11,000-15,000 feet. Chesapeake, Apache, and Linn Energy lead all players in the Granite Wash, drilling more than six of 10 wells here while Devon and Forest follow. These wells can have up to 15 frac stages (at least at this time) and cost $7.5 million to $8 million each.

- Marcellus – Most Marcellus shale wells are in Pennsylvania, with about 8 of 10 wells focused on natural gas. Range Resources and a few others are leading wet play development in the southwestern corner of the state. TVDs are around 6,300 feet with horizontals costing around $5.3 million. Busy players include Anadarko (with their Mitsui JV), Chesapeake and their associated JV with Statoil, then comes Range, Shell (which bought into the Marcellus by paying KKR $4.7 billion for East Resources), and then Chevron via their $4.3 billion acquisition of Atlas Energy. A plus for the Marcellus is its location adjacent to the biggest gas-consuming region in the country.

- Niobrara – The Niobrara formation is located in a corner of the Rockies involving Colorado, Wyoming, Kansas, and Nebraska. Most activity today is in the northeastern corner of Colorado within the Denver-Julesburg basin. Noble Energy is the hands-down leader with more than 440,000 net acres in leasehold, drilling almost one in three wells here. Growing independent Bonanza Creek and Anadarko follow, both with aggressive development programs. TVDs are in the neighborhood of 6,200 feet with well costs that range from $4.5 million to ~ $5 million/well.

- Permian – Several exciting shales now overlay an historic conventional oil basin where drilling began in the 1920s. They include the Avalon, Leonard, Wolfcamp, Bone Spring Field, Spraberry Field, and Yeso Oil Play. Also included is the Wolfberry Trend which refers to the Wolfcamp Shale and the Spraberry Field. There are plenty of operators of record here, but just eight account for around 70% of shale drilling today in the Permian. The top three: Pioneer Natural Resources, Concho Resources (which just spent over $1 billion to acquire Three Rivers Operating), and Apache. Oxy follows close behind, then comes Energen, Sandridge, Cimarex, and EOG.

All these plays cover a lot of territory and require an ocean of capital to fund development programs due to the high costs of drilling and completing the horizontal wells. As mentioned earlier, the forecast total expenditures is $54.3 billion in 2012.

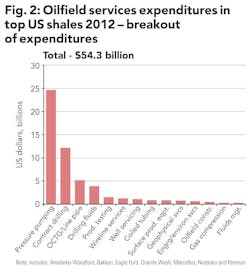

But how are those OFS expenditures spent by category? Figure 2 covers these top shales with a breakout of OFS expenditures.

WarlickEnergy's forecast is that pressure pumping, contract drilling, OCTG and line pipe, plus drilling fluids account for the vast majority of drilling and completion expenditures. But considering all the OFS sectors identified in the exhibit, each one of them is a sizable business sector on its own. For example, the smallest categorized here, fluids management, will be at least a $300-million business across the shales. Coiled tubing services will be near $900 million, and production testing should exceed $1.5 billion.

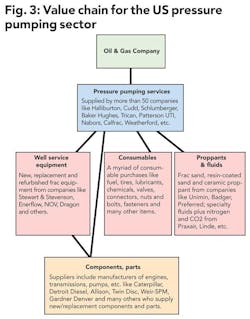

But there's more: It's important to note that additional spending is going into the construction of new equipment and to buy consumables required to keep individual shale-play equipment running. Clarifying unseen expenditures involves understanding the value chains for oil and gas that helps relate to all components of the OFS business, where buying, selling, and supply decisions are made. We have characterized the pressure pumping value chain in Figure 3.

What Figure 3 tells us is that direct expenditures for drilling and completion activity, in this instance for shale plays, also drives additional spending to maintain and support the non-stop activity going forward in these developments. In this exhibit, pressure pumping contractors constantly source major components (such as engines, transmissions, pumps, parts, and consumables) from a broad collection of suppliers as maintenance and growth requirements dictate. Result: Additional and sometimes huge expenditures to keep the wheels turning in top US shale plays.

And there is still more: Once these many wells have been completed and are producing, there are the requirements for upkeep, maintenance, and remedial efforts to maintain production. An $8 million well is a huge investment, and the owner is not about to allow fall-off in production or slippage in operating efficiencies. They will pay close attention and take care of production in their huge shale investments. Those subjects address follow-on oilfield services business sectors that concentrate entirely on the aftermarket and remedial space – but that's a topic for another time.

In summary, since the 2000-2005 era when unconventional resource plays begin their early growth in development programs, first in gas shale plays and now in oil/liquids plays, there has been an all-consuming, growing demand for oilfield services to support these seemingly non-stop programs. That will not change in the future except for some up-and-down adjustments in budgets that are affected by oil and gas prices. In any case it will be important to make sense of, track, and forecast just how drilling and development must be supported by oilfield services to assure timely and efficient support to growth in future years.