Permian Basin in demand despite increase in operating costs

Oily and liquids-rich plays, like those common in the Permian Basin, are the preferred target for those looking to capitalize on steady oil prices. However, these riches come with a price. In the past four years, during the industry's "rush to liquids," unit operating costs in the Permian Basin have increased significantly, noted Ziff Energy Group.

According to a recent operations benchmarking study conducted by Ziff, the average operating cost for oil fields increased 61% to $16.77/bbl since last analyzed by Ziff in 2007, in line with the oil price increase during the same period. That being said, the leading operators, achieved an average operating cost below $7.00/bbl.

In the gas fields, the average operating cost decreased 11% to nearly $1.20/Mcf. The leading gas field operators were able to beat that price with an average operating cost of less than $0.50/Mcf.

"Part of the increase in the average operating cost for oil fields is associated with the large increase in oil prices since 2007. Interestingly, operators have become more efficient in usage of purchased energy (i.e. electricity). Lower gas price was the driver for lower severance and ad valorem taxes, as well as lower energy costs (electricity and the value of gas consumed at the lease), while core costs increased by 15%.

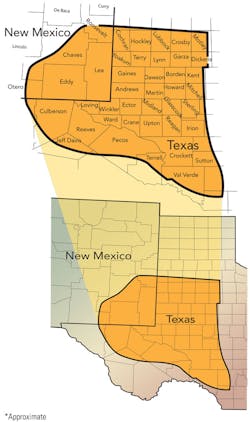

"None of the oil fields and only two of the gas fields assessed in both the 6th and 7th editions of the Permian study were able to lower their unit costs between 2007 and 2011 (i.e. where the reduction in total costs more than compensated for the cost impact of production decline). Operators are being challenged to contain costs following a period with service cost inflation, compounding the impact on unit costs of declining production," the study noted. Taxes are the largest single cost component for both oil and gas fields (32% for gas fields and 26% for oil fields). Despite this, the Permian Basin remains the largest onshore US oil-producing region and is the most active center of CO2 enhanced oil recovery operations in North America and the world, with over 50 such projects. In May, Maynard Holt, co-president and head of upstream banking for Tudor Pickering Holt & Co., told OGFJ, "About 90% of our buying customers are interested in liquids." He continued, "Pick your part of the market. If you're in the Permian or the Bakken, those are great, hot markets for sellers."

In early February, Energen Resources picked up a package of Wolfberry assets from a private seller for $65.8 million. The acquisition is expected to add some 3,200 net acres to the company's Wolfberry position. The acquisition package includes 29 producing wells, an estimated 50 undeveloped locations, and nearly 8.5 MMboe proved and probable reserves, of which some 80% are proved undeveloped. The company's estimated cost to develop the properties is $115 million. The company plans to spend $855 million in the area this year, with $415 million invested in the company's Wolfberry play.

This year, through a series of transactions worth $66 million and 2.7 million shares of stock, Forest Oil expanded its Wolfbone acreage. The company's total Permian acreage, inclusive of its Wolfcamp position in Crockett County of 51,500 net acres, sits close to 114,500 net acres.

In March, American Standard Energy closed on an acquisition from Geronimo Holding Corp. in which it gained 22,519 acres in the play.