Niobrara has huge oil potential

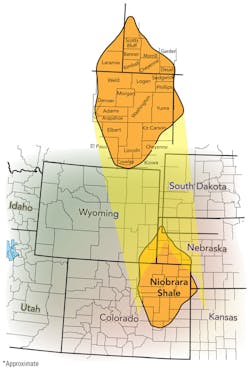

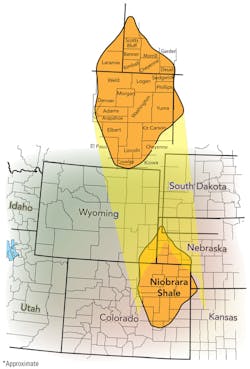

The Niobrara geologic formation is an oil play in northeastern Colorado and parts of adjacent Wyoming, Nebraska, and Kansas. It is located in the prolific Denver-Julesburg Basin (often called the DJ Basin) between the Piceance Basin to the south and the Sand Wash Basin to the north.

The Niobrara, part chalk and part shale, is still in its early stages of development, and companies have been busy leasing land for future drilling. It has been compared by some to the Bakken shale formation farther to the north, in part because both plays have a high concentration of liquids.

Rocks in the Niobrara mainly consist of interbedded organic-rich shales, calcareous shales, and marlstones. It is the fractured marlstone intervals locally known as the Buck Peak, Tow Creek, and Wolf Mountain benches that account for the majority of the areas production. These fractured carbonate reservoirs are associated with anticlinal, synclinal, and monoclinal folds, and fault zones. This proven oil accumulation is considered to be continuous in nature and lightly explored. Source rocks are predominantly oil prone and thermally mature with respect to oil generation. The producing intervals are geologically equivalent to the Niobrara reservoirs of the DJ and Powder River Basins, which are currently emerging as a major crude resource play.

Oil and natural gas can be found at depths of 3,000 to 14,000 feet.

The Upper Cretaceous Niobrara formation has emerged as another potential crude oil resource play. Natural fracturing has played a key role in producing the Niobrara historically due to the low porosity and low permeability of the formation

Recent activity

Houston-based Noble Energy is expanding its operations in Colorado with $8 billion in investment over the next five years. The company is developing horizontal wells that stretch nearly two miles through the oil-rich Niobrara formation, which lies beneath a big swatch of eastern Colorado. Houston-based Noble has expanded its holdings to 880,000 acres and is experimenting with increasing the density of wells drilled from the same pad. The company is spending $1.3 billion in Colorado in 2012 — about a third of its capital — and plans to spend a total of $8 billion over the next five years. Noble is one of three major drillers in the Colorado portion of the Niobrara. The others are Anadarko Petroleum and EOG Resources.

Denver-based Petroleum Development Corp. executed an agreement to acquire Core Wattenberg assets that contain significant liquid-rich horizontal drilling opportunities from a private party on June 29 for a purchase price of about $330.6 million. The assets are located almost entirely in the Core Wattenberg Field of Weld and Adams Counties, Colorado and are about 94% operated. They include an estimated 35,000 net acres prospective for horizontal development of the Niobrara and Codell formations. Ryder Scott, the company's independent petroleum engineering consulting firm, estimates net proved reserves of 29.2 million barrels of oil equivalent using year-end 2011 SEC flat pricing and an effective date of April 1, 2012. The proved reserves are approximately 58% crude oil and natural gas liquids, and are approximately 54% proved developed.

Results from Anadarko Petroleum's first 11 horizontal Niobrara and Codell wells in the Wattenberg field of northeastern Colorado show strong initial production (IP) rates and could serve as a catalyst for potential joint venture agreements. Average IP was 827 boe/d with nearly 70% oil. IPs range from 555 to 1,505 boe/d. One outlier well (REI 31-5HZ) produced 75% gas; others actually averaged an oil ratio of 77%, with range of 66%-86%. Anadarko's best horizontal well to date, the Dolph 27-1HZ, demonstrated an initial production (IP) rate of more than 1,100 barrels of oil per day (bopd) with more than 2.4 million cubic feet of natural gas per day (MMcf/d), resulting in an estimated EUR of better than 600,000 boe.